India Healthcare Claims Management Market Analysis

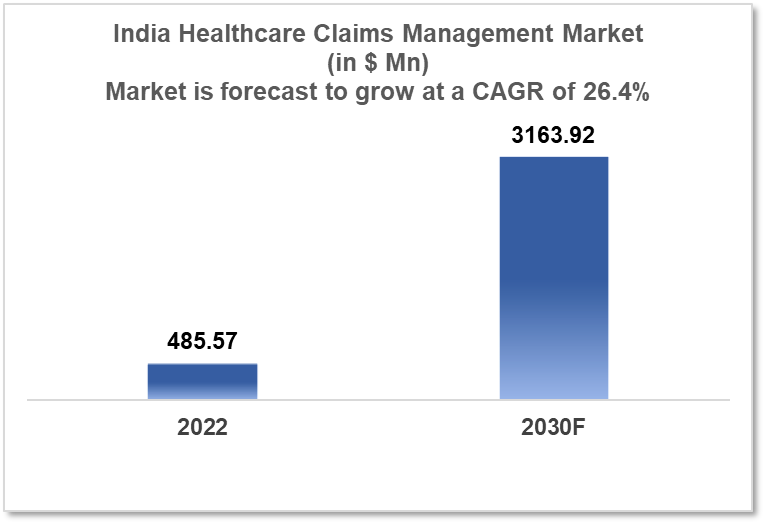

The India healthcare claims management market is projected to grow from $485.57 Mn in 2022 to $3163.92 Mn by 2030, registering a CAGR of 26.4% during the forecast period of 2022 - 2030. The main factors driving the growth would be growing health insurance penetration, increasing adoption of digital technology, rising healthcare frauds and government initiatives. The market is segmented by component, type, delivery mode and by end-user. Some of the major players include Wipro, Infosys, Tech Mahindra, Accenture and eClinicalWorks.

Buy Now

India Healthcare Claims Management Market Executive Summary

The India healthcare claims management market is projected to grow from $485.57 Mn in 2022 to $3163.92 Mn by 2030, registering a CAGR of 26.4% during the forecast period of 2022 - 2030. India has gradually expanded its health spending over the past ten years in order to support its expanding population. Spending on health increased to 3.01% of GDP in 2019 from 2.95% in 2018. Notwithstanding recent improvements, India still spends less on healthcare than the majority of wealthy nations. By boosting public financing and enacting reform laws, the government is attempting to improve the healthcare system, but there are still many issues that need to be resolved.

Over the past ten years, health insurance claims management in India has seen tremendous change. Up until the establishment of TPAs in 2002 and the creation of Mediclaim in the middle of the 1980s, the main focus of claims administration was on reimbursement claims. Early claim systems were ad hoc programs that were frequently improved to take into account the numerous requirements of payers and providers, as well as changing client demands and health insurance packages. Most of them were reactive systems that supported current products and procedures but weren't created to accommodate upcoming requirements.

The health insurance industry's operations and products will continue to develop over the coming ten years. There is a chance that additional insurers will follow the trend of bringing the claims process in-house. As the demand for efficient and effective claims management solutions rises, the healthcare claims management market in India offers considerable growth potential for healthcare providers, insurers, and technology vendors.

Market Dynamics

Market Growth Drivers

The Indian healthcare claims management market is expected to be driven by factors such as:

- Growing health insurance penetration- The government's emphasis on providing universal health care and the public's rising understanding of the value of health insurance have both contributed to the health insurance market's recent rapid growth in India. The demand for effective healthcare claims management services is rising as more people purchase health insurance

- Increasing adoption of digital technology- India has been accelerating the adoption of digital technology across a range of industries, including healthcare. The adoption of digital technology is anticipated to fuel expansion in the healthcare claims management market because it has the ability to increase the effectiveness and efficiency of healthcare claim management

- Rising healthcare frauds- There has been an increase in healthcare fraud in India, where it is believed that a sizable portion of all claims is fake. More advanced healthcare claims management tools that can spot and stop fraud are therefore becoming increasingly necessary

- Government initiatives- The Indian government has started a number of programs to increase healthcare access and quality, including Ayushman Bharat, which gives poor communities access to health insurance. It is anticipated that these measures would increase demand for healthcare claims management solutions

Market Restraints

The following factors are expected to limit the growth of the healthcare claims management market in India:

- High cost of implementation- Solutions for managing healthcare claims demand a large investment in staff, infrastructure, and technology. The high cost of installation may prevent smaller healthcare providers from implementing these solutions

- Inadequate regulatory framework- There are now no set standardised criteria or standards for the regulatory framework governing the management of healthcare claims in India. Some healthcare providers can be deterred from investing in healthcare claims management solutions due to the lack of regulatory clarity

- Limited digital infrastructure- Despite India's growing embrace of digital technologies, there are still certain gaps in the digital infrastructure for the healthcare industry. Healthcare claims management solutions may not be widely adopted if there is insufficient access to dependable internet connectivity and digital devices, particularly in rural and isolated places

Competitive Landscape

Key Players

- Wipro (IND)- based in Bengaluru, offers QCare, a potent, automated claims-processing solution created to be a crucial component of your daily health plan business operations. A wide range of healthcare payers, including managed care organisations, HMOs, and PPOs, value it because of its inherent flexibility. It makes it possible to cover dental, pharmacy, and vision services in addition to Medicare Advantage Plans, Medicaid Managed Care Plans, and indemnity plans

- Infosys (IND)- based in Bengaluru, provides insurers with a competitive differentiator through digitally driven end-to-end claims transformation services that result in faster processing times and lower total cost of ownership

- Tech Mahindra (IND)- based in Pune, offers next-generation claims processing which eliminates most clerical manual jobs in claims processing with process automation. Using effective indexing, data extraction, and data ingestion, intelligent management of documents linked to claims was prioritised. It integrates the claims system with other surrounding systems which makes the processing of claims faster

- Accenture- a global professional services company that provides healthcare claims administration services to clients in India and other countries. Accenture's healthcare management services include customer assistance, fraud and abuse detection, analytics and reporting, and claims processing and management

- eClinicalWorks- delivers the most comprehensive cloud-based EHR software for clinical recording, as well as telehealth, population health, patient engagement, and revenue cycle management solutions

Notable deals

April 2022- With the $540 Mn acquisition of Rising Intermediate Holding, a global SAP consulting firm, Wipro has claimed that its capabilities for assisting companies to become intelligent enterprises have greatly expanded.

May 2022: Tech Mahindra, a top provider of consultancy, business reengineering, and digital transformation services and solutions, stated that it has increased its cooperation with longtime partner Pegasystems in order to build a larger ecosystem over the next five years. Its customers' digital transformation will be accelerated by this partnership's unique industrial solutions.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Healthcare Claims Management Market Segmentation

By Component (Revenue, USD Billion):

Further breakdown of the software and services segment of the healthcare claims management market

- Software

- Services

By Type (Revenue, USD Billion):

Although they have nothing to do with it, skills unrelated to patient care are equally crucial for any healthcare organization that wants to stay in business. Among these are managing intricate insurance regulations, comprehending best practices for data collection, and analyzing data to identify areas for development. For the above reasons, providers are constantly looking for methods to improve claim administration and medical billing systems. Setting up an integrated billing and claims processing system is one approach to accomplish this, which has a number of benefits.

- Integrated Solutions

- Standalone Solutions

By Delivery Mode (Revenue, USD Billion):

- On-Premise

- Cloud-Based

By End User (Revenue, USD Billion):

- Healthcare Payers

- Healthcare Providers

- Other End Users

Healthcare payers in this market are anticipated to rise quickly over the course of the projection period because of the installation of strict regulatory requirements, a lack of experienced personnel internally for claims processing, rising healthcare expenditures, and fraud associated with those charges. Payers have also assisted healthcare providers by creating a web-based and cloud-based interface that helps them manage medical billing and associated claims and offers accurate and timely information about the epidemic.

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.