Indonesia Coronary Stents Market Analysis

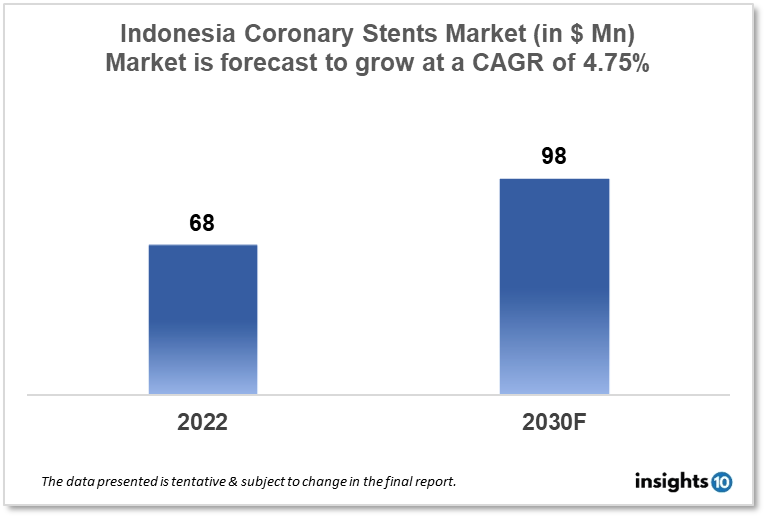

Indonesia's Coronary Stents Market is expected to witness growth from $68 Mn in 2022 to $98 Mn in 2030 with a CAGR of 4.75% for the forecasted year 2022-30. The older population in Indonesia is expanding and is more likely to acquire coronary heart disease. The need for coronary stents is anticipated to rise as the senior population continues to rise. The market is segmented by type, mode of delivery, materials, and end user. Some key players in this market include PT. Graha Farma, PT. Mensa Bina Sukses, B. Braun, Abbott Laboratories, Biotronik, Medtronic, GE Healthcare, Boston Scientific, and Philips Healthcare.

Buy Now

Indonesia Coronary Stents Healthcare Market Executive Analysis

Indonesia's Coronary Stents Market size is at around $68 Mn in 2022 and is projected to reach $98 Mn in 2030, exhibiting a CAGR of 4.75% during the forecast period. The expected rise in healthcare spending in Indonesia from 2022 to 2028 is $30.18 billion. The expected expenditure for 2028 is $69.3 billion. As a recently transforming country with a middling income, Indonesia is classified as such. It ranks 17th in terms of nominal GDP and is the seventh-largest economy in the world in terms of GDP. Indonesia's Internet economy, currently valued at $40 billion, is expected to grow to $130 billion by 2025.

In Indonesia, the prevalence of coronary artery disease is about 10.7%. According to this, almost one in ten persons in Indonesia suffer from coronary artery disease. In Indonesia, coronary artery disease causes 16.9% of all fatalities, making it the country's number one mortality. About 232,000 fatalities in Indonesia in 2020 were because of coronary heart disease. By widening or unblocking heart arteries, coronary stents are used to treat coronary artery disease. Coronary stents work by widening or unblocking constricted or clogged arteries to assist in restoring blood flow to the heart muscle. This can aid in the relief of symptoms including shortness of breath and chest pain. A small incision in the wrist or groin can be used to implant a coronary stent during a minimally invasive treatment. As a result, recuperation time is typically quicker following closed-heart surgery. The installation of a coronary stent usually takes one to two hours, and the majority of patients can go home the same day.

Market Dynamics

Market Growth Drivers

The older population in Indonesia is expanding and is more likely to acquire coronary heart disease. The need for coronary stents is anticipated to rise as the senior population continues to rise. The Indonesian government has been making investments in the country's healthcare system to enhance all residents' access to healthcare. The need for medical equipment, such as coronary stents, is predicted to rise as a result. Technology advancements have increased the safety and efficiency of coronary stents, including the creation of drug-eluting and bioresorbable stents. Patients and healthcare professionals are now more in demand for these gadgets as a result of this.

Market Restraints

The Indonesian healthcare market has a substantial presence of generics, and the same is true of the market for coronary stents. Manufacturers may feel pressure from this to maintain competitive prices and set their products apart from generic alternatives. For medical device producers in Indonesia, particularly those who are new to the market, the regulatory environment can be difficult. Market access may be impacted by regulatory changes, and the registration process for medical devices can be drawn out and complicated. The cost of coronary stents can be high, especially for those without health insurance. This may reduce patient and healthcare provider demand for these devices.

Competitive Landscape

Key Players

- PT. Graha Farma (ID)

- PT. Mensa Bina Sukses (ID)

- Biotronik

- Boston Scientific

- B. Braun

- Abbott Laboratories

- GE Healthcare

- Medtronic

- Philipps Healthcare

Healthcare Policies and Regulatory Landscape

The National Agency of Drug and Food Control (BPOM), the Indonesian Medical Device Association (IMDA), and the Ministry of Health are in charge of regulating the healthcare system and the coronary stent market in Indonesia. Medical equipment, such as coronary stents, are categorised as high-risk items in Indonesia and are subject to stringent rules. Before any medical equipment can be marketed or sold in Indonesia, it must first be registered with the BPOM. The device's quality, safety, and efficacy are rigorously examined as part of the registration procedure. To increase access to medical equipment, such as coronary stents, the Indonesian government has established a number of healthcare regulations. For instance, the National Health Insurance (JKN) programme was introduced in 2014 to give all Indonesians access to inexpensive healthcare, including medical equipment.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Coronary Stents Market Segmentation

By Type (Revenue, USD Billion):

The three main categories of coronary stents are bare-metal, drug-eluting, and bioabsorbable, depending on their nature. The segment for bioabsorbable stents is anticipated to increase at the fastest rate over the forecast period. The benefits that are encouraging the use of bioabsorbable stents include a decrease in problems including thrombosis and inflammation, the cIndonesiaity to restore normal vasomotion, and an improvement in aberrant endothelial function. However, in the upcoming years, the expansion of this market segment is anticipated to be constrained by the high cost of bioabsorbable stents.

- Bare-metal Stents

- Drug-eluting Stents

- Bioabsorbable Stents

By Mode of Delivery (Revenue, USD Billion):

The market is divided into self-expanding and balloon-expandable stents according to delivery method. Because of the high use of these stents, rising research initiatives to advance the technology, and rising regulatory approvals for balloon-expandable stents, the balloon expandable stents segment is anticipated to increase at the greatest CAGR over the projection period.

- Balloon-expandable Stents

- Self-expanding Stents

By Materials (Revenue, USD Billion):

The coronary stent market is divided into metallic (cobalt chromium, platinum chromium, nickel-titanium, and stainless steel) and other stents according to the material. The market for other stents is anticipated to experience the largest CAGR growth during the projection period. The rapid expansion of this market can be ascribed to the increased use of polymers and copolymers in the production of bioabsorbable stents.

- Metallic Stents

- Cobalt-Chromium

- Platinum Chromium

- Nickel Titanium

- Stainless Steel

- Other Stents

By End User (Revenue, USD Billion):

The coronary stent market is divided into hospitals, cardiac centres, and ambulatory surgical centres based on the end user. According to predictions, the hospital sector will control the market in 2016. This is primarily caused by hospitals using a lot of coronary stents.

- Hospitals

- Cardiac Centers

- Ambulatory Surgical Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.