India Dermatological Therapeutics Market Analysis

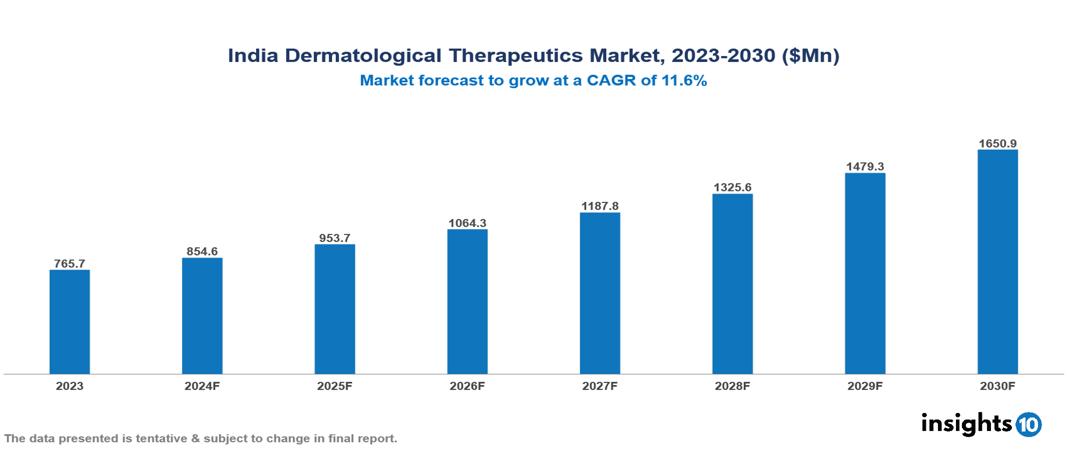

India Dermatological Therapeutics Market is at around $0.77 Bn in 2022 and is projected to reach $1.65 Bn in 2030, exhibiting a CAGR of 11.6% during the forecast period. The market is expanding due to factors like improved healthcare infrastructure, increased awareness and demand, and technological advancements. The market is dominated by key players like Gladerma India Private Limited (IND), Dr. Reddy’s Laboratories (IND), Cipla (IND), Sun Pharmaceutical Industries (IND), Lupin (IND), Zydus Cadila (IND), Torrent Pharmaceuticals (IND), Alkem Laboratories (IND), Glenmark Pharmaceuticals (IND), Pfizer, Johnson & Johnson, Novartis AG, and GlaxoSmithKline PLC.

Buy Now

India Dermatological Therapeutics Market Executive Summary

India Dermatological Therapeutics Market is at around $0.77 Bn in 2023 and is projected to reach $1.65 Bn in 2030, exhibiting a CAGR of 11.6% during the forecast period.

Dermatological therapy refers to the area of medicine that treats skin conditions. It deals with the identification and treatment of a range of dermatological disorders, including infections, psoriasis, eczema, and acne. Indian dermatologists use a variety of therapeutic approaches, such as systemic therapies, topical drugs, and cutting-edge techniques like laser therapy. With the development of science and technology, the sector is always changing to offer practical treatments for a wide range of skin conditions.

The growing aging population and greater skincare awareness drive India's dermatological market's steady rise. India had 149 Mn people in 2022 who are 60 years of age or older, or almost 10.5% of the nation's total population. The market is expanding due to the growing demand for improved dermatological treatments and cosmetic operations. Prominent companies are proactively launching inventive merchandise and utilizing digital channels to expand their customer outreach. Given the favorable regulatory framework and the growing beauty-conscious population in India, there are substantial prospects in the dermatological market for domestic and foreign firms.

The global market for dermatological treatments generated $40.94 Bn in revenue in 2023, a substantial increase over past decades. The sector is changing rapidly; cutting-edge technologies and effective production methods are fueling this growth. The dynamic combination of accessibility, innovation, and financial aid has turned the market for dermatological treatments into a robust and increasing sector.

Known for its concentration on topical treatments and well-known brands like Cetaphil, Galderma India Private Limited is a major player in the Indian dermatological therapeutics market. The excellent caliber and demonstrated effectiveness of Galderma India's products are well known. They conduct innovative research and development and uphold stringent quality control requirements.

Market Dynamics

Market Growth Drivers:

Growing Knowledge and Demand: As people become more aware of dermatological diseases and the availability of cutting-edge therapeutic solutions, there is a greater need for dermatological goods and services.

Enhancing Healthcare Infrastructure: The expansion of the dermatological therapeutics market has been aided by ongoing initiatives to enhance access to medical facilities and the quality of healthcare infrastructure throughout India. The improvement of skin disease detection and treatment is made possible by the growth of healthcare facilities in both urban and rural locations.

Technological Developments: The creation of new medications, topical therapies, and minimally invasive procedures are some examples of dermatological therapeutic advances that are driving the industry. The variety of treatment options that are now available has increased due to innovations in drugs and medical technologies.

Market Restraints:

Affordability Issues: In certain situations, patients may find the expense of dermatological treatments to be a major obstacle, especially in a nation with a wide range of economic circumstances like India. Affordability issues could prevent some people from receiving advanced or specialized therapies.

Limited Reimbursement: Patients may have to pay a large portion of the cost of dermatological treatments even if they have insurance.

Preference for Conventional Remedies: Compared to pharmaceutical dermatological treatments, some people may favor conventional or home remedies. Reluctance to adopt modern treatment options may be influenced by cultural issues as well as historical dependence on traditional medicine.

Healthcare Policies and Regulatory Landscape

National Regulatory Authority (NRA) of India is the Central Drugs Standard Control Organization (CDSCO), which is headquartered under the Directorate General of Health Services, Ministry of Health & Family Welfare, Government of India. To generate new medication formulations for retail or distribution, producers must first seek a license from the Zonal FDA and CDSCO. To receive CDSCO's clearance, this process needs to be followed. Fill out form CT-10 to get authorization to create ND for testing and analysis in form CT-11. The approval procedure involves numerous committees and agencies, which makes it more complicated and could lead to delays. Compared to other countries, the clearance process in India can take a while.

Competitive Landscape

Key Players:

- Gladerma India Private Limited (IND)

- Dr. Reddy’s Laboratories (IND)

- Cipla (IND)

- Sun Pharmaceutical Industries (IND)

- Lupin (IND)

- Zydus Cadila (IND)

- Torrent Pharmaceuticals (IND)

- Alkem Laboratories (IND)

- Glenmark Pharmaceuticals (IND)

- Pfizer

- Johnson & Johnson

- Novartis AG

- GlaxoSmithKline PLC

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

India Dermatological Therapeutics Market Segmentation

By Type

- Prescription-based Drugs

- Over-the-counter Drugs

By Disease

- Alopecia

- Herpes

- Psoriasis

- Rosacea

- Skin Cancer

- Acne

- Atopic Dermatitis

- Vitiligo

- Hidradenitis

- Other Applications

By Drug Class

- Anti-infectives

- Corticosteroids

- Anti-acne

- Calcineurin Inhibitors

- Retinoids

- Other Drug Classes

By Route of Administration

- Topical Administration

- Oral Administration

- Parenteral Administration

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.