India Breast Pump Market Report

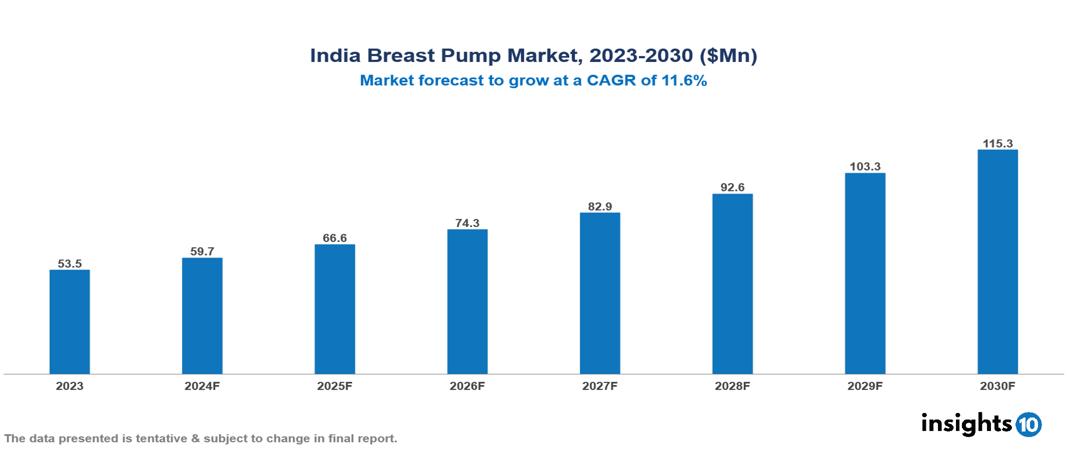

The India Breast Pump Market was valued at $53.5 Mn in 2023 and is predicted to grow at a CAGR of 11.6% from 2023 to 2030, to $115.3 Mn by 2030. The key drivers of the market include the improving healthcare infrastructure, growing consumer awareness, and rising disposable incomes. The prominent players of the India Breast Pump Market are Advin Healthcare, Chemco, NaugraMedical, Medicon Healthcare, Akshar Pharma, and Amkay, among others.

Buy Now

India Breast Pump Market Executive Summary

The India Breast Pump Market is at around $53.5 Mn in 2023 and is projected to reach $115.3 Mn in 2030, exhibiting a CAGR of 11.6% during the forecast period.

A breast pump is a mechanical device that lactating women use to extract milk from their breasts. They are available in two forms; they can be manual devices powered by hand or foot movements or automatic devices powered by electricity. Breast pumps are available in a variety of styles to meet the demands of moms. Hand-operated manual pumps are lightweight and silent, making them ideal for sporadic usage. Electric pumps are often used on a regular basis because of their higher efficiency and ability to run on mains or batteries. There are several uses for breast pumps. Many parents use them to continue breastfeeding after they return to work. They express their milk at work, which is later bottle-fed to their child by a caregiver. A breast pump may be also used to address a range of challenges parents may encounter during breast feeding, including difficulties latching, separation from an infant in intensive care, to feed an infant who cannot extract sufficient milk itself from the breast, to avoid passing medication through breast milk to the baby, or to relieve engorgement, which is a painful condition whereby the breasts are overfull.

The India Breast Pump Market is driven by significant factors such as the improving healthcare infrastructure, growing consumer awareness, and rising disposable incomes. However, high cost, lack of insurance coverage, and stigma and embarrassment restrict the growth and potential of the market.

The major players of the India Breast Pump Market are Advin Healthcare, Chemco, NaugraMedical, Medicon Healthcare, Akshar Pharma, and Amkay, among others.

Market Dynamics

Market Growth Drivers

Improving healthcare infrastructure: Increased investments in healthcare facilities have enhanced maternal and child health in India, improving access to hospitals and clinics. This boost in awareness about breastfeeding benefits and greater availability of breast pumps through medical and retail channels has led to more Indian mothers using breast pumps, driving market growth.

Growing consumer awareness: Educational campaigns and healthcare initiatives are highlighting the advantages of breastfeeding and the convenience of breast pumps, leading to more mothers becoming knowledgeable about these products. This growing awareness is also enhanced by social media, where influencers and healthcare professionals promote breast pump usage to ensure infants receive proper nutrition. Consequently, the demand for breast pumps in India is rising, significantly boosting market growth.

Rise in healthcare expenditure: India's rising health expenditure, expected to reach 2.5% of GDP by 2024-25, is boosting awareness and acceptance of breastfeeding products. Improved economic conditions allow families to invest in high-quality breast pumps, supported by better access to medical advice and lactation support. This trend drives demand and growth in the Indian breast pump market.

Market Restraints

High Cost: In India, the high cost of certain breast pumps significantly restrains market growth due to the country's diverse socio-economic landscape. Although the middle class is expanding, many families still have limited disposable income, making it difficult to afford high-end breast pump models. These premium products, equipped with advanced features and superior technology, remain inaccessible to many potential users. Therefore, the high cost of advanced breast pumps limits their widespread adoption, impeding the overall market growth in India.

Lack of Insurance Coverage: Without insurance reimbursement or support, the significant out-of-pocket expense for breast pumps becomes a considerable hurdle, especially for families with lower incomes. This financial burden may lead potential buyers to prioritize other necessities or choose more affordable options, thereby reducing overall demand. Additionally, the lack of insurance coverage can impede market penetration and the adoption of advanced breast pump technologies, ultimately slowing market expansion.

Stigma and Embarrassment: In India, the stigma and embarrassment surrounding breast pump use significantly impede market growth by dissuading many mothers from adopting these devices. Traditional breastfeeding practices are highly valued in the culture, and breast pumps may be perceived as unnecessary or unconventional. Moreover, a lack of awareness about the benefits of breast pumps contributes to misconceptions and discomfort. This societal stigma can prevent potential users from exploring breast pump options, restricting market growth.

Regulatory Landscape and Reimbursement Scenario

In India, the primary regulatory body for pharmaceutical sector is the Central Drugs Standard Control Organization (CDSCO) and the Drug Controller General of India (DCGI) is the key official within the CDSCO. The CDSCO consistently works to achieve transparency, accountability, and standardization in its services to guarantee the safety, effectiveness, and quality of medical products that are produced, imported, and distributed throughout the nation. The Drugs & Cosmetics Act, 1940 and Rules 1945 lays out the foundation for ensuring the safety, rights and well-being of patients by regulating the manufacturing, import, sale, and distribution of drugs and cosmetics.

Under this act, CDSCO is responsible for granting license for approved drugs, conducting clinical trials, setting standards for drugs, monitoring the quality of drugs imported into the nation, and coordinating the efforts of State Drug Control Organizations by offering professional advice in an effort to standardize the enforcement of the D&C Act.

India's healthcare reimbursement scenario is complex and evolving, with both public and private players involved. Ayushman Bharat Pradhan Mantri Jan Arogya Yojana is a national public health insurance scheme of the Government of India that aims to provide free access to health insurance coverage for low-income earners in the country. These programs offer cashless or payment benefits for certain illness-related hospital stays in affiliated hospitals. Certain demographics, such as government employees, are eligible for social health insurance programs in several states. Private insurance firms’ voluntary health insurance programs are becoming more popular. Reimbursement decisions are made according to the specific plan purchased and cover surgery, hospital stays, and occasionally, prescription drugs.

Competitive Landscape

Key Players

Here are some of the major key players in the India Breast Pump Market:

- Advin Healthcare

- Chemco

- NaugraMedical

- Medicon Healthcare

- Akshar Pharma

- Amkay

- Pigeon

- Medicon

- Naulakha

- Medela AG

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

India Breast Pump Market Segmentation

By Product Type

- Manual pumps

- Battery-powered pumps

- Electric pumps

By Pump System

- Open System

- Closed System

By Pumping Type

- Single

- Double

By Distribution Channel

- Hospital Pharmacies

- Retail Stores

- Online Stores

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.