Indonesia Cardiac Resynchronization Therapy Market

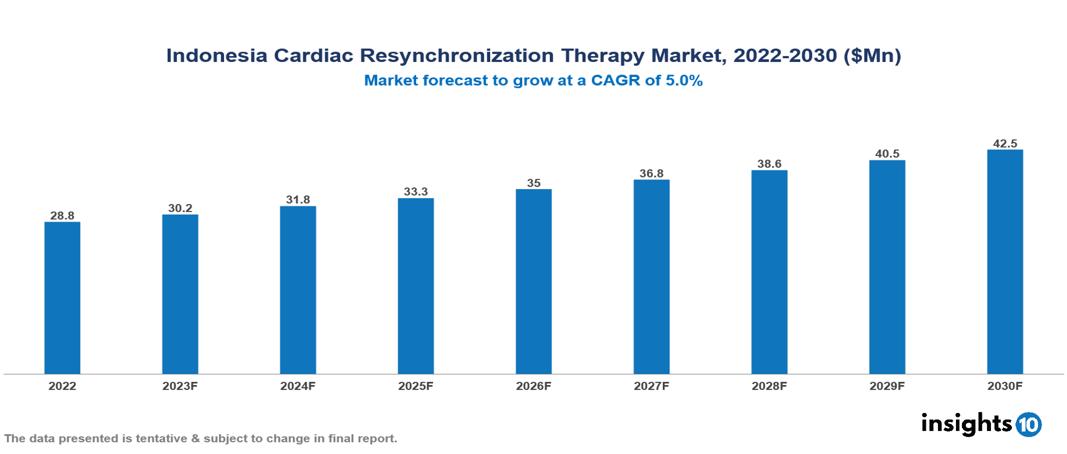

Indonesia Cardiac Resynchronization Therapy Market valued at $29 Mn in 2022, projected to reach $43 Mn by 2030 with a 5% CAGR. The global surge in heart failure cases, driven by aging populations and lifestyle-related cardiovascular diseases, is a significant catalyst contributing to the expansion of the Cardiac Resynchronization Therapy (CRT) market. Currently, major contributors to this market include companies such as Medtronic, Boston Scientific, Abbott, Siemens Healthineers, MicroPort Apsara, Lepu Medical Technology Co., Beijing Easywell Medical Device Co., Shenzhen Lepu Heart Valve Technology Co., Terumo Corporation, and Osram Health.

Buy Now

Indonesia Cardiac Resynchronization Therapy Market Executive Summary

Indonesia Cardiac Resynchronization Therapy Market valued at $29 Mn in 2022, projected to reach $43 Mn by 2030 with a 5% CAGR.

Cardiac resynchronization therapy (CRT) is a medical procedure involving the utilization of a pacemaker to rectify the heart's rhythm through a minimally invasive surgical procedure. The CRT pacemaker, positioned beneath the skin, harmonizes the timing between the upper and lower heart chambers, ensuring synchronization between the left and right sides of the heart. This therapeutic approach holds particular significance for individuals experiencing heart failure, as it addresses insufficient pumping and fluid accumulation in the lungs and legs resulting from the asynchronous beating of the heart's lower chambers. In instances of severe heart rhythm irregularities, CRT therapy may be complemented by the integration of an implantable cardioverter-defibrillator (ICD). The CRT device connects wires from the pacemaker to both sides of the heart, employing biventricular pacing to guarantee coordinated contractions and optimize overall heart function.

The cardiovascular disease (CVD) mortality rate in Indonesia has risen significantly from 356.05 to 412.46 deaths per 100,000 population. Stroke and ischemic heart disease are prevalent, with coronary heart disease also significant. Factors driving this trend include urbanization, lifestyle changes, and CVD risk factors. Urgent interventions and preventive strategies are needed to address the growing impact, with projections estimating 6 Mn individuals affected by heart disease by 2024.

Leading healthcare companies like Abbott and BIOTRONIK are revolutionizing the pacemaker market with groundbreaking innovations. They've introduced state-of-the-art technologies such as leadless pacemakers and devices with always-on, automatic MRI detection algorithms. Leadless pacemakers, a significant departure from conventional models, are small, self-contained devices inserted directly into the heart, eliminating the need for lead cables. This innovation offers patients a more efficient and minimally invasive option, reducing the risk of lead-related issues.

Market Dynamics

Market Growth Drivers

Increasing Incidence of Heart Failure: The rising rate of heart failure in Indonesia is a serious health concern, primarily due to an aging population and increased risks like obesity, diabetes, and hypertension. This results in a larger group of patients who could potentially experience benefits from CRT therapy.

Technological Advancements: Continuous improvements in CRT technology are yielding systems that are more durable and smaller, along with new features like data analysis and remote monitoring. These advancements have the potential to enhance patient comfort, treatment efficacy, and the overall delivery of healthcare services.

Expanding Aging Population: Indonesia is witnessing a demographic shift with a growing elderly population. In 2022, nearly 19 Mn citizens, or 6.86% of the total population, are aged 65 and above. This trend is fuelled by increased life expectancy and declining fertility rates. Projections indicate that by 2045, the elderly demographic could reach 20%, highlighting a significant change. The expanding elderly population, a key risk group for heart-related conditions, presents a larger pool of potential candidates for Cardiac Resynchronization Therapy (CRT) interventions.

Market Restraints

Limited Awareness and Education: Insufficient awareness among both healthcare professionals and the general public regarding the advantages and applications of CRT could impede its acceptance. It may be necessary to implement educational initiatives and training programs to enhance awareness and comprehension.

High Cost of CRT Devices and Procedures: The expenses linked to CRT devices and the procedures for their implantation can pose a notable obstacle, especially in areas with constrained financial resources. Challenges related to affordability and reimbursement may restrict accessibility for a substantial segment of the population.

Infrastructure and Resource Constraints: In specific regions, insufficient healthcare infrastructure and a deficit of proficient medical professionals might hinder the extensive adoption of CRT. The absence of specialized facilities and adequately trained staff can curtail the availability of these advanced therapies.

Healthcare Policies and Regulatory Landscape

In Indonesia, the regulatory landscape for pharmaceutical treatment is overseen collaboratively by the Ministry of Health (Kemenkes) and the National Agency of Drug and Food Control (Badan Pengawas Obat dan Makanan-BPOM). BPOM plays a crucial role in granting and supervising pharmaceutical marketing authorizations, ensuring the quality, safety, and efficacy of products. The Ministry of Health provides comprehensive healthcare guidelines that influence the standards adhered to by these medications. The national health insurance program, Jaminan Kesehatan Nasional (JKN), directly affects the accessibility and payment procedures for medications addressing brain cancer. Ongoing efforts to establish health technology assessment mechanisms and enact laws governing clinical trials and research also impact the review and approval processes.

Competitive Landscape

Key Players

- Medtronic

- Boston Scientific

- Abbott

- Siemens Healthineers

- MicroPort Apsara

- Lepu Medical Technology (Beijing) Co.

- Beijing Easywell Medical Device Co.

- Shenzhen Lepu Heart Valve Technology Co.

- Terumo Corporation

- Osram Health

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Indonesia Cardiac Resynchronization Therapy Market Segmentation

By Product

- CRT-Defibrillator

- CRT-Pacemaker

By Age

- Below 44 years

- 45-64 years

- 65-84 years

- Above 85 years

By End-Users

- Hospitals

- Cardiac care Centres

- Ambulatory Surgical Centres

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.