Indonesia Alzheimer’s Therapeutics Market Analysis

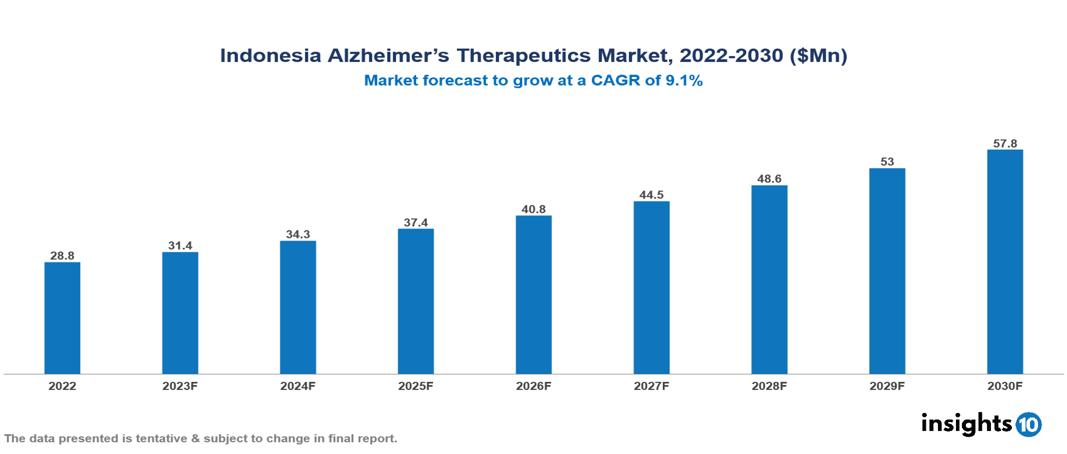

Indonesia alzheimer’s therapeutics market valued at $29 Mn in 2022, projected to reach $58 Mn by 2030 with a 9.1% CAGR. The growing prevalence of Alzheimer's disease, which is fuelled by an aging population, is one major factor driving the market for drugs used to treat the condition. The leading pharmaceutical companies currently operating in the market are Eisai Co., Otsuka Pharmaceutical Co., Janssen Pharmaceuticals, Novartis, Pfizer, Lundbeck, Merck & Co., Sanofi, PT Kalbe Farma and PT Kimia Farma.

Buy Now

Indonesia Alzheimer’s Therapeutics Market Executive Summary

Indonesia alzheimer’s therapeutics market valued at $29 Mn in 2022, projected to reach $58 Mn by 2030 with a 9.1% CAGR.

Alzheimer's disease is a neurological condition that has an impact on mental health, behavior, and memory. Usually, it starts slowly, gets worse with time, and makes it harder for the person to carry out daily tasks. Nerve cells in Alzheimer's disease die as a result of abnormal brain alterations such as plaque and tangle formation. Alzheimer's disease does not currently have a cure. However, some drugs can help with symptom control and enhance quality of life. These medications, which treat memory and cognitive issues, change specific neurotransmitters in the brain. A few of these medications are memantine, rivastigmine, and donepezil. Non-pharmacological techniques include maintaining a healthy lifestyle, engaging in social and cognitive activities, and fostering a supportive environment, all of which may improve overall illness management.

With over 518,000 affected people, Alzheimer's disease is remarkably common in Indonesia. This corresponds to around 2.18% of those who are 65 years of age or older. An important increase in Alzheimer's cases is shown with age, according to age-specific prevalence patterns analysis. About 2–5% of those 65 and older are thought to have Alzheimer's, and that number rises significantly to 15–25% for people 80 years of age and older. The statistics highlight the increasing prevalence of Alzheimer's disease in Indonesia, especially among the senior population. This necessitates ongoing attention and proactive approaches to healthcare.

The newly developed medication EMERGE-01 is the subject of a Phase II clinical trial being conducted by the Indonesian pharmaceutical company Etermis. This medication focuses on the aggregation of Tau protein, which is a well-known marker linked to Alzheimer's disease. The trial's main objective is to investigate EMERGE-01's safety and tolerability; biomarkers and cognitive function assessments are included in the secondary measures. The trial's anticipated findings should be made public in late 2024, possibly providing important new information about the medication's effectiveness.

Additionally, Indonesia is actively taking part in several worldwide clinical studies for medications that show promise for Alzheimer's disease, such as lecanemab and aducanumab. If these international partnerships are successful, the availability of efficacious Alzheimer's medicines in Indonesia may be facilitated by the drugs' specialized targeting of amyloid plaques in the brain.

Market Dynamics

Market Growth Drivers

Rising Aging Population: Indonesia's population is aging quickly, by 2030, there will be 40 Mn persons in the country who are 60 years of age or older. Given that the prevalence of Alzheimer's increases with age, this demographic shift immediately translates into an increased risk of the illness.

Growing Awareness and Diagnosis: The stigma associated with Alzheimer's disease is progressively fading, resulting in heightened consciousness and prompt diagnosis. This trend is further supported by easier access to medical facilities and diagnostic technologies like brain scans.

Unaddressed Medical Demand and Changing Treatment Scenario: Alzheimer's disease does not currently have a recognized cure; current treatments only deal with the symptoms. The market for the creation of new, possibly more effective medications is substantial because there are few readily available medical treatments. Better tau-targeting drug development and therapy combinations, together with recent developments with anti-amyloid antibodies like lecanemab, all portend well for more potent treatments in the years to come.

Market Restraints

High Costs: A significant obstacle for the majority of Indonesians is the high expense of the majority of Alzheimer's medications. A lot of people don't have enough health insurance, and paying for things out of pocket can be very expensive.

Regulatory and Approval Hurdles: Compared to developed countries, Indonesia experiences a delay in the availability of innovative therapies due to the lengthy and complex regulatory process involved in authorizing new drugs.

Lack of Awareness and Stigma: Despite the increasing number of awareness initiatives, many people are unable to receive a diagnosis and treatment for dementia and Alzheimer's disease due to the ongoing cultural stigma around these conditions. This stigma is one of the primary obstacles keeping the market from reaching a wider range of consumers.

Healthcare Policies and Regulatory Landscape

The National Agency of Drug and Food Control (BPOM) is the regulatory body in Indonesia that is in charge of approving therapeutic medications and managing healthcare policy. Functioning under the Ministry of Health, BPOM is in charge of conducting a thorough assessment of pharmaceutical goods to guarantee their quality, safety, and efficacy before their marketing and distribution. In addition, the agency is essential in managing clinical trials, keeping an eye on post-market surveillance efforts to track adverse reactions, inspecting manufacturing facilities to enforce good manufacturing practices, and helping to create and carry out healthcare policies about pharmaceuticals, including those about drug distribution and pricing.

Competitive Landscape

Key Players

- Eisai Co.

- Otsuka Pharmaceutical Co.

- Janssen Pharmaceuticals

- Novartis

- Pfizer

- Lundbeck

- Merck & Co.

- Sanofi

- PT Kalbe Farma

- PT Kimia Farma

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Indonesia Alzheimer’s Therapeutics Market Segmentation

By Drug Name

- Early-Onset Alzheimer's

- Late-Onset Alzheimer's

- Familial Alzheimer's disease

By Drug Name

- Donepezil

- Rivastigmine

- Memantine

- Galantamine

- Manufactured a combination of memantine and donepezil

By Drug Class

- Cholinesterase Inhibitors

- NMDA Receptor Antagonists

- Manufactured Combination

By End-Users

- Hospitals

- Specialty Clinics

- Homecare

- Others

By Distribution Channel

- Hospital pharmacies

- Drug stores

- Retail pharmacies

- Online pharmacies

- Other distribution channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.