India Periodontal Therapeutics Market Analysis

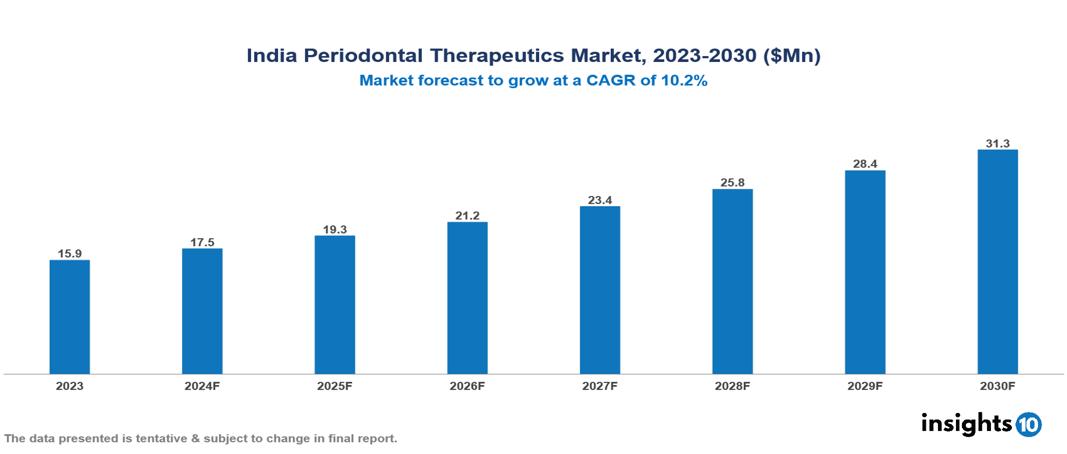

The India Periodontal Therapeutics Market was valued at $15.9 Mn in 2023 and is predicted to grow at a CAGR of 10.2% from 2023 to 2030, to $31.3 Mn by 2030. India Periodontal Therapeutics Market is growing due to Increasing disposable income and healthcare expenditure, Growing dental tourism, and Technological Advancements. The market is primarily dominated by players such as Sun Pharmaceutical Industries Ltd, Cipla, Pfizer Inc., Lupin Ltd, Teva Pharmaceuticals USA, and Bausch Health Companies Inc.

Buy Now

India Periodontal Therapeutics Market Executive Summary

India Periodontal Therapeutics Market is at around $15.9 Mn in 2023 and is projected to reach $31.3 Mn in 2030, exhibiting a CAGR of 10.2% during the forecast period.

A severe gum disease called periodontitis (CP) is characterized by inflammation, tissue destruction, and loss of bone around teeth. Gingivitis is usually the first stage, and severe periodontitis can follow. The March 2023 article states that research indicates a connection between chronic kidney disease (CKD), diabetes, cardiovascular problems, respiratory infections, and CP. Remarkably, there is a reciprocal association between CKD and CP: patients with worsening CKD are more vulnerable to CP, and patients with reduced kidney function are more likely to have moderate to severe CP and to practice poorer oral hygiene.

In India, periodontal disease affects approximately 55% of the population, with a higher prevalence in adults over 35. Key demographic factors include poor oral hygiene, smoking, diabetes, and low socioeconomic status, which contribute significantly to the disease's incidence. Rural areas are particularly affected due to limited access to dental care. Healthcare expenses related to periodontal treatment are on the rise reflecting the increasing demand for preventive and therapeutic dental services. Efforts to improve awareness and access to affordable dental care are crucial to addressing this public health concern. Therefore, the market is driven by significant factors like Increasing disposable income and healthcare expenditure, Growing dental tourism, and Technological Advancements. However, Limited awareness and low priority for oral health, Side Effects and Complications, and Shortage of skilled dental professionals restrict the growth and potential of the market.

OraVu®, which is a dental technology company dealing in dental endoscopy solutions, launched a complete micro-endoscope system called DeVA-1® Dental Vision Assistant.

Market Dynamics

Market Growth Drivers

Increasing disposable income and healthcare expenditure: As India's economy continues to grow, there is a rise in disposable income and healthcare spending among the population. This increased financial capacity allows more people to afford dental care, including periodontal treatments. The growing middle class in urban areas is particularly driving this trend, as they are more likely to prioritize oral health and seek professional dental care. Additionally, the expansion of health insurance coverage in India is making dental treatments more accessible to a broader segment of the population. This combination of higher disposable income and improved healthcare access is creating a favourable environment for the growth of the periodontal therapeutics market.

Growing dental tourism: India has become a popular destination for dental tourism due to its high-quality dental care at relatively low costs compared to Western countries. Many international patients travel to India for various dental procedures, including periodontal treatments. This influx of foreign patients is boosting the demand for advanced periodontal therapies and driving market growth. The dental tourism sector in India is expected to grow at a CAGR of around 15% in the coming years, which will have a positive impact on the periodontal therapeutic market. The availability of state-of-the-art dental facilities and skilled professionals in major cities is further enhancing India's reputation as a dental tourism hub.

Technological Advancements: Dental technology serves as a powerful educational tool in periodontal care. 3D models provide patients with vivid, understandable representations of their oral condition. Digital treatment simulations allow patients to visualize expected outcomes, enhancing informed consent processes. Intraoral cameras enable real-time demonstration of oral hygiene techniques. These visual aids improve patient comprehension of periodontal disease and treatment options.

Market Restraints

Limited awareness and low priority for oral health: Many Indians, especially in rural areas, lack awareness about periodontal diseases and their potential consequences. Oral health is often not prioritized compared to other health issues, leading to delayed diagnosis and treatment. In fact, studies indicate that over 80% of rural Indians have limited awareness of periodontal diseases. Cultural beliefs and traditional remedies may also hinder the adoption of modern periodontal therapeutics.

Side Effects and Complications: Gum sensitivity and discomfort following periodontal treatments can deter patients from seeking timely dental care. Concerns over potential complications like post-operative infections or adverse reactions to medications may lead to patient apprehension and reduced treatment adherence. Limited awareness about preventive dental care and oral hygiene practices exacerbates these challenges, resulting in delayed treatment-seeking behaviors and restrained market growth despite increasing healthcare accessibility.

Shortage of skilled dental professionals: India faces a significant shortage of trained periodontists and dental hygienists, especially in rural and semi-urban areas. This lack of specialized professionals limits the availability and quality of periodontal treatments. Additionally, many general dentists may not have adequate training in advanced periodontal therapies. To address this, there's a need for increased investment in dental education, particularly in periodontics. Continuing education programs and workshops can help upgrade the skills of existing dental practitioners. Incentives for professionals to practice in underserved areas could also help improve the distribution of skilled dental care providers across the country.

Regulatory Landscape and Reimbursement scenario

The regulatory landscape for the periodontics market in India is governed primarily by the Drugs and Cosmetics Act, of 1940, and subsequent amendments. The Central Drugs Standard Control Organization (CDSCO) oversees the regulation of dental products and devices. Periodontal treatments and products are subject to licensing, quality standards, and safety requirements. The Dental Council of India (DCI) regulates dental education and practice, influencing the adoption of periodontal treatments. Recent initiatives aim to streamline approval processes for dental devices and promote indigenous manufacturing. However, challenges remain in terms of standardization across states and enforcement of regulations.

In India, reimbursement for periodontal treatments is limited and varies significantly across the healthcare landscape. Public health insurance schemes like Ayushman Bharat typically do not cover dental procedures, including periodontal treatments. Private health insurance plans may offer some coverage, but it's often restricted to specific procedures or subject to sub-limits. Out-of-pocket payments remain the primary mode of financing for periodontal care. Some corporate health plans provide dental coverage, including periodontal treatments, as part of employee benefits. However, the overall lack of comprehensive dental insurance and limited government support for oral health initiatives contribute to the underutilization of periodontal services and create barriers to accessing care for many Indians, especially in rural areas.

Competitive Landscape

Key Players

Here are some of the major key players in India Periodontal Therapeutics Market:

- Sun Pharmaceutical Industries Ltd.

- Cipla, Inc

- Pfizer Inc.

- Lupin Ltd

- Teva Pharmaceuticals USA, Inc

- Chartwell Pharmaceuticals LLC.

- ASA Dental S.p.A.

- Steris-Hu-Friedy

- Carl Martin GmBH

- Eli Lilly and Company

- Dexcel Pharma

- Emergent Biosolutions, Inc.

- F. Hoffmann-La Roche Ltd.

- Gilead Sciences

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

India Periodontal Therapeutics Market Segmentation

By Disease

- Gingivitis

- Chronic Periodontal Disease

- Aggressive Periodontal Disease

- Others

By Drug Type

- Doxycycline

- Minocycline

- Chlorhexidine

- Metronidazole

- Others

By Treatment procedures

- Scaling And Root Planing

- Gum Grafting

- Regenerative Therapy

- Dental Crown Lengthening

- Periodontal Pocket Procedures

- Single Tooth Dental Implants

- Multiple Tooth Dental Implants

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.