Indonesia Dermatological Therapeutics Market Analysis

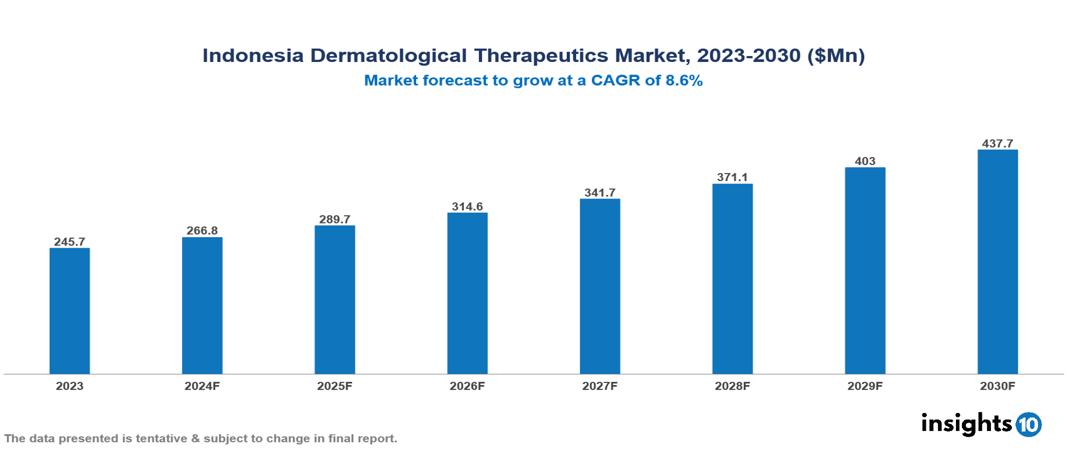

Indonesia Dermatological Therapeutics Market is at around $0.25 Bn in 2023 and is projected to reach $0.44 Bn in 2030, exhibiting a CAGR of 8.6% during the forecast period. The market is expanding due to an increase in dermatological disorders, increased awareness about skin diseases, and technological advancements. The market is dominated by key players like PT Kalbe Farma Tbk (IDN), PT Kimia Farma Tbk (IDN), PT Sanbe Farma (IDN), Almirall SA, Pfizer Inc., AbbVie Inc., Amgen Inc., Novartis AG, Johnson & Johnson, and GlaxoSmithKline Plc.

Buy Now

Indonesia Dermatological Therapeutics Market Executive Summary

Indonesia Dermatological Therapeutics Market is at around $0.25 Bn in 2023 and is projected to reach $0.44 Bn in 2030, exhibiting a CAGR of 8.6% during the forecast period.

Medical therapies for the treatment of skin illnesses and disorders are studied and applied in the field of dermatological therapeutics. The primary focus of this subject is the development and application of therapeutic techniques to address a variety of dermatological disorders. These tactics may include topical and systemic drugs, surgical procedures, and emerging technology. Enhancing the general well-being of people with different skin-related conditions is its main objective, along with promoting skin health and symptom relief.

The market for dermatological therapeutics in Indonesia is expanding steadily, propelled by the rising number of people with skin conditions. Growth in the market is aided by improvements in dermatological treatments as well as growing awareness of skincare and cosmetic issues. To take advantage of Indonesia's increasing need for dermatological therapies, major manufacturers are concentrating on strategic alliances and product innovation.

Globally, dermatological treatments brought in $40.94 Bn in revenue in 2023. This massive increase, indicative of a modernizing society, is enabled by highly efficient industrial processes and advanced technologies. Increasing investment, ongoing innovation, and improved accessibility are a few of the factors contributing to the industry's remarkable expansion. These variables have led to an increase in the market for dermatological therapies.

After the global giant GSK, Kalbe Farma has the most market share among domestic competitors. Provides a wide array of products, encompassing over-the-counter items like sun protection, skin whitening creams, and anti-aging remedies, prescription pharmaceuticals like antihistamines, antibiotics, and corticosteroids, and topical treatments for acne, eczema, psoriasis, and fungal infections. Their well-known brands with high levels of customer trust include Exorex, Proactiv, and Bio-Cleansing.

Market Dynamics

Market Growth Drivers:

Growing Dermatological Disorders: The need for dermatological therapies is driven by the population's heightened occurrence of skin ailments and dermatological disorders. Skin issues can be caused by a variety of factors, including pollution, changes in lifestyle, and exposure to toxic environmental elements.

Increasing Awareness: The public's growing knowledge of skincare and the accessibility of cutting-edge dermatological treatments is increasing demand for therapeutic goods.

Technological Developments: The creation of novel medications, creative delivery methods, and minimally invasive treatments are attracting as healthcare providers.

Market Restraints:

Regulatory Environment: Strict guidelines and lengthy approval procedures for medications and treatments related to dermatology can be a major barrier. Regulation changes or delays in approvals can have an impact on new product launches and market entry.

Healthcare Infrastructure: The adoption of dermatological therapies is impacted by the accessibility and availability of healthcare services and facilities, especially in rural areas. Inadequate availability of specialized treatment could impede market expansion.

Financial Elements: Spending on healthcare and other economic factors affects how much demand there is for dermatological goods. Reduced spending on non-essential healthcare products may result from economic downturns.

Healthcare Policies and Regulatory Landscape

Enforcement of local regulations concerning medicines and medical equipment is the responsibility of the Indonesian National Agency of Drug and Food Control, also known as Badan Pengawas Obat dan Makanan (BPOM), which is under the Ministry of Health (MOH) in Indonesia. NA-DFC oversees the review of drug registration applications and grants drug approvals in the form of marketing authorization licenses. Drug clearance procedures can provide challenges for companies due to complex regulatory standards, lengthy review durations, and copious documentation requirements. Pharmaceutical businesses may find the process more difficult to comply with local requirements.

Competitive Landscape

Key Players:

- PT Kalbe Farma Tbk (IDN)

- PT Kimia Farma Tbk (IDN)

- PT Sanbe Farma (IDN)

- Almirall SA

- Pfizer Inc.

- AbbVie Inc.

- Amgen Inc.

- Novartis AG

- Johnson & Johnson

- GlaxoSmithKline Plc.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Indonesia Dermatological Therapeutics Market Segmentation

By Type

- Prescription-based Drugs

- Over-the-counter Drugs

By Disease

- Alopecia

- Herpes

- Psoriasis

- Rosacea

- Skin Cancer

- Acne

- Atopic Dermatitis

- Vitiligo

- Hidradenitis

- Other Applications

By Drug Class

- Anti-infectives

- Corticosteroids

- Anti-acne

- Calcineurin Inhibitors

- Retinoids

- Other Drug Classes

By Route of Administration

- Topical Administration

- Oral Administration

- Parenteral Administration

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.