Indonesia Allergy Therapeutics Market Analysis

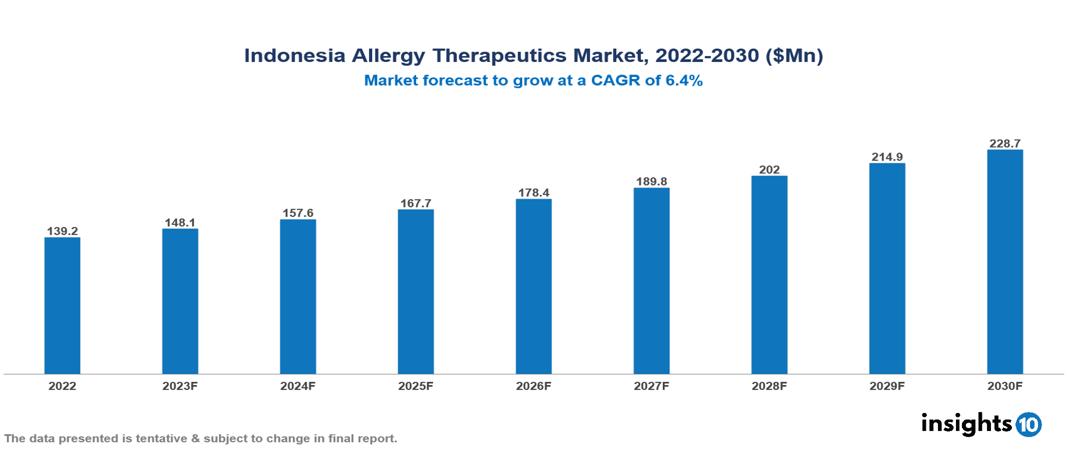

Indonesia Allergy Therapeutics Market was valued at $139 Mn in 2022 and is estimated to reach $229 Mn in 2030, exhibiting a CAGR of 6.4% during the forecast period. The need for allergy treatment drugs is being driven by the rising prevalence of allergic disorders and related health problems. Sanofi, Novartis, Boehringer Ingelheim, GlaxoSmithKline (GSK), AstraZeneca, Abbott Laboratories, Bayer, PT Kalbe Farma, PT Pharos Indonesia and PT Sanbe Farma are the leading pharmaceutical companies that are presently operating in the market

Buy Now

Indonesia Allergy Therapeutics Market Executive Summary

Indonesia Allergy Therapeutics Market was valued at $139 Mn in 2022 and is estimated to reach $229 Mn in 2030, exhibiting a CAGR of 6.4% during the forecast period.

Environmental substances known as allergens occasionally trigger an immunological reaction called allergy. Common allergens include dust mites, pollen, mildew, and certain foods, including milk, eggs, soy, and almonds. From minor symptoms like a runny nose and itchy eyes to more dangerous ones like anaphylaxis, which can result in unconsciousness and breathing difficulties, allergy reactions can take many different forms. Immunotherapy, avoiding allergens, and prescription drugs such as nasal corticosteroids and antihistamines are a few possible treatment choices.

In Indonesia, allergic diseases are a significant public health issue. About 15-20% of the population suffers from allergic rhinitis, with urban rates being greater than those in rural areas. Given that some school-aged populations have prevalence rates as high as 30%, children in particular bear a heavy burden. Estimates of the prevalence of asthma among Indonesian children range from 5 to 10% across the country, with higher rates found in metropolitan regions. Atopic dermatitis affects 5–10% of children and adolescents, which is consistent with an increasing global trend in atopic dermatitis prevalence. With an estimated prevalence of 1–5%, food allergies are less common in Indonesia than in Western nations, however, peanut allergies are particularly noticeable, with rates as high as 8% in children.

A well-known player in the Indonesian pharmaceutical market, PT Kalbe Farma, has announced a strategic partnership with CytoDyn Inc. to handle the local production of Xywav (acylinezolide), a monoclonal antibody intended to treat chronic spontaneous urticaria (CSU). This partnership is a significant step in improving the accessibility of cutting-edge allergy treatments in Indonesia and furthering the nation's endeavours to increase access to innovative drugs.

Market Dynamics

Market Growth Drivers

Prevalence of Allergies: The rising incidence of respiratory allergies and other allergic illnesses, such as hay fever, is creating a need for effective allergy therapy drugs. Urbanization, changes in lifestyle, and environmental factors may all contribute to an increase in the prevalence of allergies.

Rapid Urbanization and Environmental Changes: Allergies have become more common as a result of increased urbanization and environmental changes, such as pollution and increased exposure to new allergens. The possibility of an increase in allergic reactions is driving the market for allergy medications, particularly as more people move into cities.

Advancements in Allergen Immunotherapy (AIT): Sublingual immunotherapy (SLIT) patches and pills are examples of innovative replacements that have been developed, and they may provide longer-lasting relief with fewer side effects. This creates new business opportunities for these cutting-edge treatments.

Market Restraints

High Cost of Treatment: Some people may find allergy treatment to be expensive due to its high cost, particularly when it comes to AIT techniques like immunotherapy injections and SLIT tablets. This could limit business penetration and accessibility. Many of the most effective allergy medications currently available, such as biologics and sublingual immunotherapy, are unaffordable for a sizable section of the population due to their high cost. Patients may not receive the best care possible as a result of the pricing barrier since fewer medications will be approved by the market.

Cultural and Behavioural Factors: Some communities preference for conventional drugs or home remedies over modern therapies may hinder market penetration. Reduced community awareness may make it more difficult to recognize and understand allergy symptoms, which could delay diagnosis and treatment. Using non-pharmaceutical techniques, such as air filters, to reduce allergens and/or eliminate allergy symptoms is becoming more popular despite these disadvantages.

Long-Term Treatment Commitment: Allergen immunotherapies sometimes require a long-term commitment, ranging from months to years, in order to achieve the optimum benefits. This may be challenging for people who struggle to follow treatment programs or who might not see relief right away.

Healthcare Policies and Regulatory Landscape

The national regulatory body, the Indonesian Food and Drug Authority, or Badan Pengawas Obat dan Makanan (BPOM), is in charge of assessing and authorizing marketing authorizations for pharmaceuticals, including allergy treatments, in order to guarantee their efficacy, safety, and quality. In close partnership with BPOM, the Ministry of Health develops and administers national health policies, including rules pertaining to drug safety and accessibility. The Indonesian Medical Council (IDI) establishes guidelines with a focus on ethical and professional behaviour for medical professionals, including those who prescribe medications for allergy therapy. Furthermore, the Social Security Administrative Bodies (BPJS) have a significant impact on how healthcare services are reimbursed, which may have an effect on how easily and affordably allergy drugs are available.

Competitive Landscape

Key Players

- Sanofi

- Novartis

- Boehringer Ingelheim

- GlaxoSmithKline (GSK)

- AstraZeneca

- Abbott Laboratories

- Bayer

- PT Kalbe Farma

- PT Pharos Indonesia

- PT Sanbe Farma

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Indonesia Allergy Therapeutics Market Segmentation

By Treatment Type

- Anti-allergy drugs

- Immunotherapy

By Type of Allergy

- Eye allergy

- Asthma

- Skin allergy

- Food allergies

- Rhinitis

- Other allergy types

By Route of Administration

- Oral

- Inhalers

- Intranasal

- Other routes of administration

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

- Other distribution channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.