Indonesia Cancer Induced Bone Diseases Therapeutics Market

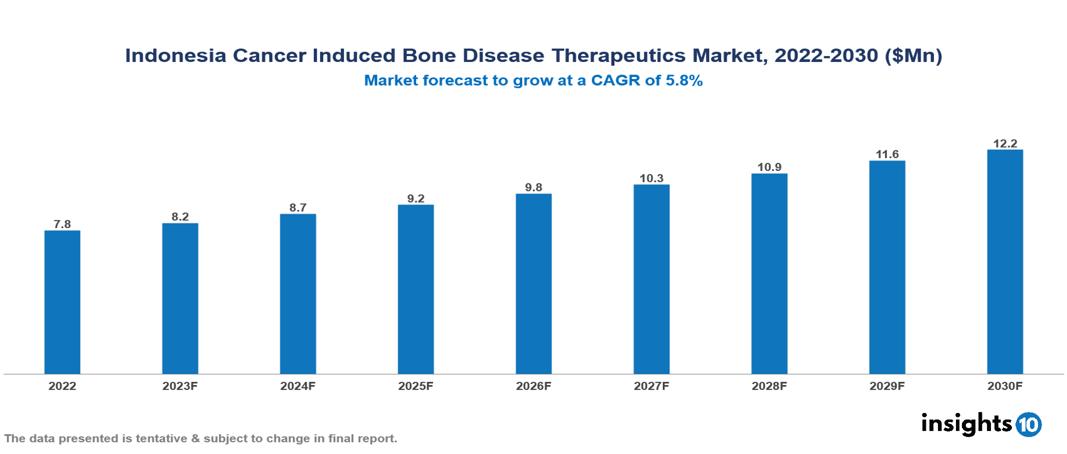

Indonesia Cancer Induced Bone Disease Therapeutics Market valued at $8 Mn in 2022, projected to reach $12 Mn by 2030 with a 5.8% CAGR. The key drivers of this industry include the rising incidence of cancers, government initiatives, and unmet medical needs. The industry is primarily dominated by players such as Roche, Bayer, Merck, Johnson & Johnson, Novartis, and Amgen among others.

Buy Now

Indonesia Cancer Induced Bone Diseases Therapeutics Market Analysis

Indonesia Cancer Induced Bone Disease Therapeutics Market valued at $8 Mn in 2022, projected to reach $12 Mn by 2030 with a 5.8% CAGR.

Cancer-related bone diseases entail situations where cancer cells metastasize, impacting the bones and resulting in issues like bone destruction, fractures, and pain. Common causes involve the migration of cancer from primary tumors to the bones, frequently seen in breast, prostate, lung cancers, and multiple myeloma. Symptoms typically consist of localized pain, bone fractures, and diminished mobility, significantly affecting the overall quality of life for those afflicted. The current approach to managing cancer-induced bone diseases employs a comprehensive strategy. Medical interventions encompass chemotherapy, radiation therapy, and targeted therapies to tackle the underlying cancer. Additionally, the use of bisphosphonates and other bone-targeted agents may be employed to fortify bones and relieve pain. Noteworthy pharmaceutical companies, including Amgen, Novartis, and Eli Lilly, play a pivotal role in the development and production of medications. These companies have introduced drugs such as denosumab and bisphosphonates for the management of bone complications in cancer patients.

In Indonesia, there is an increasing prevalence of cancers such as breast (around 43%), prostate (more than 30%), and lung cancer (about 23%) that result in the development of bone metastases. The market is being driven by factors such as the upward trend in cancer incidence, government initiatives, and high unmet medical needs. However, conditions such as limited accessibility, limited diagnoses, and a complex regulatory landscape in the country limit the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Increasing cancer incidence: Indonesia is experiencing a growing challenge posed by cancer, with projections indicating a 13% rise in new cancer cases from 2020 to 2040. This increase in cancer diagnoses results in a larger population vulnerable to CIBD, contributing to a heightened demand for pertinent therapeutics. The estimated prevalence of cancers such as breast (around 43%), lung (about 23%), and prostate (approximately 30%) is rapidly rising. Another contributing factor is the aging population in Indonesia, as the risk of cancer, including bone metastases, rises with age.

Government initiatives: The Indonesian government is enacting measures to broaden healthcare accessibility and insurance inclusion, particularly in rural areas. The enhanced access to healthcare services is expected to result in higher diagnoses and treatment rates for CIBD, thereby increasing market demand. Healthcare reforms by the government, which concentrate on enhancing healthcare infrastructure, personnel, and access to essential medications, contribute to a more conducive environment for the CIBD therapeutics market.

Unmet medical need: Despite advancements, there is a shortage of effective treatment choices for Cancer-Induced Bone Diseases (CIBD), especially in advanced stages. This gap in medical solutions presents a chance for novel therapies to emerge and meet unmet needs in patient care. The need for targeted therapies: The varied characteristics of CIBD highlight the requirement for therapies tailored to specific cancer types and patient requirements. The creation and accessibility of such targeted treatments have the potential to propel market expansion.

Market Restraints

Limited accessibility: Limited availability of quality healthcare facilities and specialists, especially in rural regions, leads to disparities in the diagnosis, treatment, and access to advanced therapies for CIBD patients. While national health insurance (BPJS) covers certain CIBD treatments, numerous newer or innovative therapies are not included, placing a financial burden on patients and their families. Despite having insurance, patients frequently encounter substantial out-of-pocket expenses for medications, consultations, and diagnostics, posing challenges to treatment adherence and affecting overall outcomes.

Limited diagnoses: Insufficient awareness of CIBD and its symptoms among the general public and healthcare professionals may result in delayed diagnoses and treatment initiation, affecting overall outcomes. The scarcity of healthcare professionals specializing in CIBD, including a limited number of oncologists and specialists trained in its management, poses challenges in terms of diagnosis, treatment planning, and access to specialized care. Additionally, the constrained availability of advanced diagnostic tools such as specialized imaging and specific biomarkers can impede accurate diagnosis, optimal treatment selection, and the monitoring of disease progression.

Stringent regulatory environment: Securing regulatory approval for novel therapeutics addressing CIBD in Indonesia can be a protracted and costly process, impeding timely access to potentially life-saving treatments for patients. Complications in negotiating prices: Prolonged and intricate negotiations between pharmaceutical companies and the government regarding drug pricing add further delays to market entry, restricting affordability for patients. Insufficient transparency in pricing and reimbursement: The lack of clarity in pricing and reimbursement procedures introduces uncertainty for both patients and healthcare providers, influencing treatment decisions and hindering access.

Healthcare Policies and Regulatory Landscape

In Indonesia, the primary regulatory agency overseeing pharmaceuticals, drugs, and medical products is the National Agency of Drug and Food Control (Badan Pengawas Obat dan Makanan or BPOM). BPOM operates under the Ministry of Health and is responsible for the evaluation, registration, and monitoring of pharmaceuticals, food products, and medical devices. It ensures that these products meet the necessary safety, efficacy, and quality standards before they can be distributed and consumed in the Indonesian market.

The process of obtaining a license for pharmaceuticals and medical products in Indonesia involves submission to BPOM of a comprehensive set of documents, including data from preclinical and clinical trials, details on manufacturing processes, and quality control procedures. BPOM conducts a thorough evaluation to assess the safety, efficacy, and quality of the products, and inspections of manufacturing facilities may also be carried out. While the regulatory environment in Indonesia is designed to protect public health, the process can be intricate and time-consuming. New entrants need to navigate these regulatory complexities, invest in meeting stringent standards, and work closely with BPOM to ensure compliance.

Competitive Landscape

Key Players

- Amgen

- Pfizer

- Novartis

- Bayer

- Johnson & Johnson

- Basf SE

- Eli Lilly

- Merck

- Roche

- AstraZeneca

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Indonesia Cancer Induced Bone Diseases Therapeutics Market Segmentation

By Cancer Type

- Breast cancer

- Prostate cancer

- Lung cancer

- Others

By Treatment Type

- Bisphosphonates

- Denosumab

- Radiation Therapy

- Pain Management Medications

- Surgical Intervention

- Targeted Therapy

By Distribution channel

- Hospitals

- Pharmacies

- Oncology clinics

- Others

By Stage of Treatment

- Early stage CIBD

- Advanced stage CIBD

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.