Indonesia Chronic Pain Therapeutics Market Analysis

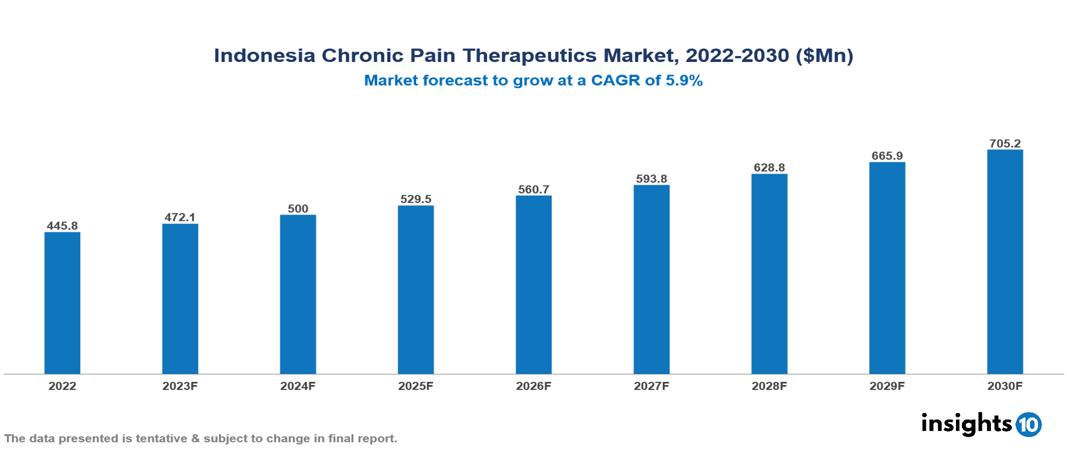

The Indonesia Chronic Pain Therapeutics Market is anticipated to experience a growth from $446 Mn in 2022 to $705 Mn by 2030, with a CAGR of 5.9% during the forecast period of 2022-2030. An aging population with rising chronic pain, growing awareness among healthcare professionals and patients, and supportive government initiatives are the key drivers of this market. The Indonesia Chronic Pain Therapeutics Market encompasses various players across different segments, including Pfizer, Abbott, AstraZeneca, Bristol Myers Squibb, Roche, Johnson & Johnson, Kalbe Pharma, Indo Pharma, Kimia Pharma, Tempo Scan Group, etc., among various others.

Buy Now

Indonesia Chronic Pain Therapeutics Market Analysis Executive Summary

The Indonesia Chronic Pain Therapeutics Market is anticipated to experience a growth from $446 Mn in 2022 to $705 Mn by 2030, with a CAGR of 5.9% during the forecast period of 2022-2030.

Chronic pain is a form of pain that persists for more than three months and can remain for years. It is not the same as acute pain, which is temporary and typically caused by an accident or disease that goes away after the underlying cause is addressed. Chronic pain can affect several sections of the body and have a substantial influence on everyday activities, resulting in despair, anxiety, and sleep difficulties. Chronic pain can be caused by a variety of factors, including persistent health disorders such as arthritis or cancer, as well as changes in the body's sensitivity to pain after an injury has healed. Another type of chronic pain is psychogenic pain, which is caused by psychological causes such as stress or sadness. Managing chronic pain involves a combination of medications, therapies, and lifestyle adjustments to alleviate symptoms and improve quality of life. While there is no universal cure for chronic pain, seeking appropriate treatment and support from healthcare providers is essential to effectively manage this challenging condition.

Chronic pain is a major health issue in Indonesia, with a high prevalence that is expected to rise further in the future. Recent collaborations in this field include prototype multidisciplinary pain clinics with local partners in Indonesia, Myanmar, and Vietnam. Lower back discomfort was common among middle-aged individuals in Indonesia, with a prevalence of 44.29% after 12 months. Other prevalent kinds of chronic pain in Indonesia include neck pain, shoulder discomfort, and joint illnesses including osteoarthritis and gout.

An aging population with rising chronic pain, growing awareness among healthcare professionals and patients, and supportive government initiatives are the key drivers of this market.

Indonesia's pharmaceutical market is varied, including both foreign and domestic firms. While domestic giant Kalbe Farma has the largest market share due to its vast product line and brand awareness, the topic alters when it comes to overall revenue. Global pharmaceutical heavyweights such as Pfizer, Abbott Laboratories, and Merck & Co. are poised to dominate, capitalizing on their enormous portfolios and global reach.

Market Dynamics

Market Growth Drivers

Prevalence of chronic pain conditions: As Indonesia's population grows and ages, the incidence of age-related disorders such as arthritis and neuropathy rises, causing an increase in chronic pain prevalence. This demographic shift in the country creates a demand for effective pain therapeutics, presenting a good opportunity for pharmaceutical companies to address the healthcare needs of the population.

Expanding awareness: Increasing understanding of chronic pain management among healthcare professionals and patients is a driving force for the market. As the complexities of chronic pain and their associated treatment options are more popular among the healthcare community, there is a greater likelihood of early diagnosis and the need for interventions. This contributes to the overall growth of the chronic pain therapeutics market.

Government initiatives: The Indonesian government is increasingly making efforts to improve healthcare infrastructure and accessibility. Policies aimed at enhancing the healthcare system and ensuring affordability for better access to pain management solutions for the public contribute to the market’s expansion. Government support can positively impact the adoption of chronic pain therapeutics by making them more widely available and affordable for the population.

Market Restraints

Regulatory issues: Certain regulatory barriers and clearance processes for new pain drugs in the nation can considerably stymie market growth. Stringent regulatory restrictions imposed by the regulatory body may cause delays in product releases, compromising the timely availability of novel therapies to patients in need.

Affordability issues: Access to costly pain management medicines may be restricted for some demographic groups due to financial constraints. This socioeconomic component may lead to differences in healthcare access, which might hinder the general use of treatments for chronic pain.

Limited Healthcare Access: Despite government efforts, access to quality healthcare services and pain specialists remains limited to the urban areas in the country. Issues still exist for the rural areas and low-income populations. This restricts patients' ability to receive proper diagnosis and treatment for chronic pain.

Healthcare Policies and Regulatory Landscape

The National Agency of Drug and Food Control (BPOM) in Indonesia holds a pivotal role in safeguarding public health and ensuring the safety and quality of pharmaceutical products. Operating under the Ministry of Health, BPOM evaluates and approves drugs entering the market, conducts inspections to enforce compliance with regulatory standards, and regulates various industries and products for human consumption. Collaborating with healthcare policies, BPOM establishes guidelines for pharmaceutical companies, contributing to the creation of a robust healthcare system that instills confidence in healthcare professionals and the general public regarding the safety and efficacy of medications. This collaborative effort is essential in shaping Indonesia's healthcare landscape, ensuring access to quality medical services for its diverse population, and addressing healthcare challenges effectively.

Competitive Landscape

Key Players:

- Pfizer

- Abbott

- AstraZeneca

- Bristol Myers Squibb

- Roche

- Johnson & Johnson

- Kalbe Pharma

- Indo Pharma

- Kimia Pharma

- Tempo Scan Group

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Indonesia Chronic Pain Therapeutics Market Segmentation

By Indication

- Neuropathic Pain

- Back Pain

- Headaches

- Arthritis Pain

- Muscular Pain

- Idiopathic Pain

- Others

By Drug Class

- Analgesics

- Opioids

- NSAIDs

- Anaesthetics

- Others

By Route of Administration

- Oral

- Topical

- Parenteral

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By End User

- Hospitals

- Speciality Clinics

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.