India Financial Assistance Programs Market Analysis

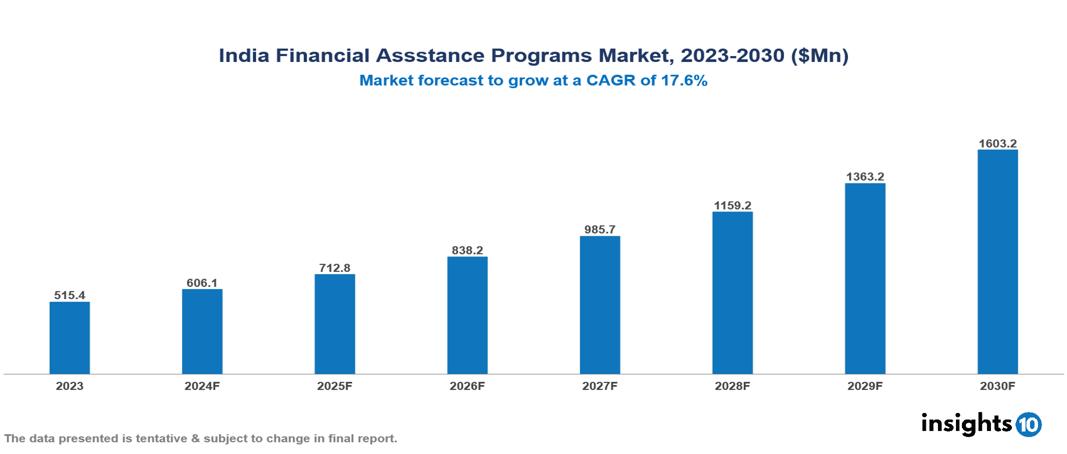

The India Financial Assistance Programs Market was valued at $515.4 Mn in 2023 and is projected to grow at a CAGR of 17.6% from 2023 to 2023, to $1,603.2 Mn by 2030. The market is driven by various sector such as rising drug cost, complex insurance landscape, regulatory environment, market competition, patient adherence concern etc. The prominent pharmaceutical companies providing financial assistance to patient are such as Cipla, Dr Reddy’s, Sanofi, Merck, GSK, Johnson & Johnson, Novartis among others.

Buy Now

India Financial Assistance Programs Market Executive Summary

The India Financial Assistance Programs Market is at around $515.4 Mn in 2023 and is projected to reach $1,603.2 Mn in 2030, exhibiting a CAGR of 17.6% during the forecast period 2023-2030.

The goal of pharmaceutical companies' patient financial assistance is to reduce or eliminate out-of-pocket expenses as a barrier to prescription selection, allowing patients to continue taking name-brand prescriptions for extended periods of time. Among the often-utilized financial aid programs under patient assistance programs include co-pay help, free drug trials, bridge programs, sliding scale programs, coupons, bulk purchase programs, etc. Patients' out-of-pocket drug cost sharing is determined by their health plans or pharmacy benefit manager's (PBM's) formulary--a list of preferred and nonpreferred prescription drugs. Preferred status is based on a drug's effectiveness, price, and the level of rebate the payer receives from the manufacturer for giving the drug preference over its competitors. Generics and preferred brand drugs are generally assigned lower patient cost sharing than nonpreferred brand drugs. As drug prices have increased, so has patient cost sharing, causing some patients to stretch, forgo, or discontinue medication that is too expensive. Drug manufacturers often seek to mitigate these effects by providing or funding various forms of patient financial support.

In India, there are estimated 77 Mn people above the age of 18 years are suffering from diabetes (type 2) and nearly 25 Mn are prediabetics (at a higher risk of developing diabetes in near future). More than 50% of people are unaware of their diabetic status which leads to health complications if not detected and treated early. Therefore, the market is predominately driven by factors such as increasing prevalence of chronic diseases and rising healthcare costs whereas limited awareness in the population, insufficient resources and budgetary concerns restrict market growth.

Market Dynamics

Market Drivers

Chronic disease prevalence: In India, there are estimated 77 Mn people above the age of 18 years are suffering from diabetes (type 2) and nearly 25 Mn are prediabetics (at a higher risk of developing diabetes in near future). More than 50% of people are unaware of their diabetic status which leads to health complications if not detected and treated early. The increasing number of patients with chronic conditions necessitates long-term, often expensive treatments. This creates a sustained need for financial assistance over extended periods. Chronic disease management is a priority in healthcare, driving support for assistance programs.

Rising healthcare costs: The increasing cost of healthcare services, medications, and treatments has made it difficult for many individuals and families to afford necessary medical care. Patients often bear a substantial portion of healthcare costs out-of-pocket, leading to financial hardship which boosts the demand for financial assistance in the population.

Market Restraints

Limited awareness: Many individuals and businesses are unaware of the various financial assistance programs available to them, leading to underutilization. Accessibility to these programs varies significantly across different regions of India, with rural areas often facing greater challenges

Limited Funding and Resources: Many financial assistance programs suffer from insufficient funding, limiting their ability to reach a wider population and provide adequate support. In some cases, funds are not allocated efficiently, leading to delays in disbursement and reduced impact.

Budgetary pressures: Pharmaceutical companies must balance the cost of assistance programs with maintaining profit margins. Economic downturns or changes in company strategy could lead to reduced funding for these programs. This pressure might result in more selective or limited assistance offerings.

Regulatory Landscape and Reimbursement Scenario

The Central Drugs Standard Control Organization (CDSCO) under the Ministry of Health and Family Welfare (MoHFW) is the key pharmaceutical regulatory body in India. The CDSCO is responsible for approving drugs, conducting clinical trials, laying down standards for drugs, controlling the quality of imported drugs, and coordinating with State Drug Control Organisations to enforce the Drugs and Cosmetics Act and Rules.

India does not have a specific regulatory framework for drug reimbursement. The main sources of healthcare financing are out-of-pocket expenditure, government schemes like the Central Government Health Scheme (CGHS) and Employees' State Insurance (ESI) Scheme, private insurance, and non-governmental organizations (NGOs). However, there is no overarching reimbursement policy or mechanism for drugs, including biologics and biosimilars, in India. The Drugs Prices Control Order 2013 governs pricing of scheduled drugs, including some biologics, by the National Pharmaceutical Pricing Authority (NPPA).

Competitive Landscape

Key Players

Here are some of the major key players in the India Financial Assistance Programs Market:

- Cipla

- Dr Reddy

- Roche

- Pfizer

- Bayer

- Sanofi

- Novartis

- Merck

- GSK

- Johnson & Johnson

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

India Financial Assistance Programs Market Segmentation

By Application

- Population Health Management

- Outpatient Health Management

- In-patient Health Management

- Others

By Therapeutics Area

- Health & Wellness

- Chronic Disease Management

- Other therapeutic area

By End Users

- Payers

- Providers

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.