India Cancer Immunotherapy Market Analysis

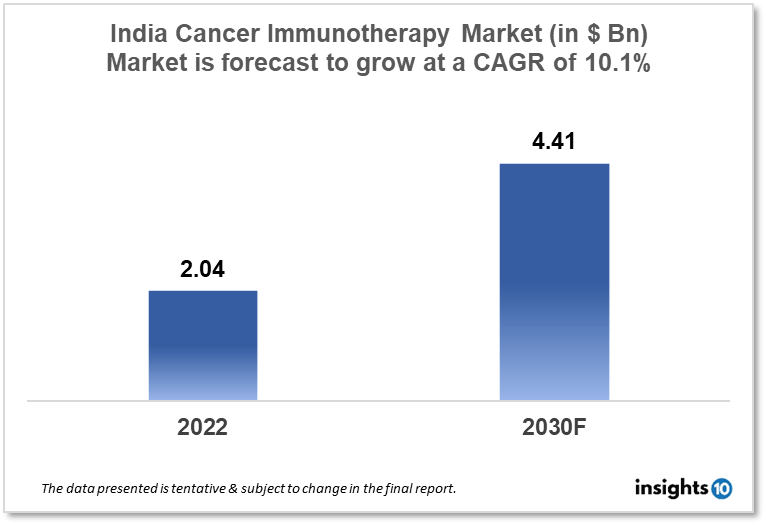

India's cancer immunotherapy market is expected to witness growth from $2.04 Bn in 2022 to $4.41 Bn in 2030 with a CAGR of 10.1% for the forecasted year 2022-2030. Supportive government policies for promoting cancer care and the growing acceptance of cancer immunotherapy in India are responsible for the growth of the market. The Indian cancer immunotherapy market is segmented by type, application, and end user. Swisschem Healthcare, Epigeneres Biotech, and Bayer are the major players in the Indian cancer immunotherapy market.

Buy Now

India Cancer Immunotherapy Market Executive Analysis

India's cancer immunotherapy market is expected to witness growth from $2.04 Bn in 2022 to $4.41 Bn in 2030 with a CAGR of 10.1% for the forecasted year 2022-30. In the Union budget for 2023–24, the Ministry of Health and Family Welfare was given an allocation of $1.08 Bn, an increase of 12.6% from the revised Budget estimates for 2022–23. The Central and State Governments budgeted spending on the health sector at 2.1% of GDP in Financial Year (FY) 23 and 2.2% in FY22, up from 1.6% in FY21, according to the Economic Survey 2022–23. However, the budgeted expenditure for the health sector in the current budget, which is the final full budget of the Modi 2.0 government, was almost 1.98 % of the GDP. This is when the National Health Policy, 2017 calls for a time-bound increase in public health spending to 2.5% of GDP by 2025. India's healthcare expenditure as a %age of GDP is much below the global average and that of other emerging and developed countries due to continued minimal allocation to the healthcare sector.

Around 2.7 Mn cancer patients are anticipated in India by 2020. 13.9 lakh new cancer patients are registered each year. About 8.5 lakh people die in India each year from cancer. Recent decades have seen tremendous growth in scientific developments for the treatment of cancer. Cancer research is one area of medicine that has benefitted from this enormous advancement. In addition to a greater understanding of the condition, there are many cutting-edge cancer therapies available today. Immunotherapy for cancer is one of these ground-breaking therapies. Cancer immunotherapy is a form of biological or targeted therapy that use the body's own immune system to eradicate cancer cells. Other names for immunotherapy for cancer include immuno-oncology.

The cancer patient's immune system is assisted by immunotherapy in the battle against cancerous cells. Immunotherapy, which was introduced in India a few years ago, is improving every day. The best hospitals in the nation's healthcare system offer immunotherapy to their patients. Compared to a few decades ago, patients today have better access to the type of cancer treatment that their clinical needs require. Synthetic antibodies created in a lab are known as monoclonal antibodies. The immune system often makes antibodies in reaction to a threat, and these antibodies locate and target the threat to remove it from the body. The way that monoclonal antibodies function is similar. By interfering with cancer cells' proteins and making them visible to immune cells, monoclonal antibodies can aid the immune system in locating cancer cells. Additionally, it can aid in weakening cancer cells so that the immune system can eliminate them. Proteins called cytokines to aid in the body's destruction of aberrant or harmful cells. Proteins like interleukin and interferon are examples of cytokines. These proteins make cancer cells more apparent to the immune system and disrupt the processes through which cancer cells divide and proliferate. They also enhance the functionality and expansion of killer T-cells.

Market Dynamics

Market Growth Drivers

The National Cancer Grid and the Ayushman Bharat scheme, which gives Mns of people access to healthcare, are just two of the initiatives the Indian government has launched to improve cancer care in the nation. In India, there is a growing tendency toward the acceptance of cancer immunotherapy treatments as awareness of these therapies rises. India has a rising cancer prevalence, which presents a substantial market opportunity for cancer immunotherapy treatments. These factors contribute significantly to the growth of the Indian cancer immunotherapy market.

Market Restraints

The high cost of these treatments is one of the key factors limiting the growth of the Indian cancer immunotherapy market. Not many patients can afford immunotherapies because they are frequently pricey. Fewer patients can receive these medicines as a result of the market's size being constrained. In India, immunotherapy therapies are not widely accessible, and not all patients can receive them. This is due to the fact that some of these therapies demand sophisticated infrastructure, such as specialized medical facilities, skilled employees, and cutting-edge machinery. Finally, immunotherapy may have serious adverse effects, which may restrict its application in some individuals. Patients may develop immune-related side effects, which can occasionally be quite serious and include organ or tissue inflammation. Because of this, the use of immunotherapy may be restricted in patients who are not suitable for it.

Competitive Landscape

Key Players

- Pharmacyclics (IND)

- Healthkind Labs (IND)

- Arlak Biotech (IND)

- Swisschem Healthcare (IND)

- Epigeneres Biotech (IND)

- Bayer

- Bristol-Myers Squibb

- Eli Lily

- F. Hoffmann-La Roche

- Pfizer

- Johnson & Johnson

- Merck

Recent Deals

January 2023- The Drugs Controller General of India (DCGI) has authorized MSD's anti-PD-1 medication Keytruda (pembrolizumab) for the treatment of persistent, recurring, or metastatic cervical cancer in adults whose tumours express PD-L1 with a CPS 1. MSD is a trademark of Merck & Co. In addition, Keytruda has been approved for the first-line therapy of adults with HER-2 negative gastroesophageal junction adenocarcinoma or locally advanced unresectable or metastatic oesophagal cancer that expresses PD-L1 with a CPS 10. The Phase 3 Keynote 590 and 826 investigations for oesophagal and cervical cancer, respectively, served as the foundation for the approval.

Healthcare Policies and Regulatory Landscape

The Indian government introduced Ayushman Bharat, a national health insurance program, in 2018. It offers economically disadvantaged groups in a society free health coverage worth up to INR 5 lakhs per household per year. Immunotherapy is one of the cancer treatments covered by the program. Government employees, retirees, and their families are all given access to healthcare through the Central Government Health Scheme (CGHS) program. Up to a specific amount, it pays for the cost of cancer treatments, including immunotherapy. There are health insurance programs in several Indian states that cover cancer treatments, including immunotherapy. For instance, Telangana's Arogyasri Health Insurance Scheme covers cancer treatments, including immunotherapy. The Indian government has also established several cancer treatment centres that provide patients with free cancer therapy. For instance, the Tata Memorial Hospital in Mumbai provides patients who cannot afford it with free cancer care, including immunotherapy.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

India Cancer Immunotherapy Segmentation

By Type (Revenue, USD Billion):

- Monoclonal Antibodies

- Cancer Vaccines

- Checkpoint Inhibitors

- Immunomodulators

- PD-1/PD-L1

- CTLA-4

By Application (Revenue, USD Billion):

- Lung Cancer

- Breast Cancer

- Head and Neck Cancer

- Prostate Cancer

- Colorectal Cancer

- Melanoma

- Others

By End User (Revenue, USD Billion):

- Hospitals

- Clinics

- Ambulatory Surgical Centers (ASCs)

- Cancer Research Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

Swisschem Healthcare, Epigeneres Biotech, and Bayer are the major players in the India cancer immunotherapy market.

The India cancer immunotherapy market is expected to grow from $2.04 Bn in 2022 to $4.41 Bn in 2030 with a CAGR of 10.1% for the forecasted year 2022-2030.

The India cancer immunotherapy market is segmented by type, application, and end user.