India Chronic Obstructive Pulmonary Disease (COPD) Therapeutics Market Analysis

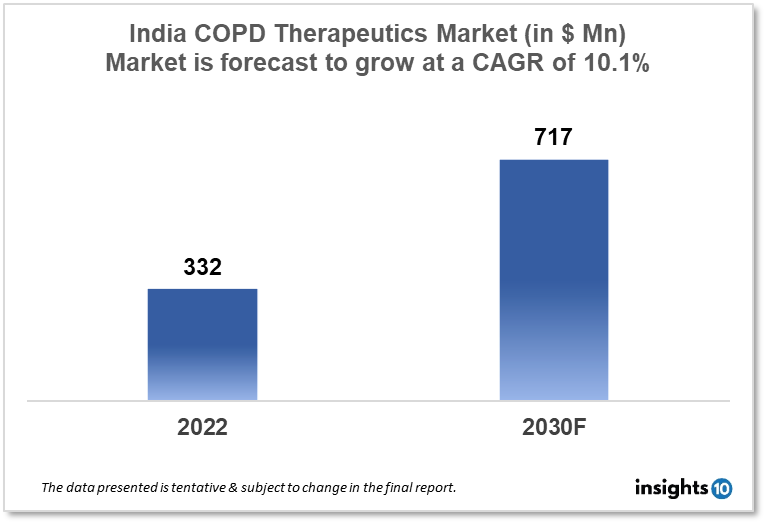

India's COPD Therapeutics Market was valued at $332 Mn in 2022 and is estimated to expand at a CAGR of 10.1% from 2022 to 2030 and will reach $717 Mn in 2030. One of the main reasons propelling the growth of this market is the increased prevalence rate and government initiative. The market is segmented by Drug class and by distribution channel. Some key players in this market are Cipla, Glenmark Pharmaceuticals, Lupin Limited, Sun Pharmaceutical Industries, Torrent Pharmaceuticals, AstraZeneca, Boehringer Ingelheim Pharmaceuticals, Novartis, Pfizer, Teva India Limited and others.

Buy Now

India Chronic Obstructive Pulmonary Disease (COPD) Therapeutics Market Executive Summary

The India Chronic Obstructive Pulmonary Disease (COPD) Therapeutics Market was valued at $332 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 10.1% from 2022 to 2030 and will reach $717 Mn in 2030. Chronic Obstructive Pulmonary Disease (COPD) is a "common preventable, and treatable disease that is characterized by persistent respiratory symptoms and airflow limitation due to abnormalities in the airway and (or) alveolar abnormalities usually caused by significant exposure to noxious particles or gases”. The World Health Organization (WHO) lists COPD as one of the major causes of death worldwide. The reduction of the global burden of respiratory diseases is a shared commitment of the WHO Global Partnership against Chronic Respiratory Disorders. Due to expensive medical expenses and a reduced quality of life related to one's health, COPD also places a heavy burden on society. It is the most common chronic respiratory disease to cause impairment and was the second-leading cause of Disability Adjusted Life Years (DALY) in 2016.

The prevalence of COPD (chronic obstructive pulmonary disease) is highest in India. The number climbed from 28.1 million in the 1990s to 55.3 million in 2016, according to the Lancet Respiratory Medicine article. According to the Indian Study on Epidemiology of Asthma, Respiratory Symptoms, and Chronic Bronchitis in Adults, India significantly contributes to the morbidity and mortality of COPD in the world, with 3% of India's disability-adjusted life years (DALYs) being recorded due to chronic respiratory diseases (CRDs) (INSEARCH). The primary cause of CRDs is COPD, which must be noted and understood. Several studies estimate that the yearly economic cost of COPD to be more than 48,000 crores, which is significantly greater than the Ministry of Health and Family Welfare's annual budget (MOHFW) of 2010-2011.

Market Dynamics

Market Growth Drivers

According to a study published in the Journal of Family Medicine and Primary Care India in 2020, the prevalence of COPD in is around 4.2%. The study also projected that the prevalence of COPD in India will continue to increase in the coming years, primarily due to rising smoking rates, air pollution, and aging population. This increasing prevalence of COPD is driving the demand for COPD therapeutics in India. The Indian government and various organizations have been taking steps to raise awareness about COPD and its risk factors. For instance, the Indian Chest Society launched the "Breathefree" initiative in 2012 to increase awareness about COPD and provide access to affordable COPD therapeutics. This rising awareness about COPD is expected to drive the demand for COPD therapeutics in India. Government initiatives: The Indian government has taken several initiatives to promote the use of COPD therapeutics in the country. For instance, in 2020, the Ministry of Health and Family Welfare launched the "National Chronic Obstructive Pulmonary Disease (COPD) Program" to improve the diagnosis and treatment of COPD in the country. This initiative is expected to drive the demand for COPD therapeutics in India. Growing healthcare infrastructure: India has been investing heavily in improving its healthcare infrastructure in recent years. According to a report, India's healthcare market is expected to grow at a CAGR of 22% between 2020 and 2025. This growing healthcare infrastructure is expected to increase access to COPD therapeutics in India and drive the growth of the India COPD therapeutics market. Several players in the India COPD therapeutics market are focusing on developing new and innovative COPD therapeutics. For instance, in 2020, Glenmark Pharmaceuticals launched a new inhaler for the treatment of COPD in India. This product innovation is expected to drive the demand for COPD therapeutics in India.

Market Restraints

Despite efforts by the government and various organizations, many people in India are still not aware of COPD and its risk factors. This lack of awareness can lead to underdiagnosis and undertreatment of COPD, which can hinder the growth of the India COPD therapeutics market. COPD therapeutics can be expensive, especially for patients who require long-term treatment. Many people in India may not be able to afford the cost of COPD therapeutics, which can limit the demand for these drugs. Despite the growing healthcare infrastructure in India, many people still have limited access to healthcare, especially in rural areas. This limited access to healthcare can make it difficult for people with COPD to receive timely and adequate treatment, which can hinder the growth of the India COPD therapeutics market. In addition to COPD therapeutics, there are several alternative therapies available for the treatment of COPD, such as traditional medicines and home remedies. These alternative therapies can compete with COPD therapeutics and limit the growth of the India COPD therapeutics market. The Indian regulatory environment for pharmaceuticals is known to be strict, and companies must adhere to strict regulations to obtain approval for their products. This can increase the cost and time required for product development and hinder the growth of the India COPD therapeutics market.

Competitive Landscape

Key Players

- Cipla

- Glenmark Pharmaceuticals

- Lupin Limited

- Sun Pharmaceutical Industries

- Torrent Pharmaceuticals

- AstraZeneca

- Boehringer Ingelheim Pharmaceuticals

- Novartis

- Pfizer

- Teva India Limited

Healthcare Policies and Regulatory Landscape

The Ministry of Health and Family Welfare is responsible for formulating and implementing healthcare policies in India. The ministry oversees several departments, including the Department of Health and the Department of Family Welfare.

Central Drugs Standard Control Organization (CDSCO) responsible for regulating the import, manufacture, distribution, and sale of pharmaceuticals in India. The organization is responsible for granting approvals for drugs, medical devices, and clinical trials. National Pharmaceutical Pricing Authority (NPPA) is responsible for fixing and regulating the prices of drugs in India. The organization ensures that the prices of essential drugs are affordable and accessible to all. Drugs Controller General of India (DCGI) is responsible for regulating the safety, efficacy, and quality of drugs in India. The organization oversees the approval of new drugs, clinical trials, and post-marketing surveillance.

Indian Pharmacopoeia Commission (IPC) is responsible for setting standards for drugs in India. The commission develops and publishes the Indian Pharmacopoeia, which is a book of standards for drugs in India. The government has taken several initiatives to improve the healthcare system in India, including the launch of the Ayushman Bharat scheme, which aims to provide free healthcare to millions of people in India.

Reimbursement Scenario

In general, COPD treatment in India is covered by both public and private insurance schemes, but the reimbursement rates vary widely. Public insurance schemes, such as the Rashtriya Swasthya Bima Yojana (RSBY) and Ayushman Bharat, provide coverage for COPD treatment, but the reimbursement rates may not cover the full cost of treatment. Private insurance schemes may provide more comprehensive coverage, but the premiums can be expensive and not all individuals have access to private insurance. In addition, the reimbursement scenario for COPD treatment can vary depending on the type of healthcare provider. Treatment in government hospitals and clinics may be more affordable and accessible for low-income individuals, but these facilities may have limited resources and long wait times. Private healthcare providers may offer more personalized care and better facilities, but the costs can be higher.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

India Chronic Obstructive Pulmonary Disease (COPD) Therapeutics Market Segmentation

By Drug Class

Bronchodilators: Bronchodilators are medications that help to relax the muscles around the airways, making it easier to breathe. These can be further classified as short-acting or long-acting bronchodilators.

Corticosteroids: Corticosteroids are anti-inflammatory medications that can help reduce swelling and inflammation in the airways. These can be used alone or in combination with bronchodilators.

Combination therapies: Combination therapies combine bronchodilators and corticosteroids in a single medication. These are often used for patients with more severe COPD.

Phosphodiesterase-4 inhibitors: Phosphodiesterase-4 inhibitors are medications that help to reduce inflammation and improve airflow in the lungs.

Others: Other medications that may be used to treat COPD include mucolytics, oxygen therapy, and vaccines for influenza and pneumococcal disease.

By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.