India Biosimilars Market Analysis

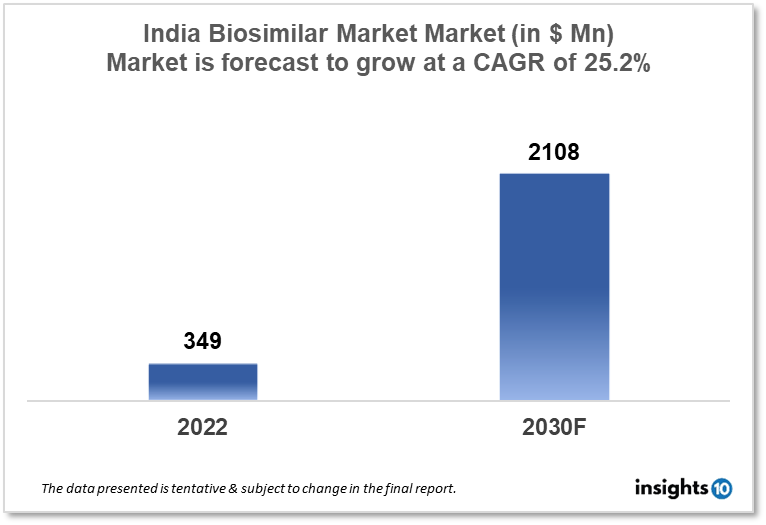

India's biosimilars market size was valued at $349 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 25.2% from 2022 to 2030 and will reach $2108 Mn in 2030. The market is segmented by product type and indication type. The Indian Biosimilars market will grow as India biosimilar market is driven by its cost-effective manufacturing capabilities. The key market players are Biocon Ltd (IND), Intas Pharmaceuticals Ltd (IND), Dr. Reddy's Laboratories Ltd (IND), Reliance Life Sciences Pvt. Ltd (IND), Zydus Cadila Healthcare Ltd (IND), Lupin Limited (IND)and others.

Buy Now

India Biosimilars Market Executive Summary

The India Biosimilars market size was valued at $349 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 25.2% from 2022 to 2030 and will reach $2108 Mn in 2030. India now accounts for a sizable portion of the global market for biosimilars. When a biological product is referred to be "biosimilar," it means that it is very similar to another biological product that has already acquired regulatory clearance. They have the same efficacy and safety profiles as the reference product and are used to treat a number of disorders, including diabetes, autoimmune diseases, and cancer.

India has a substantial and rapidly growing biosimilar sector as a result of the availability of low-cost production facilities and a sizeable labour pool of highly trained scientific and technical professionals. Due to the country's highly established regulatory framework for the licencing of biosimilars, several Indian companies have had their products authorised by regulatory agencies in India, Europe, and the US. In addition, the Indian government has taken a few steps to encourage the study and development of biosimilars. The Biotechnology Industry Partnership Program (BIPP) was launched by the Indian government in 2016 to assist small and medium-sized biotech firms in the creation of biosimilars.

The National Biotechnology Development Plan was created by the Indian government to aid in the growth of the nation's biotechnology sector (NBDS). As there is a growing need for high-quality, reasonably cost biologics on a global scale, the biosimilars market in India is anticipated to expand throughout the course of the projected period.

Market Dynamics

Market Growth Drivers

India's market for biosimilars appears to be driven by the country's preference for effective production. The nation has access to a sizable pool of highly qualified scientific and technical employees, and its production facilities are less expensive than those in other countries.

A strong regulatory environment for biosimilar approval exists in India, which has helped in the production and distribution of biosimilars there. The regulations also guarantee the safety and effectiveness of biosimilars for patients.

In India, the incidence of chronic diseases including cancer, hypertension, and diabetes is rising, which is fueling an increase in demand for biosimilars across the country. Because they are frequently less expensive than other pharmaceuticals, biosimilars are a viable choice for individuals who require long-term care. The nation's healthcare system is also changing, with a stronger emphasis now placed on ensuring everyone has access to inexpensive treatment.

Market Restraints

Biosimilar providers in India deal with a number of patent-related issues, including patent litigation and the challenge of developing biosimilars prior to the reference product's patent expires. This might reduce biosimilar production and postpone the product's introduction to the market.

This might lower the profitability of companies that make biosimilars, discouraging them from investing in the development of new biosimilars. The challenges faced by producers are diverse. For example, the regulatory process could be drawn out and unpredictable, and some elements of the regulatory framework may not be completely clear.

Competitive Landscape

Key Players

- Biocon Ltd (IND)

- Intas Pharmaceuticals Ltd (IND)

- Dr Reddy's Laboratories Ltd (IND)

- Reliance Life Sciences Pvt. Ltd (IND)

- Zydus Cadila Healthcare Ltd (IND)

- Lupin Limited (IND)

- Wockhardt Limited (IND)

- Panacea Biotec Ltd (IND)

- Emcure Pharmaceuticals Ltd (IND)

- Torrent Pharmaceuticals Ltd (IND)

- Pfizer Inc. (USA)

- Novartis International AG (CHE)

- Roche Holding AG (CHE)

- Sanofi S.A. (FRA)

- Merck & Co., Inc. (USA)

- GlaxoSmithKline plc (GBR)

- AstraZeneca plc (GBR)

- Johnson & Johnson (USA)

- Boehringer Ingelheim GmbH (DEU)

- Fresenius SE & Co. KGaA (DEU)

Recent Developments

In 2021, Johnson & Johnson and Biological E Ltd. formed a cooperation for the development and marketing of a COVID-19 vaccine in India. While not being a biosimilar, this collaboration demonstrates India's rising interest in biologics and vaccines.

In order to introduce a biosimilar form of adalimumab in Brazil, Biocon Biologics formed a cooperation with Libbs Farmaceutica in 2021.

Healthcare Policies and Regulatory Landscape

For the approval and marketing of biosimilars, India has a well-established regulatory system. Following are several essential laws that apply to biosimilars in India:

In India, the Central Drugs Standard Control Organization (CDSCO) is the regulatory body in charge of approving biosimilars. The World Health Organization (WHO) and other international regulatory bodies' rules are followed by the CDSCO.

Biosimilars must go through a rigorous approval procedure mandated by the CDSCO, which includes preclinical and clinical tests to prove their safety and efficacy. The CDSCO mandates that the quality, safety, and effectiveness of biosimilars be evaluated against those of a reference biologic product. The product and the data that are available determine the degree of similarity needed for approval. Biosimilars must be labelled as such by the CDSCO in order to prevent misunderstanding with the reference biological product. To guarantee the consistency and quality of their goods, the CDSCO mandates that producers of biosimilars have an effective quality control system in place. To guarantee continued adherence to legal requirements, the CDSCO analyses biosimilar goods that have already hit the market on a regular basis. For the development and approval of biosimilar drugs in India, the CDSCO has set detailed regulations, including rules for preclinical and clinical research, manufacturing, and labelling.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

India Biosimilars Market Segmentation

By Product

The monoclonal antibodies, insulin, granulocyte colony-stimulating factor, erythropoietin, recombinant human growth hormone, etanercept, follitropin, teriparatide, interferons, enoxaparin sodium, glucagon, and calcitonin are among the product categories that make up the biosimilars market. Monoclonal antibodies held a sizable portion of the market in 2020. The market is being driven by elements including the widespread use of monoclonal antibodies in the treatment of autoimmune diseases, cancer, and osteoporosis, as well as the affordability of such treatments.

- Monoclonal Antibodies

- Infliximab

- Trastuzumab

- Rituximab

- Adalimumab

- Other monoclonal antibodies (bevacizumab, cetuximab, ranibizumab, denosumab, and eculizumab)

- Insulin

- Granulocyte Colony-Stimulating Factor

- Erythropoietin

- Recombinant Human Growth Hormone

- Etanercept

- Follitropin

- Teriparatide

- Interferons

- Enoxaparin Sodium

- Glucagon

- Calcitonin

By Indication

The biosimilars market is divided into oncology, autoimmune and inflammatory diseases, chronic illnesses, blood disorders, growth hormone insufficiency, infectious diseases, and other indications based on the indication (infertility, hypoglycemia, myocardial infarction, postmenopausal osteoporosis, chronic kidney failure, and ophthalmic diseases). The market's largest sector in 2020 will be oncology. This market is expanding as a result of elements like the reduced cost of biosimilars compared to novel biologics and the increased incidence and prevalence of cancer.

- Oncology

- Inflammatory & Autoimmune Disorders

- Chronic Diseases

- Blood Disorders

- Growth Hormone Deficiency

- Infectious Diseases

- Other Indications (infertility, hypoglycemia, postmenopausal osteoporosis, chronic kidney failure, and ophthalmic diseases)

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.