Indonesia Addiction Therapeutics Market Analysis

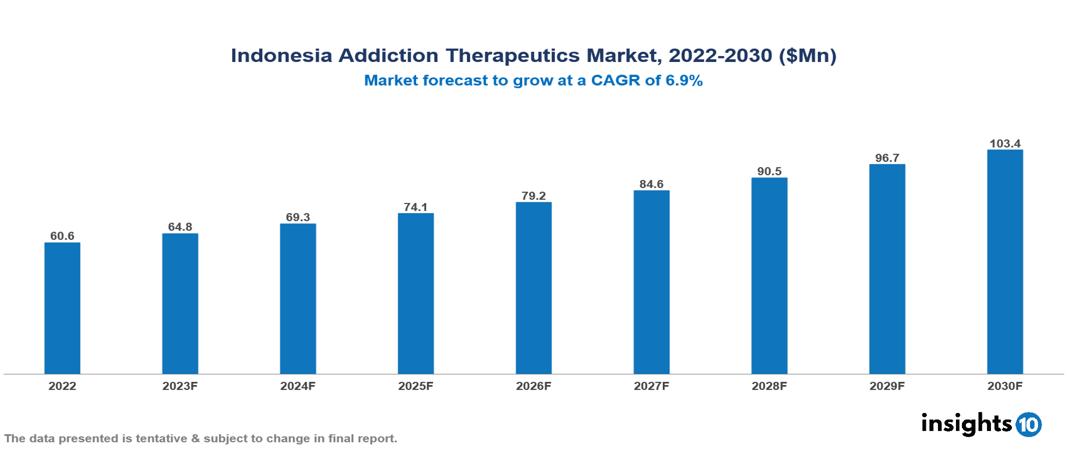

Indonesia addiction therapeutics market was valued at $61 Mn in 2022 and is estimated to reach $103 Mn in 2030, exhibiting a CAGR of 6.9% during the forecast period. The market for addiction therapies has grown rapidly due to the growing knowledge and identification of mental health concerns, including substance abuse and addiction. Some of the leading players operating in the market include Kalbe Farma, PT Sanbe Farma, PT Tempo Scan Pacific Tbk, PT Dexa Medica, Combiphar, PT Phapros Tbk, Abbott, Pfizer, Novartis AG and GSK.

Buy Now

Indonesia Addiction Therapeutics Market Executive Summary

Indonesia addiction therapeutics market was valued at $61 Mn in 2022 and is estimated to reach $103 Mn in 2030, exhibiting a CAGR of 6.9% during the forecast period.

A wide range of interventions and therapies are included in the vast field of addiction therapy, with the goal of helping individuals recover from drug use disorders. This encompasses a wide range of methods, such as behavioural therapies that address the psychological aspects of addiction and medication-assisted treatments (MAT) that employ medications to decrease cravings and withdrawal symptoms. In addition, community resources and social support networks are critical to long-term recovery.

Indonesia is among the low- and middle-income countries that are presently struggling with the growing problem of drug consumption. 2.2% of people in Indonesia who are between the ages of 10 and 59 use drugs. This represents around 4.9 million individuals. Cannabis is the most often used drug, with methamphetamine, ecstasy, heroin, and ecstasy coming in second and third. It is noteworthy that drug use is more common in men and especially in people between the ages of 20 and 29. The specific drug usage rates are: 1.9% of those aged 10-59 use cannabis, 0.5% use methamphetamine, 0.2% use ecstasy, and 0.1% use heroin. To address drug misuse and illicit trafficking in the nation, the National Narcotics Board (BNN) of Indonesia has been focusing on preventive and eradication programs.

Severe drug addiction was clearly linked to factors like poor mental health, major work-related challenges, medical conditions, and family or social concerns. Interestingly, the largest correlation was seen for poor behavioural health; people with this problem were four times more likely to suffer from severe drug addiction, which is consistent with findings from other types of research. In addition, men showed 1.8 times greater odds of serious drug addiction than women, which may have been impacted by stigma associated with gender.

Pharmaceutical companies in Indonesia, such as Kimia Farma and Kalbe Farma, are investing heavily in creating their own drugs for addiction treatment.

The accessibility of medication-assisted therapy is being further propelled by government initiatives and agreements with international organizations such as the Union Nations Office of Drugs and Crime. This is creating opportunities for further market penetration.

Market Dynamics

Market Growth Drivers

Increasing Awareness and Recognition: More people are seeking treatment and support services as mental health disorders, especially substance abuse, come to light more frequently. The need for addiction treatment is being driven by initiatives to lessen stigma and raise public understanding of addiction as a treatable illness. People have adopted "person-first" language, whose main goal is to avoid language that dehumanizes or stigmatizes people, which has lessened the stigma associated with addiction. This awareness and recognition have helped the addiction treatment market grow exponentially. The expansion of the addiction treatment industry in Indonesia has been greatly aided by the greater understanding and acceptance of addiction as a curable illness.

Investment in Healthcare Infrastructure: The nation's accessibility to addiction treatment services is being enhanced by the continuous expenditures made in healthcare infrastructure, such as the construction of rehabilitation facilities and centres promoting addiction treatment. These expenditures are crucial for enhancing patient care and wait times, as well as the working conditions for healthcare professionals.

Growing Need for Services: As a large section of the population struggles with substance misuse, there is a growing need for comprehensive therapy programs and pharmaceuticals that effectively treat addiction. This demand is fuelling the expansion of the market.

Market Restraints

Barriers to Awareness and Stigma: People may be discouraged from getting treatment if they believe that mental health disorders and drug usage are taboo topics. Inadequate knowledge and instruction regarding addiction as a medical illness impede initiatives to motivate individuals to get treatment, which acts as a barrier to the growth of the market.

Regulatory Hurdles: The timely availability of effective medications in the market might be impacted by the time- and resource-intensive nature of the regulatory processes and approvals for drugs used in addiction treatment, which restricts the market's ability to expand and grow.

Affordability: Concerns regarding the price of services and prescriptions for addiction treatment are common. It may be challenging to get necessary prescription medications and comprehensive treatment regimens due to high out-of-pocket expenses and a lack of insurance coverage. Addiction treatment comes with high out-of-pocket costs, which limits market expansion.

Healthcare Policies and Regulatory Landscape

The Indonesian Food and Drug Authority, or Badan Pengawas Obat dan Makanan (BPOM), is in charge of healthcare policies and the laws pertaining to medications used for addiction treatment. Before allowing a pharmaceutical product to be sold, BPOM carefully assesses and approves it, making sure it is safe, effective, and compliant with all applicable regulations. This includes medications used in addiction treatment. To stop abuse and illicit trafficking, the nation imposes stringent regulations on narcotic and psychotropic drugs used in addiction therapy. Pharmaceutical businesses that follow Good Manufacturing Practice (GMP) standards have to go through a rigorous registration and approval process. Expanding coverage through health insurance plans and public health programs is one way to enhance access and affordability.

Rehabilitation programs, harm reduction techniques, and easy access to support services are given top priority in Indonesia's healthcare policies for treating addiction. The policies place a strong emphasis on regulatory compliance, which is managed by the Badan Pengawas Obat dan Makanan (BPOM), cooperation with healthcare providers, and public awareness initiatives.

Competitive Landscape

Key Players

- Kalbe Farma

- PT Sanbe Farma

- PT Tempo Scan Pacific Tbk

- PT Dexa Medica

- Combiphar

- PT Phapros Tbk

- Abbott

- Pfizer

- Novartis AG

- GSK.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Indonesia Addiction Therapeutics Market Segmentation

By Treatment Type

- Opioid Addiction Treatment

- Alcohol Addiction Treatment

- Nicotine Addiction Treatment

- Other Substance Addiction Treatment

By Drug Type

- Buprenorphine

- Naltrexone

- Bupropion

- Disulfiram

- Nicotine Replacement Products

- Varenicline

- Others

By Treatment Centre

- Inpatient Treatment Centre

- Residential Treatment Centre

- Outpatient Treatment Centre

By Distribution Channel

- Hospital Pharmacies

- Medical stores

- Online Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.