India Infectious Disease Therapeutics Market Analysis

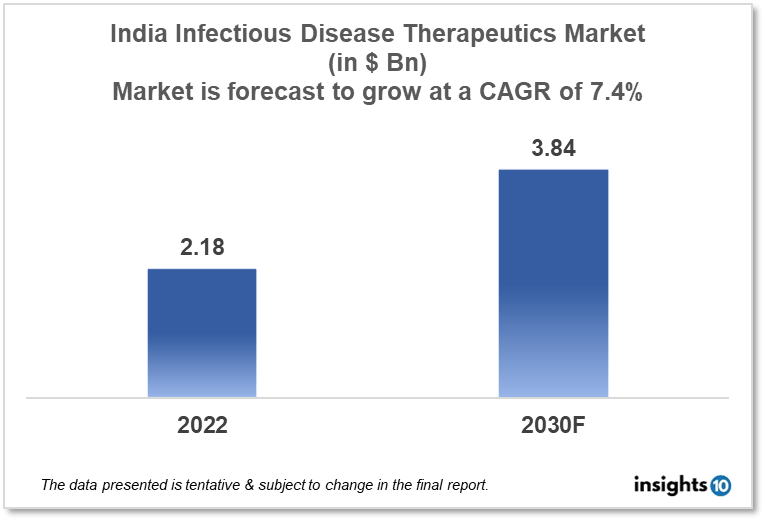

By 2030, it is anticipated that the Indian infectious disease therapeutics market will reach a value of $3.84 Bn from $2.18 Bn in 2022, growing at a CAGR of 7.4% during 2022-2030. Infectious Disease Therapeutics in India is dominated by a few domestic pharmaceutical companies such as Cadila Healthcare, Lupin Limited, and Sun Pharmaceutical. The Infectious Disease Therapeutics market in India is segmented into different therapeutic areas and different disease types. The major factors affecting the Indian infectious disease therapeutics market are the increasing disease burden of communicable diseases like TB, hepatitis, and COVID-19 and the amount of healthcare funding for infectious disease treatment in various areas of India.

Buy Now

India Infectious Disease Therapeutics Analysis Summary

By 2030, it is anticipated that the Indian infectious disease therapeutics market will reach a value of $3.84 Bn from $2.18 Bn in 2022, growing at a CAGR of 7.4% during 2022-2030.

India is a lower middle-income, developing country located in Southern Asia bordering the Arabian Sea and the Bay of Bengal. According to the World Factbook, India is extremely vulnerable to infectious diseases. Food or waterborne infections include bacterial diarrhoea, hepatitis A and E, and typhoid fever. Two vector-borne diseases are dengue fever, Crimean-Congo haemorrhagic fever, Japanese encephalitis, and malaria. Leptospirosis and rabies are two other infectious diseases unique to India.

The Indian government has launched a number of programmes and policies to promote access to infectious illness treatment. The National Vector Borne Disease Reduce Programme is one such initiative that tries to control the spread of vector-borne diseases such as malaria, dengue fever, and chikungunya. According to a report by the Indian Brand Equity Foundation, the Indian pharmaceutical market is expected to be worth around US$41 Bn in 2020, with anti-infective medications accounting for a significant portion of that figure. India's government spends 3% of its GDP on healthcare.

Market Dynamics

Market Growth Drivers Analysis

India is also a major manufacturer of vaccinations, including polio, measles, and rotavirus vaccines. The Serum Institute of India is the world's largest vaccine factory, generating more than 1.5 Bn doses of vaccines each year. In recent years, India has also worked to address the issue of antimicrobial resistance (AMR), which has become a global concern. Infectious disorders such as tuberculosis, malaria, dengue fever, and HIV/AIDS are prevalent in India. In India, infectious illness medicines have been a key focus of research and development. The Indian government has established a number of programmes to promote antibiotic stewardship and to stimulate the discovery of novel antibiotics and alternative treatments. India has a massive workforce and population (almost half of the population is under the age of 25). These aspects could boost India's infectious disease therapeutics market.

Market Restraints

Developing new pharmaceuticals and therapies necessitates adhering to regulatory rules established by organisations such as India's Central Drugs Standard Control Organization (CDSCO). These requirements can be complicated and time-consuming, resulting in delays and higher expenses. Poverty, inequality, and informality are pervasive in India. Infectious disorders such as tuberculosis, malaria, and dengue fever are prevalent in India. This heavy load can make developing effective therapies and conducting clinical trials difficult. These factors may deter new entrants into the Indian infectious disease therapeutics market.

Competitive Landscape

Key Players

- Serum Institute of India - Serum Institute of India is a leading Indian biotech company that develops and manufactures a range of vaccines, including those for infectious diseases such as polio, measles, and rubella

- Bharat Biotech - Bharat Biotech is an Indian biotechnology company that develops and manufactures vaccines and immunotherapies for infectious diseases such as hepatitis B, polio, and influenza

- Cadila Healthcare - Cadila Healthcare is an Indian pharmaceutical company that develops and manufactures a range of therapeutics, including antibiotics and antivirals

- Lupin Limited - Lupin Limited is an Indian pharmaceutical company that develops and manufactures a range of generic drugs, including those for infectious diseases such as HIV/AIDS and tuberculosis

- Sun Pharmaceutical Industries - Sun Pharmaceutical Industries is an Indian multinational pharmaceutical company that develops and manufactures a range of therapeutics, including antivirals and antibiotics

Recent Notable Updates

January 2023: Sun Pharmaceutical announced the acquisition of three brands from Aksigen Hospital Care, a Mumbai-based research-driven healthcare business with over two decades of experience in the healthcare field: Disperzyme, Disperzyme-CD, and Phlogam. The Drugs Controller General of India ("DCGI") has approved all of the brands for postoperative inflammation in patients having minor surgery and dental treatments.

December 2022: Cadila Pharmaceuticals has signed an Investment Intention Form (IIF) with the Government of Odisha to establish a pharmaceutical formulation manufacturing unit under the newly launched Industrial Policy 2022 of the Odisha government. With an initial investment of Rs 100 crores, the proposed green field pharmaceutical formulations manufacturing complex in Malipada, Bhubaneswar, is expected to be one of the largest pharma manufacturing units in the region. The Odisha government would expedite clearances to aid in the establishment of the aforementioned project.

Healthcare Policies and Reimbursement Scenarios

The Central Drugs Standard Control Organization (CDSCO), a branch of the Ministry of Health and Family Welfare, regulates infectious disease medicines in India. The CDSCO is in charge of ensuring the safety, effectiveness, and high quality of all medicines and medical equipment, particularly those used to treat infectious diseases. In addition to the CDSCO, other regulatory bodies in India that may be involved in the regulation of infectious disease therapeutics include the Indian Council of Medical Research (ICMR), which provides guidance on the use of new treatments within the healthcare system, and the National Health Systems Resource Centre (NHSRC), which provides technical assistance to the Ministry of Health and Family Welfare.

In India, the funding of infectious disease medicines is managed by a combination of governmental and private health insurance providers, such as the Aayushman Bharat scheme. These therapies are either partially or completely covered by insurance, depending on the patient's insurance coverage and the type of treatment. In India, the reimbursement procedure is tier-based, with different levels of coverage depending on the type of insurance coverage and the type of treatment sought. Treatments for life-threatening infectious diseases like HIV or tuberculosis, for example, are often covered at a higher rate than treatments for less serious infections. Treatment must be approved by the Drugs Controller General of India (DCGI) before it may be reimbursed.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Infectious Disease Therapeutics Segmentation

By Mode of Treatment (Revenue, USD Billion):

- Vaccines

- Drugs

By Applications (Revenue, USD Billion):

- HIV/AIDS

- Influenza

- Hepatitis

- Malaria

- Tuberculosis

- Others

By Disease Type (Revenue, USD Billion):

- Viral Diseases

- Bacterial Diseases

- Fungal Diseases

- Parasitic Diseases

- Others

By Target Organism (Revenue, USD Billion):

- Antibiotics

- Antivirals

- Antifungals

- Anti-Parasitic

- Others

By End User (Revenue, USD Billion):

- Hospitals and Clinics

- Ambulatory Care Centers

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

The Central Drugs Standard Control Organization (CDSCO), a branch of the Ministry of Health and Family Welfare, regulates infectious disease medicines in India.

In India, the funding of infectious disease medicines is managed by a combination of governmental and private health insurance providers, such as the Aayushman Bharat scheme.

Infectious Disease Therapeutics in India is dominated by domestic pharmaceutical companies such as Cadila Healthcare, Lupin Limited and Sun Pharmaceutical.