India Hospital Market Analysis

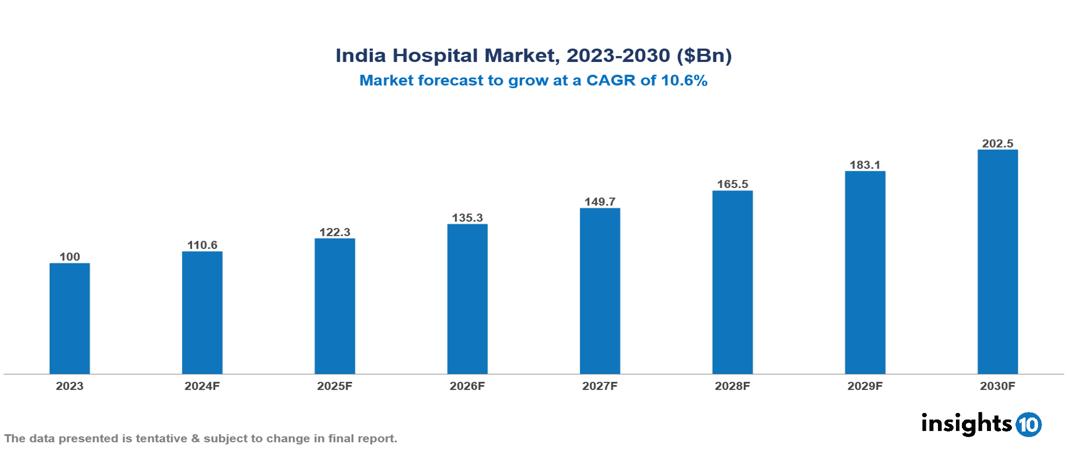

The India Hospital Market was valued at $100.01 Bn in 2023 and is predicted to grow at a CAGR of 10.6% from 2023 to 2030, to $202.46 Bn by 2030. The key drivers of this industry are the increasing prevalence of chronic disease, technological advancements, and government initiatives. The key players in the industry are Max Healthcare, Sterling Hospitals, Manipal Hospitals, and CARE Hospitals among others.

Buy Now

India Hospital Market Executive Summary

The India Hospital Market is at around $100.01 Bn in 2023 and is projected to reach $202.46 Bn in 2030, exhibiting a CAGR of 10.6% during the forecast period.

Hospitals are essential pillars of our healthcare system. They provide a wide range of services to keep us healthy and cared for in times of illness or injury. Hospital services are delivered by a multidisciplinary team of healthcare professionals, including doctors, nurses, technicians, and support staff, all working together to diagnose, treat, and support patients on their journey to recovery. Hospitals invest in advanced medical technologies and equipment to meet the healthcare requirements of an aging population. This includes state-of-the-art diagnostic tools, surgical equipment, and telemedicine solutions, which contribute to hospital revenue growth. Overall, hospital services are pivotal in maintaining and promoting the health and well-being of individuals and communities by delivering comprehensive medical care and addressing a variety of healthcare needs.

The private sector hospitals, driven by competition and innovation, offer the latest medical technologies and personalized care. Patients often choose these institutions for their shorter wait times, luxurious amenities, and access to renowned specialists. While it comes with a price tag. On the other hand, public sector hospitals uphold the principle of healthcare as a fundamental right. They serve as safety nets for vulnerable and underserved populations, offering comprehensive healthcare services and research regardless of a patient’s financial means.

India has a total of 43,486 private hospitals. The state of Uttar Pradesh had the highest number of hospitals. The rate of hospitalization is increasing gradually. The market therefore is driven by significant factors like increasing prevalence of chronic disease, technological advancements, and government initiatives. However, high healthcare costs, inadequate infrastructure, and regulatory issues restrict the market's growth.

Hospitals known for their comprehensive medical services include Apollo Hospitals and Max Healthcare. Narayana Health, Columbia Asia Hospitals, and Medanta - The Medicity are also significant contributors.

Market Dynamics

Market Growth Drivers

Increasing Prevalence of Chronic Disease: The rise in chronic diseases such as diabetes, cardiovascular conditions, and cancer is a major contributor to the growing demand for hospital services. Cardiovascular diseases account for 25-30% of deaths in India. This trend places a considerable burden on the healthcare system, necessitating enhanced medical facilities and services to manage these conditions effectively.

Technological Advancements: Rapid advancements in medical technology, including telemedicine, electronic health records, and robotic surgery, are transforming healthcare delivery. These innovations not only enhance patient care but also improve operational efficiency within hospitals, making them more attractive to patients.

Government Initiatives: The Indian government has introduced various initiatives to boost the healthcare sector, including 100% foreign direct investment (FDI) in healthcare projects and substantial budget allocations for infrastructure development. These policies aim to improve healthcare accessibility and quality across the nation.

Market Restraints

High Healthcare Cost: The rising costs associated with hospital services, including treatment and hospitalization, are a significant barrier for many patients. This is particularly challenging for lower-income populations who may not have adequate insurance coverage.

Inadequate Infrastructure: Despite improvements, many regions in India still lack sufficient healthcare infrastructure, particularly in rural and semi-urban areas. This inadequacy limits access to quality hospital services and leads to disparities in healthcare delivery.

Regulatory Issues: The healthcare sector in India is subject to complex regulatory frameworks that vary by state. Navigating these regulations is challenging for hospital operators, potentially delaying service delivery and increasing operational costs.

Regulatory Landscape and Reimbursement Scenario

Ministry of Health and Family Welfare (MoHFW) is the central authority responsible for health policy formulation and implementation in India. Each state has its own councils and regulatory bodies that oversee the licensing and operation of healthcare facilities, ensuring compliance with local regulations. Clinical Establishments Act, of 2010 governs the registration and regulation of clinical establishments (hospitals, clinics, etc.) to ensure minimum standards of care and infrastructure.

Pradhan Mantri Jan Arogya Yojana (PM-JAY) is the world's largest government-funded health insurance scheme. It offers cashless reimbursement coverage of up to Rs. 5 lakhs per family per year for secondary and tertiary care hospitalization in both public and impanelled private hospitals. Rashtriya Arogya Nidhi (RAN) scheme provides financial assistance to patients below the poverty line for major life-threatening diseases requiring treatment at super-specialty government hospitals.

Competitive Landscape

Key Players

Here are some of the major key players in the India Hospital Market:

- Apollo Hospitals

- Fortis Healthcare

- Max Healthcare

- Narayana Health

- Columbia Asia Hospitals

- Sterling Hospitals

- Medanta - The Medicity

- Manipal Hospitals

- Gleneagles Global Health City

- CARE Hospitals

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

India Hospital Market Segmentation

By Service Type

- Inpatient Services

- Outpatient Services

By Hospital Type

- Private Hospital

- Public Hospital

By Service Areas

- Acute Care

- Cardiovascular

- Cancer Care

- Neurorehabilitation & Psychiatry Services

- Pathology Lab, Diagnostics, and Imaging

- Obstetrics & Gynecology

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.