Indonesia Diabetes Therapeutics Market Analysis

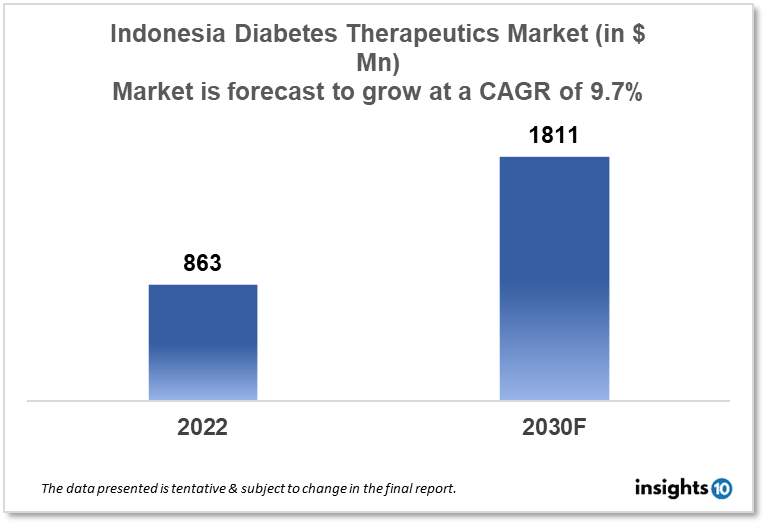

Indonesia's diabetes therapeutics market is expected to grow from $863 Mn in 2022 to $1,811 Mn in 2030 with a CAGR of 9.7% for the forecasted year 2022-2030. The increasing awareness regarding the consequences of diabetes in Indonesia as well as supportive government policies to promote diabetes awareness in Indonesia are the major market drivers. The Indonesia diabetes therapeutics market is segmented by type, application, drug, route of administration, and distribution channel. Tatarasa, Dexa Group, and GlaxoSmithKline are the major players in the Indonesia diabetes therapeutics market.

Buy Now

Indonesia Diabetes Therapeutics Market Executive Analysis

Indonesia's diabetes therapeutics market is expected to grow from $863 Mn in 2022 to $1,811 Mn in 2030 with a CAGR of 9.7% for the forecasted year 2022-30. This year, the Indonesian government will spend $11.9 Bn on healthcare. In contrast to recent years, the government is no longer allocating a particular sum of money to deal with Covid-19 in 2023. According to data, the government spent an estimated $12 Bn on healthcare last year. Spending on Covid was approximately $3.2 Bn. This was considerably less than the budgeted amount for healthcare in 2022, which was $14 Bn, of which $5.5 Bn would be used to combat the coronavirus epidemic. Indonesia intends to use the $12 Bn funding, among other things, to buy extra food for 138,889 underweight toddlers and 50,000 pregnant women with chronic energy deficiencies. 10,280 toddler development anti-stunting packages are the target number.

One of the most populous nations in the globe, Indonesia has 10.7 Mn people living with diabetes, or 6.2% of its total population. As a result, Indonesia has one of the greatest rates of diabetes patients worldwide. In Indonesia, diabetes is one of the leading causes of mortality, and the country's diabetes management strategies include dietary management, education, physical exercise, and pharmaceutical treatment, according to 2016 WHO data.

For people with diabetes, metformin is regarded as the first-line oral medication. It can also be used to treat prediabetes. It functions by reducing the liver's ability to produce glucose, raising insulin sensitivity, and reducing intestinal sugar intake. A1 levels have been shown to fall by 1% to 2%, fasting glucose levels by 25% on average, and postprandial glucose levels by 44% when taking metformin. After taking metformin for three months and if the A1C result is still above target, a doctor may decide to add glipizide to the patient's treatment plan. The pancreatic beta cells are stimulated to secrete more insulin as a result of this drug, which lowers postprandial blood glucose levels. Glipizide is used to treat T2D; it is contraindicated in T1D because it cannot be combined with insulin, which is a necessary therapy for all T1D, as was previously mentioned. Glipizide should not be used with insulin because it can result in serious hypoglycaemia. Although glimepiride and metformin have a similar mechanism of action, their joint use is uncommon due to the higher risk of hypoglycaemia. The first major meal of the day should be consumed along with the once-daily medication glimepiride. The medication functions best when used in conjunction with a healthy diet and exercise. Glimepiride, a sulfonylurea, is favoured for patients with cardiovascular disease because it has no negative effects on ischemic preconditioning and is linked with the least amount of weight gain of all the sulfonylureas.

Market Dynamics

Market Growth Drivers

In Indonesia, there has been an increase in the number of individuals seeking diagnosis and treatment for the disease as a result of increasing awareness of the significance of managing diabetes. There is a rising need for more sophisticated and efficient therapies to manage the disease as diabetes is becoming more common. The National Movement to Control Diabetes, one effort the Indonesian government has put into place to combat the diabetes epidemic, seeks to enhance diabetes prevention, diagnosis, and management leading to the growth of Indonesia's diabetes therapeutics market.

Market Restraints

Indonesia is a large, populous nation with a sparsely developed healthcare system in many regions. This can restrict access to cutting-edge therapies and make it challenging for diabetic patients to obtain a correct diagnosis and treatment. The cost of many diabetes therapies and devices prevents all patients from using them. This could restrict the use of advanced therapies and result in patients having worse health results. In Indonesia, many diabetic people lack health insurance, which may restrict their access to diabetes therapeutics which can hamper the growth of the Indonesia diabetes therapeutics market.

Competitive Landscape

Key Players

- Kimia Farma (IDN)

- Shima (IDN)

- Indofarma (IDN)

- Tatarasa (IDN)

- Dexa Group (IDN)

- Glaxosmithkline

- Novartis

- Novo Nordisk

- Sanofi

- Takeda Pharmaceutical

- Johnson And Johnson

- Merck

Healthcare Policies and Regulatory Landscape

The primary duties of legislation, regulation, and standardization of policies and processes regarding food and drug products in Indonesia fall under the purview of the National Agency of Drug and Food Control (BPOM). This entails the pre- and post-market assessment of products, as well as the licensing and certification of pharmaceutical industries based on Good Manufacturing Practices (GMP). Product sampling, lab testing, manufacturing and distribution facility inspections, research, and collaboration with law enforcement are all part of market monitoring. In order to confirm that product claims adhere to predetermined standards, the organization also assesses product advertisements and promotions. The BPOM is in charge of public education and communication regarding product safety as well as public alerts in the event that subpar goods enter the market. Last but not least, the organization is in charge of locating and pursuing drug counterfeiters in cooperation with law enforcement. To synchronize standards throughout the ASEAN area, the BPOM has been collaborating with other ASEAN governments. Additionally, there has been a strong push to ratify the PIC/S treaty in order to impose GMP standards in line with global norms.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Diabetes Therapeutics Segmentation

By Type (Revenue, USD Billion):

- Diabetes 1

- Diabetes 2

By Application (Revenue, USD Billion):

- Preventive

- Prediabetes

- Nutrition

- Obesity

- Lifestyle Management

- Treatment/Care

- Diabetes

- Smoking Cessation

- Musculoskeletal Disorders

- Central Nervous System Disorders

- Cardiovascular Disease

- Medication Adherence

- Chronic Respiratory Disorders

- Gastrointestinal Disorders

- Rehabilitation

- Substance Use Disorders & Addiction Management

By Drug (Revenue, USD Billion):

- Oral Anti-diabetic Drugs

- Insulin

- Non-insulin Injectable Drug

- Combination Drug

By Route of Administration (Revenue, USD Billion):

- Oral

- Subcutaneous

- Intravenous

By Distribution Channel (Revenue, USD Billion):

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

Tatarasa, Dexa Group, and GlaxoSmithKline are the major players in the Indonesia diabetes therapeutics market.

The Indonesia diabetes therapeutics market is expected to grow from $863 Mn in 2022 to $1,811 Mn in 2030 with a CAGR of 9.7% for the forecasted year 2022-2030.

The Indonesia diabetes therapeutics market is segmented by type, application, drug, route of administration, and distribution channel.