India Electronic Health Records Market Analysis

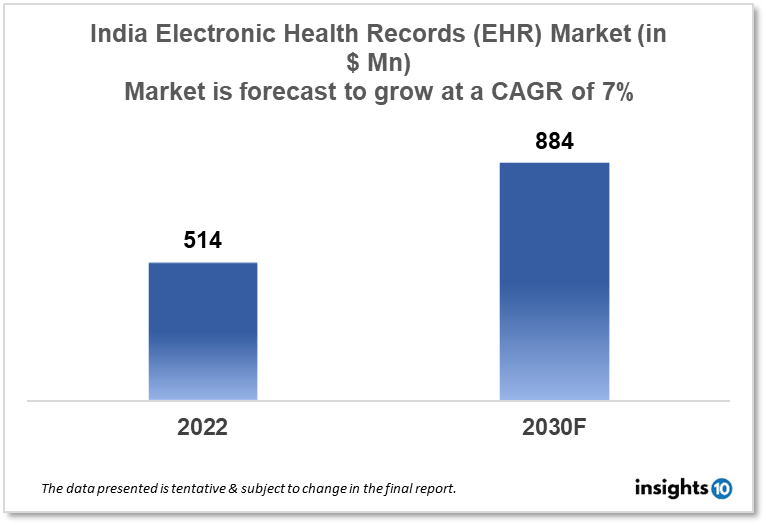

India's electronic health record market size was valued at $514 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 7% from 2022 to 2030 and will reach $884 Mn in 2030. This growth can be attributed to hospitals seeing benefits from EMR implementation and integration with their core operations. The market is segmented by product type, application type, and end user. Some of the major players DocEngage Informatics, Gem3s Technologies, NovoCura Tech Health Services, Practo Technologies, Cerner Healthcare, and others.

Buy Now

India Electronic Health Record Market Executive Summary

India's electronic health record market size was valued at $514 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 7% from 2022 to 2030 and will reach $884 Mn in 2030. In the fiscal year 2022, the Indian government is expected to spend more than 2% of the GDP on healthcare. By the fiscal year 2025, it was predicted that this will account for more than 2.5 % of the GDP.

An electronic medical record (EMR) is only a medical record that is stored electronically. An EMR stores various types of medical data. The data consists of details on the patient's hospital expenses, prescriptions, drug allergies, and medical background. The current paper-based methodology is ineffective, wasteful, and expensive to maintain. The advantages of EMR, on the other hand, include cooperation, portability, and simple data recovery.

EMR facilitates clinicians' ability to make informed medical decisions. Additionally, EMR makes it possible for care providers to quickly gather, store, and retrieve patient medical information with the use of the hospital information system (HIS). Along with managing medical data, EMR supports workflow management, hospital order administration, and data security.

India's market for electronic medical records is expected to grow as a result of the country's healthcare industry becoming increasingly digital. According to data from the Future Health Index (FHI) 2019 study, 76% of healthcare professionals in India are already using digital health records (DHRs). In terms of the adoption of digital health technologies, India currently leads the world. The usage of digitization in the medical industry and the electronic medical industry will undoubtedly rise in the upcoming years as a result of the introduction of digital technologies in India, such as artificial intelligence, machine learning, cloud computing, and others. In order to adapt and develop digital healthcare solutions, major businesses, hospitals, and organizations have invested a large sum of money.

Market Dynamics

Market Growth Drivers

Government Initiatives: Due to the numerous initiatives done by the Indian government to promote electronic medical records in the nation, the market for electronic medical records is predicted to grow dramatically in the upcoming years. In order to create India's e-health ecosystem, the MoHFW established the National e-health Authority of India (NeHA) in 2015. One of the main goals of the NeHA, according to the Ministry of Health and Family Welfare of the Government of India, is to establish data management, privacy, and security policies, guidelines, and patient health records under statutory provisions.

In addition, the Indian government has begun its Digital Health Mission, which seeks to digitize all of the country's citizens' medical records by 2022. The National Institution for Transforming India has suggested the National Health Stack, a forward-thinking digital platform (NITI Aayog). The National Health Stack (NHS), according to NITI Aayog, is a comprehensive platform that supports numerous health verticals and their diverse branches and is able to integrate future IT technologies for a sector ready for quick, disruptive changes and unanticipated turns. By 2022, it is feasible to aim for the universal adoption of digital health records. During the forecasted period, it is predicted that all of these government actions will support the expansion of EMR in India.

Rising EHR Adaptations: Large hospitals are seeing benefits from EMR implementation and integration with their core operations. Through the value chain, the streamlining of the process decreases or stops revenue leaks. By lowering administrative costs and improving data accuracy, long-term EMR use will result in cost savings. Doctors are able to treat patients more effectively with the use of EMR thanks to easy and accurate data accessibility. Clinical data gathering at the time of care increases productivity and boosts data quality. The regulatory agencies and pharmaceutical corporations use the data gathered to enhance the PMS (post-marketing surveillance) of medications. Considering all these factors the India EHR market will grow in the coming years.

Market Restraints

India has a very low adoption of EMR when compared to developed countries. There are a number of gaps between EMR vendors and doctors that contribute to the poor adoption rate.

The biggest apparent obstacle is a lack of knowledge of the advantages of EMR. The adoption rate is being hampered by the small and medium-sized healthcare service providers' general lack of knowledge about the benefits of EMR.

The adoption is hampered by the resistance to the new and innovative information technology platform. Doctors, who form the backbone of the healthcare system, are resistant to EMR. The absence of compatible technology on the market is the main cause of this. The doctors must also use computers in order to use the EMR.

Competitive Landscape

Key Players

- DocEngage Informatics

- Gem3s Technologies

- NovoCura Tech Health Services

- Practo Technologies

- Cerner Healthcare

- Epic Systems

- Allscripts

- McKesson

- Meditech

- Athenahealth

- NextGen Healthcare

- GE Healthcare

- Drchrono

Healthcare Policies and Regulatory Landscape

Policy changes and Reimbursement scenario

In India, electronic health records (EHRs) are regulated by the Ministry of Health and Family Welfare. The government has issued guidelines for using and managing EHRs in the healthcare sector. The government has also launched several initiatives to promote the use of EHRs in the country. One such initiative is the National Health Stack, which is a set of digital infrastructure and services to support the use of EHRs and other digital health services in India. The government also has plans to establish a National Health Data Network to share and exchange health data securely among different stakeholders.

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

India's Electronic Health Records Market Segmentation

By Product (Revenue, USD Billion)

Web-based and cloud-based software is more affordable since it saves on additional costs like license fees, regular upgrades, and device upkeep. Additionally, it reduces the need for IT workers because SaaS providers help with software installation, configuration, testing, operation, and upgrades. The cost-effectiveness of cloud-based EHR systems in small healthcare organizations will therefore fuel developments as well as the expansion of the category. MHealth services

- Web/Cloud-based EHR software

- On-premise EHR software

By Application Type (Revenue, USD Billion)

Large amounts of patient health data may be stored and processed by EHRs, which aids doctors in automating both financial and operational operations with rapid and simple access. Therefore, integrated EHR and practice management software navigates all tasks, making it easier for front-line healthcare providers to do their jobs, and will therefore drive the segment's revenue during the anticipated time period.

- E-prescription

- Practice management

- Referral management

- Patient management

- Population health management

By End User (Revenue, USD Billion)

By 2027, the category of ambulatory surgical centers is expected to rise at a 7.1% annual rate. The acceptance of EHR in these facilities will be fueled by ambulatory surgical centers' growing preference for digital technologies to efficiently manage workflow. These are outpatient facilities offering planned surgeries and same-day surgical services.

- Hospitals

- Specialty centers

- Clinics

- Ambulatory surgical centers

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.