Indonesia Financial Assistance Programs Market Analysis

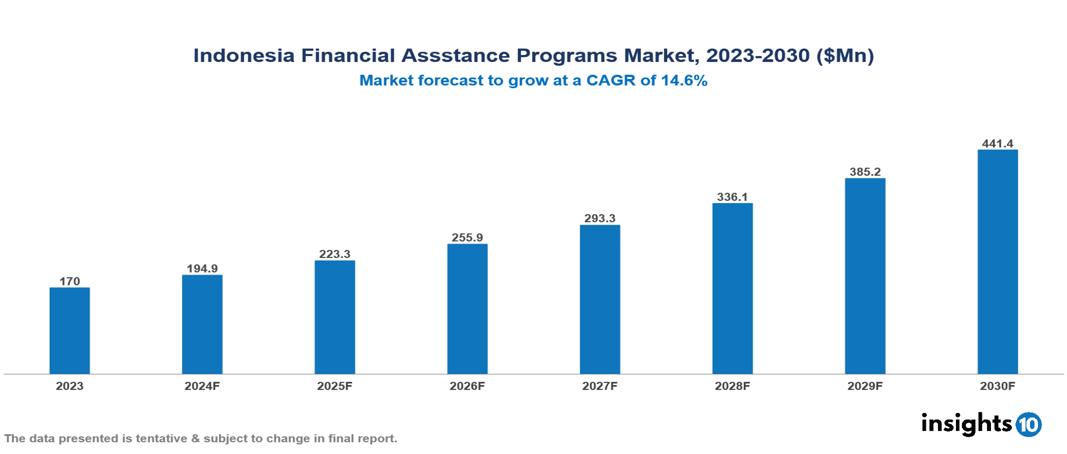

The Indonesia Financial Assistance Programs Market was valued at $170 Mn in 2023 and is projected to grow at a CAGR of 14.6% from 2023 to 2023, to $441.4 Mn by 2030. The market is driven by various sector such as rising drug cost, complex insurance landscape, regulatory environment, market competition, patient adherence concern etc. The prominent pharmaceutical companies providing financial assistance to patient are such as Mayer, Cipla, Merck, GSK, Johnson & Johnson, Novartis among others.

Buy Now

Indonesia Financial Assistance Programs Market Executive Summary

The Indonesia Financial Assistance Programs Market is at around $170 Mn in 2023 and is projected to reach $441.4 Mn in 2030, exhibiting a CAGR of 14.6% during the forecast period 2023-2030.

Drug makers provide patient financial assistance with the goal of minimizing or eliminating out-of-pocket costs as a barrier to prescription choice, keeping patients on name-brand pharmaceuticals longer. Among the popular financial help programs offered under patient assistance programs include co-pay assistance, free drug trials, bridge programs, sliding scale programs, coupons, bulk purchasing programs, and so forth. Patients' out-of-pocket drug cost sharing is determined by their health plans or pharmacy benefit manager's (PBM's) formulary--a list of preferred and nonpreferred prescription drugs. Preferred status is based on a drug's effectiveness, price, and the level of rebate the payer receives from the manufacturer for giving the drug preference over its competitors. Generics and preferred brand drugs are generally assigned lower patient cost sharing than nonpreferred brand drugs. As drug prices have increased, so has patient cost sharing, causing some patients to stretch, forgo, or discontinue medication that is too expensive. Drug manufacturers often seek to mitigate these effects by providing or funding various forms of patient financial support.

The prevalence and number of Diabetes cases (total) in Indonesia and in each province is estimated to increase quite high in 2020–2045. Nationally, Diabetes prevalence increased from 9.19% in 2020 (18.69 Mn cases) to 16.09% in 2045 (40.7 Mn cases). Therefore, the market is predominately driven by factors such as rising drug cost, and increasing prevalence of chronic diseases prevalence whereas regulatory challenges, lack of awareness and budgetary pressures restrict market growth.

Pharmaceutical companies providing financial assistance to patient are such as Mayer, Cipla, Merck, GSK, Pfizer, Johnson & Johnson, Novartis among others.

Market Dynamics

Market Drivers

Chronic disease prevalence: The increasing prevalence of chronic conditions such as diabetes, heart disease, and autoimmune disorders necessitates ongoing access to medications. Patient assistance programs are particularly important in this context, as they can help ensure continuity of care for patients who require long-term treatment but may face financial barriers to consistent access. The prevalence and number of Diabetes cases (total) in Indonesia and in each province is estimated to increase quite high in 2020–2045. Nationally, Diabetes prevalence increased from 9.19% in 2020 (18.69 Mn cases) to 16.09% in 2045 (40.7 Mn cases).

Increasing cost of medicines: Specialty and innovative drugs, especially those for rare diseases or complex conditions, are becoming more expensive. This rising cost results in higher out-of-pocket expenses for patients, even for those with insurance. Consequently, an increasing number of patients require financial assistance to afford their prescribed treatments.

Market Restraints

Regulatory concerns: Patient assistance programs must navigate a complex web of healthcare laws and regulations. Ensuring compliance with anti-kickback statutes, privacy laws, and other relevant regulations can be challenging and may limit the scope of assistance that can be offered. The fear of running afoul of these regulations may cause some organizations to be overly cautious in their program designs.

Limited awareness: Despite the existence of many patient assistance programs, awareness among eligible patients often remains low. This lack of knowledge means that many who could benefit from these programs don't access them. Outreach and education efforts are crucial but can be costly and challenging to implement effectively, particularly for reaching vulnerable or isolated populations.

Budgetary pressures: Pharmaceutical companies need to manage the expense of assistance programs while keeping profit margins intact. Economic challenges or shifts in company strategy could lead to cuts in funding for these programs, potentially resulting in more restricted or selective assistance options.

Regulatory Landscape and Reimbursement Scenario

Indonesia's pharmaceutical regulatory body is the National Agency of Drug and Food Control (BPOM), responsible for ensuring the safety, efficacy, and quality of pharmaceutical products. BPOM regulates the importation, manufacturing, and distribution of medicines, as well as the registration of new drugs and medical devices. Key responsibilities include drug registration, inspection and monitoring, drug recall, and labelling and packaging. The agency also conducts regular inspections of pharmaceutical manufacturing facilities and distribution centres to ensure compliance with good manufacturing practices (GMP) and good distribution practices (GDP).

Indonesia's reimbursement policy is governed by the National Formulary (NF), which is a list of medicines covered by the social health insurance (JKN) program. The National Health Ministry (MOH) compiles the list, and it is used to determine which medicines are eligible for reimbursement. The e-Catalogue is an electronic platform that lists medicines covered by the JKN program, used by healthcare facilities to procure medicines and by patients to access medicines at a lower cost. The reimbursement ceiling, set by the Case-Based Groups (INA-CBGs), determines the maximum amount that healthcare facilities can claim for a particular medicine, affecting the pricing of medicines and reimbursement rates. The MOH negotiates prices with pharmaceutical companies for medicines included in the NF, considering factors such as the drug's clinical value, production costs, and market conditions. The Health Technology Assessment (HTA) process is used to evaluate the clinical and cost-effectiveness of new medicines.

Competitive Landscape

Key Players

Here are some of the major key players in the Indonesia Financial Assistance Programs Market:

- Cipla

- Mayer

- Baxter

- Roche

- Pfizer

- Bayer

- Sanofi

- Novartis

- Merck

- GSK

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Indonesia Financial Assistance Programs Market Segmentation

By Application

- Population Health Management

- Outpatient Health Management

- In-patient Health Management

- Others

By Therapeutics Area

- Health & Wellness

- Chronic Disease Management

- Other therapeutic area

By End Users

- Payers

- Providers

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.