India Lung Cancer Therapeutics Market Analysis

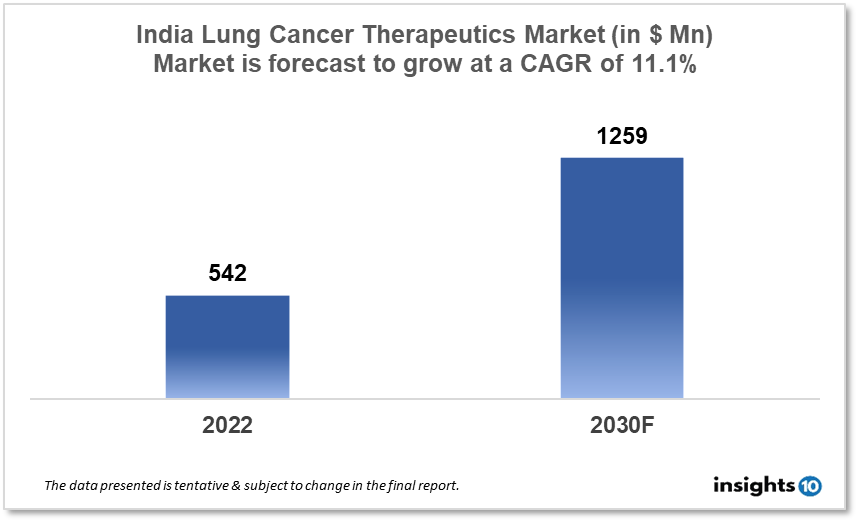

By 2030, it is anticipated that the India Lung Cancer Therapeutics Market will reach a value of $1259 Mn from $542 Mn in 2022, growing at a CAGR of 11.1% during 2022-2030. The Lung Cancer Therapeutics Market in India is dominated by a few domestic pharmaceutical companies such as Lupin, Cipla, and Biocon. The Lung Cancer Therapeutics Market in India is segmented into different types of cancer and different therapy type. Some of the major factors affecting the Indian lung cancer therapeutics market are the prevalence of unhealthy lifestyles, demand for targeted therapies and the presence of highly efficient drugs.

Buy Now

India Lung Cancer Therapeutics Analysis Summary

By 2030, it is anticipated that the India Lung Cancer Therapeutics market will reach a value of $1259 Mn from $542 Mn in 2022, growing at a CAGR of 11.1% during 2022-2030.

India is a lower middle-income, developing country located in Southern Asia bordering the Arabian Sea and the Bay of Bengal. Lung cancer accounts for 5.9 % of all cancers and 8.1 % of cancer-related deaths in India. The prevalence of smoking in lung cancer patients is about 80%. Lung cancer epidemiology in India has progressed from being dominated by histologic types closely related to tobacco smoking (squamous and small cell) to an era in which adenocarcinoma became equally prevalent and has now become the main histologic type. Overall, India's cancer care infrastructure remains inadequate in relation to the population and load of cancer patients. Failure to overcome these shortcomings may result in higher mortality rates and shorter survival rates for cancer patients in India when compared to developed countries.

According to the latest WHO data published in 2020 Lung Cancers Deaths in India reached 88,276 or 1.04% of total deaths. The age-adjusted Death Rate is 7.82 per 100,000 population ranks India 117th in the world. India's government spends 3 % of its GDP on healthcare.

Market Dynamics

Market Growth Drivers

India is the world's second-largest user and third-largest producer of tobacco. Tobacco products are used by around 28.6 % of the Indian population, accounting for an estimated 267 Mn tobacco users in the country. In India, tobacco consumption has a massive influence on health, particularly cancer. According to the National Cancer Registry Program, tobacco-related malignancies account for 27% of all cancers in both sexes combined. For the treatment of EGFR-mutated advanced or metastatic NSCLC, erlotinib and gefitinib (first generation), afatinib and dacomitinib (second generation), and osimertinib (third generation) are currently approved and available in India. These aspects could boost India's Lung Cancer Therapeutics market.

Market Restraints

The expense of treatment in the private sector is too expensive for low- and middle-income patients. According to WHO standards for a developing country, the required for radiation equipment is 1380, compared to the present 686, which is only enough to serve nearly half of India's population. According to the most recent data from the Atomic Energy Regulatory Board, India has just 514 radiation facilities. There is a significant disparity between the rural and urban sectors in terms of access to radiation facilities and treatment costs. When compared to the public sector, the waiting time in private hospitals is shorter. Despite accounting for one-fifth of the global population, India is represented in only 1.5 % of global clinical trials. Recently, regulatory standards and administrative processes for pharmaceutical clinical trials have been simplified, encouraging big pharmaceutical corporations to bring new medication studies to India. These factors may deter new entrants into the India Lung Cancer Therapeutics market.

Competitive Landscape

Key Players

- Dr. Reddy's Laboratories: Dr. Reddy's Laboratories is an Indian multinational pharmaceutical company that produces several drugs for the treatment of cancer, including lung cancer

- Biocon: Biocon is an Indian biopharmaceutical company that produces several drugs for the treatment of cancer, including lung cancer

- Cipla: Cipla is an Indian multinational pharmaceutical company that produces several drugs for the treatment of cancer, including lung cancer

- Sun Pharmaceutical Industries: Sun Pharmaceutical Industries is an Indian multinational pharmaceutical company that produces several drugs for the treatment of cancer, including lung cancer

- Lupin

- Cadila Healthcare

- Hetero Drugs

Recent Notable Updates

February 2023: The India-Sweden Healthcare Innovation Centre and its expertise partner AstraZeneca India worked with the Directorate of Health Services (DHS) Jammu to include Qure.ai's clever artificial intelligent technology to diagnose lung cancer early on. Qure.ai is expanding the integration of its AI-powered chest x-ray interpretation tool, which can benefit early and easy identification of lung disorders such as lung cancer, under the auspices of the Indo Sweden Healthcare Innovation Centre (ISHIC).

December 2022: Adagrasib, a lung cancer medication developed by Mirati Therapeutics, was recently licenced by the US Food and Drug Administration (FDA). Mirati was seeking FDA approval for the medicine to treat patients with advanced lung cancer who had failed to react to prior treatments. Adagrasib, an oral medication, is intended to target a mutant variant of the KRAS gene, which is found in approximately 13% of Non-Small Cell Lung Cancers (NSCLC), the most common type of the illness, and less commonly in various other solid tumours. Another KRAS inhibitor, Amgen's Lumakras, is already available as a second-line therapy for patients with advanced lung cancer if initial therapy fails or stops responding.

Healthcare Policies and Reimbursement Scenarios

Certain organizations, including the Central Drugs Standard Control Organization (CDSCO), the Ministry of Health and Family Welfare, and the Indian healthcare system, supervise and compensate for lung cancer medicines in India. In India, the CDSCO oversees enforcing and authorizing lung cancer medicines. The Indian healthcare system is the system of reimbursing lung treatment programs approved by the Ministry of Health and Family Welfare. The Indian healthcare system includes medical services and pharmaceuticals for Indian citizens through it a variety of government-funded ventures and insurance programmes. Also, some lung cancer medications may be made available through specific programmes within the Indian healthcare system, such as the National Health Protection Scheme (Ayushman Bharat), which provides capital for lung cancer therapies that are not commonly available.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Lung Cancer Therapeutics Segmentation

By Type (Revenue, USD Billion):

- Small Cell Lung Cancer

- Non-small Cell Lung Cancer

- Lung Carcinoid Tumor

By Therapy (Revenue, USD Billion):

- Radiation Therapy

- Targeted Therapy

- Immunotherapy

- Chemotherapy

- Others

By Type of Molecule (Revenue, USD Billion):

- Small Molecules

- Biologics

By Drug Class (Revenue, USD Billion):

- Alkylating Agents

- Antimetabolites

- Multikinase Inhibitors

- Mitotic Inhibitors

- EGFR Inhibitors

- Others

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.