Indonesia Digital Therapeutics Market Analysis

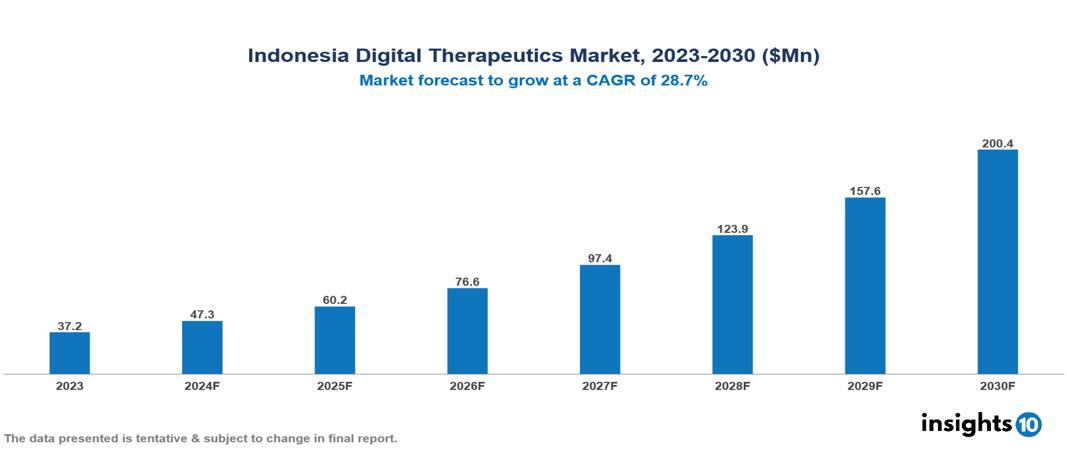

Indonesia Digital Therapeutics Market is at around $37.2 Mn in 2023 and is projected to reach $200.43 Mn in 2030, exhibiting a CAGR of 27.2 % during the forecast period. Increasing healthcare awareness, partnerships, and collaborations, investment, and funding are the drivers propelling the market's expansion. The market is dominated by key players like Halodoc, Good Doctor, Omada Health Inc., 2Morrow Inc., Livongo Health Inc., WellDoc, Propeller Health, Canary Health, Noom Inc., Akili Interactive Labs Inc., and HYGIEIA.

Buy Now

Indonesia Digital Therapeutics Market Executive Summary

Indonesia Digital Therapeutics Market is at around $37.2 Mn in 2023 and is projected to reach $200.43 Mn in 2030, exhibiting a CAGR of 27.2 % during the forecast period.

The Indonesian market for digital therapeutics is a quickly developing field that uses digital technologies to provide evidence-based treatment treatments for various medical diseases. Software, smartphone apps, and other digital solutions for managing, treating, and preventing illnesses are all included in this rapidly expanding business. The Indonesian Digital Therapeutics Market demonstrates the nation's dedication to promoting cutting-edge medical care innovations, with a particular emphasis on utilizing technology to improve healthcare results.

Growing awareness of digital health solutions is behind the enormous expansion of the Indonesian digital therapeutics market. Growing smartphone penetration, the incidence of chronic illnesses on the rise, and government programs encouraging the use of healthcare technology are important causes. In Indonesia, cooperation between IT firms and healthcare providers is promoting the creation and uptake of digital therapies.

Digital therapeutics revenue reached $6.2 Bn globally in 2023, demonstrating the market's remarkable growth. This industry has experienced tremendous growth as a result of the fundamental revolution brought about by contemporary technology and economical production techniques. Digital treatments are therefore being used at a growing rate in the healthcare industry. New developments are expected to support the industry's sustained performance since the current trend in the market indicates that further changes might be ahead.

With more than 20 Mn active users each month, Halodoc is the leader in digital health in Indonesia. Its wide reach gives it a great deal of effect and influence. It offers a more comprehensive healthcare ecosystem that includes telemedicine, drug delivery, and hospital partnerships in addition to teleconsultations. To expedite post-visit experiences and scheduling appointments, they have partnered with more than 1,400 hospitals. They also provide tools for monitoring and managing long-term illnesses like hypertension and diabetes.

Market Dynamics

Market Growth Drivers:

Growing Healthcare Awareness: There is a higher demand for preventive and customized healthcare solutions as Indonesians become more aware of healthcare issues.

Collaborations and Partnerships: The integration of digital therapeutics into current healthcare systems is facilitated by partnerships between pharmaceutical corporations, healthcare providers, and digital therapeutics companies. Partnerships can aid in broadening the market's appeal and enhancing the ecosystem as a whole.

Investment and finance: Digital therapeutics enterprises can flourish with the support of sufficient investment and finance from both domestic and foreign sources. This can help with the marketing and distribution of these solutions, as well as research and development initiatives.

Market Restraints:

Interoperability Challenges: There may be difficulties integrating digital therapies with the current healthcare infrastructure and electronic health records. Problems with interoperability might make it more difficult for healthcare providers to collaborate and communicate information smoothly.

Regulatory Difficulties: The approval procedure for digital therapies may be severely constrained by regulatory obstacles and uncertainty. A protracted clearance process or a lack of clear standards can limit market growth.

Healthcare Infrastructure: The adoption of digital therapies may be hampered by Indonesia's poor state of healthcare infrastructure in some areas with restricted access to technologies.

Healthcare Policies and Regulatory Landscape

The Indonesian National Agency of Drug and Food Control, also known as Badan Pengawas Obat dan Makanan (BPOM), which is under the Ministry of Health (MOH) in Indonesia, is in charge of enforcing local laws about medications and medical equipment. Drug approvals are granted in the form of marketing authorization licenses by NA-DFC, which also supervises the evaluation of drug registration applications. Companies might encounter difficulties with drug clearance processes because of complicated regulatory regulations, protracted review periods, and extensive documentation needs. It could be more challenging for pharmaceutical companies to comply with local regulations.

Competitive Landscape

Key Players:

- Halodoc

- Good Doctor

- Omada Health Inc.

- 2Morrow Inc.

- Livongo Health Inc.

- WellDoc

- Propeller Health

- Canary Health

- Noom Inc.

- Akili Interactive Labs Inc.

- HYGIEIA

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Indonesia Digital Therapeutics Market Segmentation

By Solution

- Software

- Services

By Deployment

- Cloud-based

- On-premises

By Application

- Therapy

- Diabetes

- Obesity

- CNS

- Respiratory

- CVD

By End-use

- Diagnostic Centres

- Healthcare Players

- Healthcare Research Centres

- Hospitals & Clinics

- Nursing Care Centres

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.