Indonesia Bio-implant Market Analysis

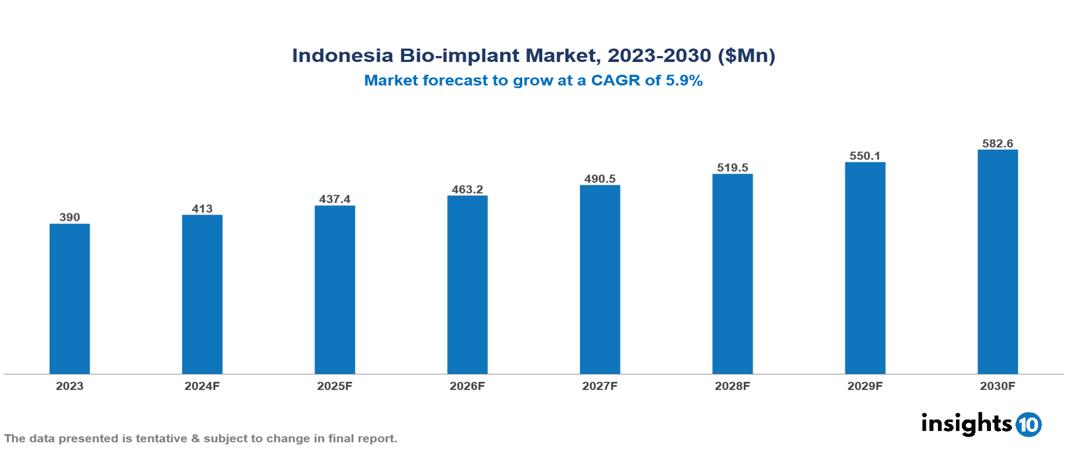

The Indonesia Bio-implant Market was valued at $390 Mn in 2023 and is predicted to grow at a CAGR of 5.9% from 2023 to 2030, to $582.6 Mn by 2030. The Indonesia Bio-implant Market is growing due to like Growing Disposable Income, Increasing Aging Population, and Government Initiatives. The market is primarily dominated by players such as 3dindonesia, Boogie Medical Indonesia, Cipta Medika Indonesia, Zimmer Biomet, Stryker Boston Scientific Corporation, Otto Bock Holding GmbH & Co. KG, and Medtronic plc.

Buy Now

Indonesia Bio-implant Market Executive Summary

Indonesia Bio-implant Market is at around $390 Mn in 2023 and is projected to reach $582.6 Mn in 2030, exhibiting a CAGR of 5.9% during the forecast period.

These implants are designed to make it easier for living tissues to integrate and work with them in order to achieve specific medical objectives. The characteristics, applications, and makeup of bio-implants may vary substantially. Numerous medical professions, including neurology, dentistry, orthopedics, cardiology, and plastic surgery, regularly use them. They can also replace any damaged or faulty body parts or structures. For example, joint replacements (hip or knee implants) can help persons with joint degeneration regain mobility and experience reduced pain.

Indonesia rising prevalence of chronic diseases like diabetes and cardiovascular conditions affects approximately 17.5% and 9% of the population respectively. The country's rapidly aging population, projected to reach 17% by 2050, exacerbates demand for orthopedic and dental implants. Demographically, Indonesia's large and growing middle class, coupled with increasing healthcare expenditure, presents opportunities amid challenges. Therefore, the market is driven by significant factors like Growing Disposable Income, Increasing Aging Population, and Government Initiatives. However, Educational and Awareness Gaps, Limited Healthcare Infrastructure, and Cultural and Behavioral Factors restrict the growth and potential of the market.

Zimmer Biomet developed a customizable knee implant system using 3D printing technology. This system allows surgeons to create patient-specific knee implants that match the patient's unique anatomy, potentially leading to better post-operative outcomes.

Market Dynamics

Market Growth Drivers

Growing Disposable Income: Increasing disposable incomes among the middle-class population are enabling more Indonesians to afford costly medical procedures, including implant surgeries. Data from the Indonesian Statistics Bureau shows a steady rise of 6% in per capita income, empowering more individuals to opt for advanced healthcare solutions.

Increasing Aging Population: Indonesia's aging population is a significant driver for the bioimplant market, with a growing number of elderly individuals requiring orthopedic and dental implants. According to the World Bank, Indonesia's population aged 65 years and above is projected to increase from 6.4% in 2020 to 13.5% by 2050, indicating a robust demand for implants to support an active lifestyle.

Government Initiatives: Government initiatives aimed at promoting healthcare accessibility and affordability, such as the National Health Insurance Program (BPJS Kesehatan), are facilitating greater patient access to bioimplants. The program's expansion has led to a broader coverage of medical treatments, including surgical interventions requiring implants.

Market Restraints

Educational and Awareness Gaps: There is a need for increased education and awareness among healthcare professionals and the general public about the benefits and availability of bioimplants. Misconceptions and lack of knowledge about these advanced medical solutions can lead to reluctance to adopt them, further hindering market growth.

Limited Healthcare Infrastructure: Indonesia's healthcare infrastructure, particularly outside major urban centers, confronts significant challenges. Accessibility and quality are hindered, with only 10% of the population having access to healthcare facilities in rural areas. This limitation restricts the distribution and adoption of bioimplants, especially in remote regions where specialized treatments are scarce. As a result, despite rising healthcare awareness, the uneven distribution of resources remains a barrier to widespread bioimplant use across the country.

Cultural and Behavioral Factors: Sociocultural beliefs and patient preferences often favor traditional treatment methods over innovative bioimplant solutions. Lack of awareness about the benefits and safety of bioimplants among the general population further hampers market growth and acceptance.

Regulatory Landscape and Reimbursement scenario

In Indonesia, the regulatory landscape for the bio implant market is overseen by the National Agency of Drug and Food Control (NADFC), operating under the Indonesian Ministry of Health (MoH). NADFC plays a pivotal role in regulating the safety, efficacy, and quality standards of bio-implants, ensuring they comply with Indonesian health regulations and international standards. Market entry for bio-implants requires stringent registration processes, including clinical trial data submission and adherence to specific manufacturing practices. The regulatory framework aims to safeguard public health by monitoring post-market surveillance and enforcing compliance with ongoing safety assessments.

The reimbursement landscape primarily favors basic healthcare needs over specialized bioimplants, restricting market growth. High out-of-pocket expenses deter patient adoption, despite increasing chronic disease prevalence and an aging population driving demand. Government initiatives to expand healthcare coverage could potentially alleviate these barriers, but regulatory reforms are essential to facilitate broader reimbursement access and foster market expansion for bioimplants in Indonesia.

Competitive Landscape

Key Players

Here are some of the major key players in the Indonesia Bio-implant Market:

- 3dindonesia

- Boogie Medical Indonesia

- Cipta Medika Indonesia

- Zimmer Biomet

- Stryker

- Neodent

- Ossur

- Boston Scientific Corporation

- Otto Bock Holding GmbH & Co. KG

- Medtronic

- Boston Scientific Corporation

- Johnson & Johnson Services, Inc.

- LifeNet Health

- Smith & Nephew

- Arthrex, Inc.

- Clinic Lemanic

- DePuy Synthes

- Exactech, Inc.

- Cochlear Ltd

- Straumann AG

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Indonesia Bio-implant Market Segmentation

By Material

- Ceramics

- Polymers

- Alloys

- Biomaterials Metals

By Type

- Dental Bio-implants

- Orthopedic Bio-implants

- Spinal Bio-implants

- Ophthalmology Bio-implants

- Cardiovascular Bio-implants

- Others

By Mode of Administration

- Surgical

- Injectable

By End User

- Hospitals

- Speciality Clinics

- Ambulatory surgical centres

By Origin

- Autograft

- Allograft

- Xenograft

- Synthetic

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.