India Kidney Cancer Therapeutics Market Analysis

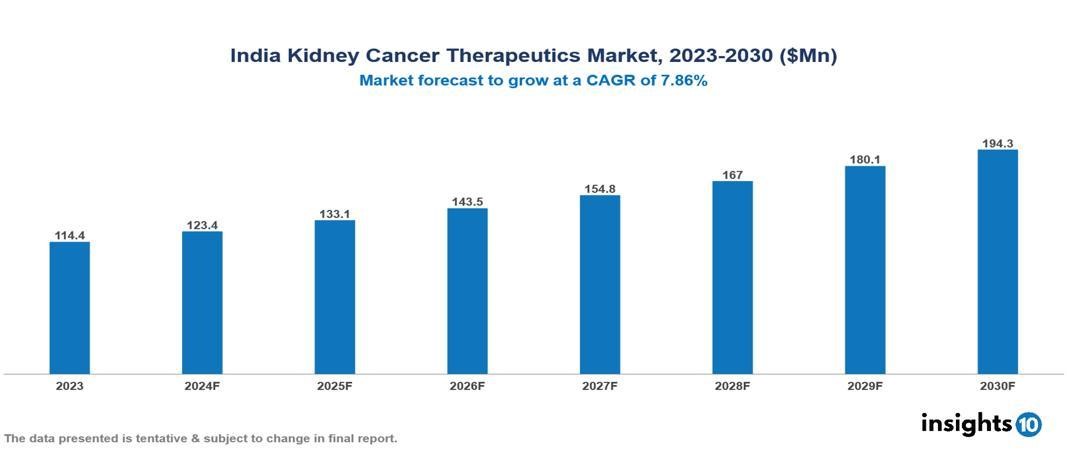

India Kidney Cancer Therapeutics Market was valued at $114.39 Mn in 2023 and is predicted to grow at a CAGR of 7.86% from 2023 to 2030, to $194.27 Mn by 2030. The key drivers of this industry include rising incidences of kidney cancer, Increased awareness of immunotherapies, and a rise in R&D expenditures by pharmaceutical businesses Source. The industry is primarily dominated by players by Pfizer Inc., Dr. Reddy's Laboratories Ltd, Sun Pharmaceutical Industries Ltd, Novartis AG, Lupin, Cipla Inc, Aurobindo Pharma UNIQURE N.V. Orchard Therapeutics plc FibroGen Inc., Ionis Pharmaceuticals Inc. Alnylam Pharmaceuticals Inc. among others.

Buy Now

India Kidney Cancer Therapeutics Market Executive Summary

India's Kidney Cancer Therapeutics Market was valued at $114.39 Mn in 2023 and is predicted to grow at a CAGR of 7.86% from 2023 to 2030, to $194.27 Mn by 2030.

A characteristic of renal cancer is the growth of abnormal cells in the renal tissues, which leads to tumors. Symptoms include appetite loss, flank pain, blood in the urine, etc. Tests for blood and urine, biopsies, MRIs, CT scans, and other diagnostic procedures are among them. Potential therapeutic options include medication, radiation therapy, chemotherapy, nephrectomy, and targeted therapy. The key drivers of this industry include rising incidences of kidney cancer, Increased Knowledge of Immunotherapies, and a rise in R&D expenditures by pharmaceutical businesses Source. The industry is primarily dominated by Pfizer Inc., Dr. Reddy's Laboratories Ltd, Sun Pharmaceutical Industries Ltd, Novartis AG, Lupin, Cipla Inc, Aurobindo Pharma UNIQURE N.V. Orchard Therapeutics plc Fibro Gen Inc., Ionis Pharmaceuticals Inc. Alnylam Pharmaceuticals Inc.

In India, 1 in 600 women and 1 in 442 males are estimated to be at risk of kidney cancer. It seems that men are marginally more at risk than women. Furthermore, it is estimated that the incidence of renal cell carcinoma (RCC), which is the most prevalent kind of kidney cancer, is 1 per 100,000 people for females and 2 per 100,000 people for males in India. The incidence of kidney cancer is nearly four times higher than in the West. It is estimated that 2 out of every 100,000 males and 1 out of every 100,000 females are affected by renal cell carcinoma (RCC). The International Kidney Cancer Coalition (IKCC) carried out a global survey in 2020 with the participation of Indian patients and caregivers. The purpose of the study was to learn more about the care experiences of Indian patients with kidney cancer.

Market Dynamics

Market Growth Drivers

Rise in the prevalence of kidney disease: The expanding need for renal cancer treatments is primarily due to the rising global prevalence of chronic renal disease. Chronic kidney disease (CKD) affects about 10% of the population, based on the National Kidney Foundation. Renal cell carcinoma accounts for more than 90% of instances of kidney cancer, whereas renal pelvis cancer accounts for less than 10% of cases with microscopy-confirmed kidney cancer. About 70.0% of the people with renal cell carcinoma, also known as RCC, have clear cell RCC, which is the most common subtype. This suggests a greater need for renal treatment for cancer.

Increased knowledge of immunotherapies: The growing demand for innovative immunotherapies and immune-oncologic drugs will drive the usage of personalized therapies for certain individual subpopulations. Programmed death-1 (PD-1) inhibitors are meant to take the place of TKIs & inhibitors of mTOR as the basis of treatment in first- and second-line RCC cases. Combining regimens, especially those with PD-1 inhibitors, will be used in the first-line scenario to meet significant unmet needs, improve progression-free survival, overcome cancer resistance, and preserve quality of life. Therefore, this type of care promotes the expansion of the market.

Rise in R&D expenditures by pharmaceutical businesses Source: In 2019, the pharmaceutical industry spent an incredible $83 billion on research and development globally. After deducting inflation, this amount is almost 10 times the industry's yearly spending from the 1980s. The number of new medications approved for sale increased by 60% between 2010 and 2019, reaching a peak of 59 new drugs in 2018. The availability of more innovative drugs has increased as a consequence of this rise in R&D spending, benefiting patients everywhere.

Market Restraints

Side Effects and Toxicities: Due to the severe side effects that accompany these medications, it is possible that the renal cancer treatment market won't grow as much as expected in the estimated time frame. A few negative consequences that could impede market growth include rash, fever, or appetite loss.

Excessive health care costs: The high costs connected with these agents prevent the market from growing. Numerous individuals are unable to afford the relatively high cost of generic renal cancer drugs. As such, it hinders market expansion.

Poor reimbursement policies: Inadequate reimbursement regulations make it more difficult for people with kidney cancer to get the medications they need, which raises costs and impedes market expansion. Financial barriers prevent patients from beginning and completing treatment when payment plans do not cover the whole cost of prescription medications. Patients may have to pay substantial out-of-pocket expenses in these situations. These payment constraints further diminish the market potential for kidney cancer medications.

Regulatory Landscape and Reimbursement Scenario

As part of the India@100 strategy, the pharmaceutical business in India is expected to proliferate, with aims of US$450 billion by 2047 and US$130 billion by 2030. Central Drugs Standard Control Organization (CDSCO) is India's main regulatory body for pharmaceuticals and medical devices. Its responsibilities include drug approvals, post-marketing surveillance, and clinical studies. An organization that controls and guarantees the affordability of medication prices is the National Pharmaceutical Pricing Authority (NPPA).

India Council of Medical Research (ICMR), this organization is essential to the advancement of knowledge and the moral conduct of clinical trials. The Department of Biotechnology (DBT) aims to further biotechnology research and development, including developing cancer medications.

The government-sponsored PM program, Pradhan Mantri Jan Arogya Ayushman Bharat Yojana, pays for kidney cancer treatment. Through their health insurance schemes, several states provide coverage for cancer treatment. Many private insurance plans include kidney cancer treatment in addition to other cancer treatments.

Competitive Landscape

Key Players

Here are some of the major key players in the India kidney cancer therapeutics market.

- Pfizer Inc

- Dr. Reddy's Laboratories Ltd

- Sun Pharmaceutical Industries Ltd

- Novartis AG

- Lupin

- Cipla Inc

- Aurobindo Pharma

- Uniqure N.V. Orchard Therapeutics plc FibroGen Inc.

- Ionis Pharmaceuticals Inc.

- Alnylam Pharmaceuticals Inc

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

India Kidney Cancer Therapeutics Market Segmentation

Type Of Kidney Diseases

- Renal cell carcinoma (RCC)

- Papillary renal cell carcinoma

- Chromophobe renal cell carcinoma7

- Unclassified renal cell carcinoma

- Transitional cell carcinoma

- Wilms tumor (Nephroblastoma)

- Renal sarcoma

- Angiomyolipoma

- Oncocytoma

- Others

Drug Class

- Monoclonal antibodies

- Trastuzumab

- Pertuzumab

- mTOR Inhibitors

- Sirolimus

- Everolimus

- Temsirolimus

- Immune Checkpoint Inhibitor

- Atezolizumab

- Avelumab

- Durvalumab

- Combined Therapies

- Interleukin-2

- Alpha-Interferon

- Others

End-User

- Hospitals

- Homecare

- Specialty Clinics

- Others

Distribution Channel

- Hospital pharmacy

- Online pharmacy

- Retail pharmacy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.