Indonesia Brain Cancer Therapeutics Market

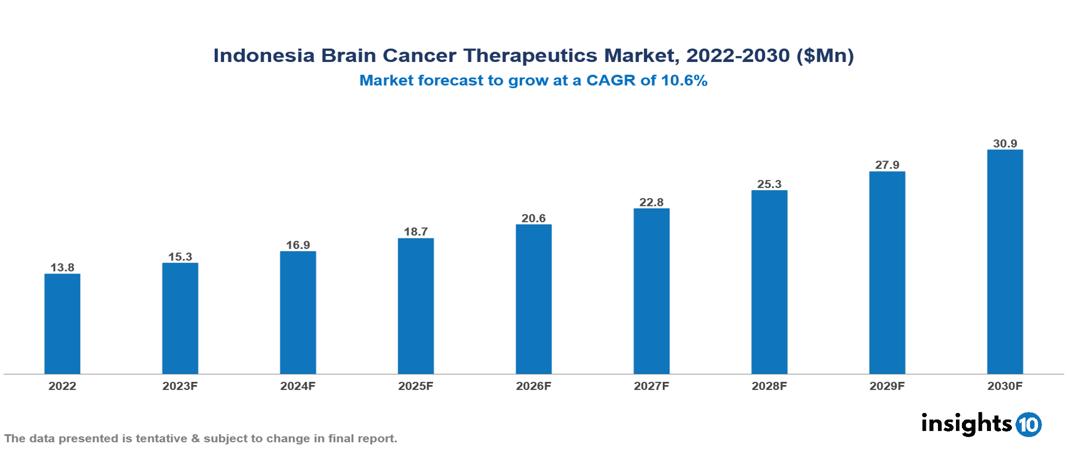

Indonesia Brain Cancer Therapeutics Market valued at $14 Mn in 2022, projected to reach $31 Mn by 2030 with a 10.6% CAGR. The anticipated increase in cases of brain cancer, particularly glioblastoma multiforme, is expected to markedly boost the need for brain cancer therapeutics, shaping the overall market landscape significantly. The top leading pharmaceutical companies currently operating in the market are Roche, Novartis, Pfizer, Merck, AstraZeneca, Bristol Myers Squibb, Eli Lilly, Sanofi, Johnson & Johnson and Takeda.

Buy Now

Indonesia Brain Cancer Therapeutics Market Executive Summary

Indonesia Brain Cancer Therapeutics Market valued at $14 Mn in 2022, projected to reach $31 Mn by 2030 with a 10.6% CAGR.

The abnormal proliferation of brain cells serves as an indication of brain cancer, where these cells exhibit characteristics that can be either malignant (cancerous) or benign (non-cancerous). While the exact cause of brain cancer remains unclear, identified risk factors include exposure to ionizing radiation and a family history of brain tumors. Common symptoms associated with a brain tumor include headaches, gradual sensory decline, issues with balance, speech impediments, and hearing difficulties. The manifestation of these symptoms varies depending on factors such as the tumor’s size, location, and growth rate. Treatment approaches for brain cancer are determined by the tumor’s type, location, and size, with frequently utilized methods including radiosurgery, chemotherapy, radiotherapy, surgery, and the use of carmustine implants.

In Indonesia, the 5-year prevalence of brain and other Central Nervous System (CNS) tumors stands at 946,088. This figure reflects the cumulative number of individuals living with these conditions over five years. In addition, there were an estimated 396,914 new instances of cancer in the nation, with 183,368 cases affecting men and 213,546 cases affecting women. According to reports, Indonesia has an age-standardized incidence rate of 141.1 per 100,000 individuals for cancer. This rate indicates that 1.4% of the total population has received a cancer diagnosis and offers a standardized measurement that considers demographic age disparities. Unfortunately, there are still 234,511 documented cancer-related fatalities in the area, making cancer a major cause of death.

DSP-0390, an experimental Emopamil-binding Protein (EBP) Inhibitor, has been granted Orphan Drug Designation to Sumitomo Pharma Oncology, a clinical-stage firm. GBM is a type of high-grade glioma that affects the brain. This designation underscores the profound need for novel brain cancer treatment. A Phase 1 clinical trial is presently being carried out in the US and Japan to assess the drug's safety and effectiveness in treating patients with high-grade gliomas.

Market Dynamics

Market Growth Drivers

Rising Incidence of Brain Tumours: Due to a number of circumstances, the frequency of brain tumors is rising in Indonesia. The risk is larger among the aging population because the chance of getting these tumors increases with age. The rising incidence of brain tumors is also attributed to alterations in lifestyle that include smoking, poor diets, and increased exposure to environmental pollutants. Additionally, this tendency is largely due to advances in diagnostic tools that make it possible to discover brain cancers early. This early detection highlights the market's growth trajectory by increasing demand for brain cancer therapy as well as facilitating timely medical intervention.

Technological Advancements and Drug Pipeline: Pharmaceutical companies in Indonesia are proactively allocating resources to research and development efforts aimed at creating innovative drugs for brain cancer, with a specific focus on targeted therapies and immunotherapies. The rise in clinical trials for these promising new drugs not only expands the pool of potential treatments but also provides a broader range of options for patients. Furthermore, the local production of generic versions of well-established drugs is contributing to a reduction in costs and overcoming accessibility barriers, ensuring a more widespread availability of these critical treatments.

Growing Awareness and Demand for Improved Treatment Outcomes: Media campaigns and patient advocacy groups are driving the public's growing awareness of brain cancer and the variety of treatment options available. Patients are becoming more and more motivated to seek longer survival times and higher quality of life, which is fuelling the desire for more effective treatments.

Market Restraints

Regulatory Hurdles: The rigorous regulatory demands and approval procedures may present obstacles in the development and introduction of novel drugs for brain cancer treatment, potentially causing delays in their market entry.

Cost and Affordability: Newly developed immunotherapies and tailored treatments often come with high costs, making them unavailable to many patients, especially those living in rural areas. Even if more people have access to healthcare insurance, the costs of expensive new medications or cutting-edge treatment plans could not be fully covered. Patients frequently incur significant out-of-pocket expenses, which can cause financial hardship and, in rare circumstances, lead to treatment termination.

Limited Efficacy of Current Treatments: The effectiveness of current treatments for brain cancer might be constrained, emphasizing the necessity for groundbreaking innovations to markedly enhance patient outcomes. This constraint could potentially influence the market prospects of presently available drugs.

Healthcare Policies and Regulatory Landscape

In Indonesia, the Ministry of Health (Kemenkes) and the National Agency of Drug and Food Control (Badan Pengawas Obat dan Makanan-BPOM) work together to control the regulatory environment for the treatment of pharmaceuticals. BPOM is essential to approving and overseeing pharmaceutical marketing authorizations since it guarantees the products' quality, safety, and efficacy. The Ministry of Health establishes broad guidelines for healthcare, influencing the standards these medications follow. The national health insurance program, known as Jaminan Kesehatan Nasional, or JKN, impacts the accessibility and payment of medications used to treat brain cancer. The review and approval procedures are also impacted by continuing efforts to create health technology assessment mechanisms and laws controlling clinical trials and research.

Competitive Landscape

Key Players

- Roche

- Novartis

- Pfizer

- Merck

- AstraZeneca

- Bristol Myers Squibb

- Eli Lilly

- Sanofi

- Johnson & Johnson

- Takeda

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Indonesia Brain Cancer Therapeutics Market Segmentation

By Type

- Gliomas

- Meningiomas

- Pituitary Adenomas

- Vestibular Schwannomas

- Neuroectodermal Tumours

By Treatment

- Chemotherapy

- Immunotherapy

- Targeted Drug Therapy

- Radiation Therapy

- Others

By End-Users

- Hospitals

- Oncology Specialty Clinics

- Oncology Treatment Centres

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.