India Biosensors Market Analysis

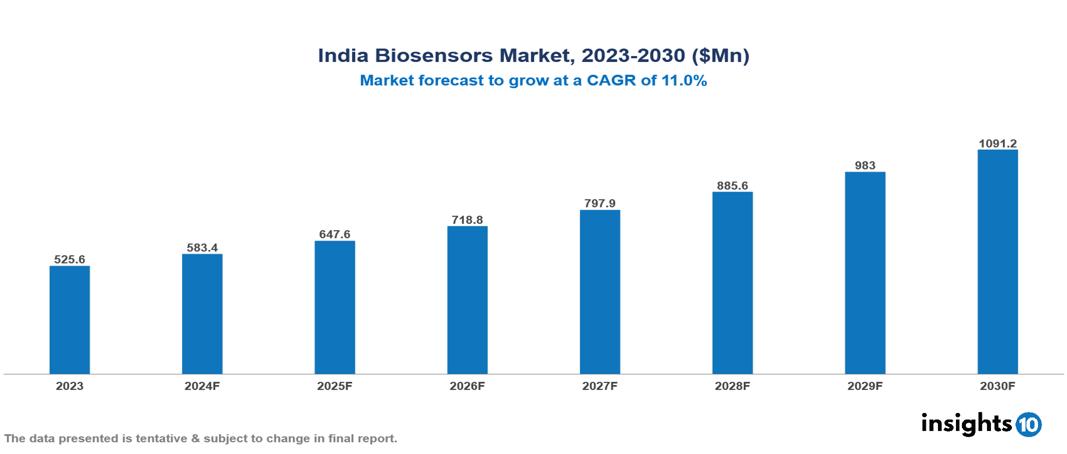

The India Biosensors Market was valued at $525.6 Mn in 2023 and is predicted to grow at a CAGR of 11% from 2023 to 2030, to $1091.2 Mn by 2030. The key drivers of the market include increasing burden of chronic diseases, increasing demand for accurate disease diagnosis, and growing demand for Point-of-Care (POC) testing. The prominent players of the India Biosensors Market are i- SENS, SD Biosensor, Fortune Biosolutions, Glowvista Instruments, and Healthium Medtech, among others.

Buy Now

India Biosensors Market Executive Summary

The India Biosensors market is at around $525.6 Mn in 2023 and is projected to reach $1091.2 Mn in 2030, exhibiting a CAGR of 11% during the forecast period.

Biosensors, short for biological sensors, are analytical devices which combine a biological component with physicochemical detector in order to detect the presence of analytes in sample. There are certain static and dynamic attributes that every biosensor possesses. The optimisation of these properties is reflected on the performance of the biosensor. One of the most important features of a biosensor is selectivity. Selectivity is the ability of a bioreceptor to detect a specific analyte in a sample containing other admixtures and contaminants. Next crucial feature is the stability of biosensors which refers to how susceptible the biosensor is to internal and external disturbances. Due to disturbances, output signals can vary which may result in measurement errors in the concentration and can affect the biosensor’s accuracy and precision. Sensitivity is the minimum amount of analyte that can be detected by a biosensor which also defines its limit of detection (LOD). In a number of medical and environmental monitoring applications, a biosensor is required to detect analyte concentration of as low as ng/ml or even fg/ml to confirm the presence of traces of analytes in a sample. Linearity is the next attribute which represents the accuracy of the measured response with varying concentrations of analyte. Usually, a straight line in the form of equation y=mc (where c is the concentration of the analyte, y is the output signal, and m is the sensitivity of the biosensor) is used. Lastly, resolution is closely associated with linearity which is the smallest change in the concentration of an analyte which results in a change in the response of the biosensor.

Chronic diseases are a major public health concern in India, with cardiovascular diseases, diabetes, respiratory diseases, cancer, and mental health disorders among the top concerns. These diseases pose a significant threat to both individual health and the nation's healthcare system and the burden of diseases is expected to rise in the future due to changing lifestyle patterns and aging population. The India Biosensors Market is thus driven by significant factors such as the increasing burden of chronic diseases, increasing demand for accurate disease diagnosis, and growing demand for Point-of-Care (POC) testing. However, stringent regulatory requirements, technical challenges, and data management issues restrict the growth and potential of the market.

The major players of the India Biosensors Market are i- SENS, SD Biosensor, Fortune Biosolutions, Glowvista Instruments, and Healthium Medtech, among others.

Market Dynamics

Market Growth Drivers

Increasing Burden of Chronic Diseases: In India, about 21% of the elderly had at least one chronic disease in 2022. 17% elderly in rural areas and 29% in urban areas suffer from a chronic disease. Hypertension and diabetes account for about 68% of all chronic diseases. There is a strong need for managing healthcare treatment for long-term diseases, such as diabetes, heart disease, and cancer. Biosensors can help with effective health treatments as they help monitor the level of drug in the blood and accordingly, dosage regimen can be decided by the doctors. Due to the significant role of biosensors in chronic disease treatment, the Biosensors Market is at its full potential growth.

Increasing Demand for Accurate Disease Diagnosis: Early and accurate diagnosis is vital for effective treatment and improved patient outcomes. Biosensors can efficiently, accurately, and conveniently detect a wide range of diseases, such as diabetes, cancer, and infections, often before symptoms arise. Early detection is critical for many diseases, increasing the likelihood of successful treatment and enhancing patient quality of life. Consequently, the demand for precise disease diagnostics is fuelling the growth of the biosensors market, providing quicker, more convenient, and potentially more affordable diagnostic solutions, which leads to improved patient care.

Growing Demand for Point-Of-Care (POC) Testing: The need for point-of-care (POC) testing is growing. It is a significant factor in the biosensors market's growth for a number of important reasons. Biosensors are ideal for point-of-care (POC) testing because they offer several advantages that traditional lab-based testing methods sometimes do not. Among the many benefits are its mobility, simplicity of usage, and quick turnaround time. Additionally, POC testing with biosensors increases patient access to healthcare, especially for patients with limited mobility or in rural places. The relevance of point-of-care (POC) testing is marked by the COVID-19 pandemic in which biosensors were essential to the pandemic’s containment. As a result, the market for biosensors is expanding due to the growing need for POC testing.

Market Restraints

Stringent Regulatory Requirements: The health impact of biosensors, especially in medical applications, is profound. Companies producing these devices must adhere to GDPR and HIPAA regulations. Regulatory bodies in various countries conduct thorough testing to ensure accuracy, safety, and to identify risks like data security and biocompatibility. Although stringent guidelines ensure patient safety and foster market trust, the lengthy and expensive approval process can delay the introduction of new biosensors. This can stifle innovation and restrict patient access. Moreover, the high costs of meeting regulatory requirements result in higher biosensor prices, preventing full market growth.

Technical Challenges: While biosensors are making significant strides in healthcare, they face technical hurdles. To ensure accurate diagnoses, it's crucial to continually improve the sensitivity, specificity, and accuracy of biosensors. A key challenge is the sensor's ability to identify the target analyte among other sample components. Moreover, detecting low concentrations of analytes is essential for early disease diagnosis and environmental monitoring, but achieving such sensitivity in complex biological samples is challenging. Reproducibility of results is also essential but difficult to attain. These challenges slow down the growth of the biosensors market by making it hard to enhance sensitivity, specificity, and reproducibility.

Data Management Issues: Biosensors generate extensive health data that must be efficiently analysed. This requires a robust data management infrastructure and advanced solutions, which can be both costly and challenging to manage. Accurate and precise data is essential for effective analysis and decision-making, especially in the medical field, where poor data quality can result in incorrect and harmful decisions for patients. Integrating data from multiple biosensors is also difficult due to differing formats, standards, and protocols, impeding data sharing and interoperability across departments. As a result, these data management issues can limit the growth of the biosensors market.

Regulatory Landscape and Reimbursement Scenario

In India, the primary regulatory body for pharmaceutical sector is the Central Drugs Standard Control Organization (CDSCO) and the Drug Controller General of India (DCGI) is the key official within the CDSCO. The CDSCO consistently works to achieve transparency, accountability, and standardization in its services to guarantee the safety, effectiveness, and quality of medical products that are produced, imported, and distributed throughout the nation. The Drugs & Cosmetics Act, 1940 and Rules 1945 lays out the foundation for ensuring the safety, rights and well-being of patients by regulating the manufacturing, import, sale, and distribution of drugs and cosmetics.

Under this act, CDSCO is responsible for granting license for approved drugs, conducting clinical trials, setting standards for drugs, monitoring the quality of drugs imported into the nation, and coordinating the efforts of State Drug Control Organizations by offering professional advice in an effort to standardize the enforcement of the D&C Act.

India's healthcare reimbursement scenario is complex and evolving, with both public and private players involved. Ayushman Bharat Pradhan Mantri Jan Arogya Yojana is a national public health insurance scheme of the Government of India that aims to provide free access to health insurance coverage for low-income earners in the country. These programs offer cashless or payment benefits for certain illness-related hospital stays in affiliated hospitals. Certain demographics, such as government employees, are eligible for social health insurance programs in several states. Private insurance firms’ voluntary health insurance programs are becoming more popular. Reimbursement decisions are made according to the specific plan purchased and cover surgery, hospital stays, and occasionally, prescription drugs.

Competitive Landscape

Key Players

Here are some of the major key players in the India Biosensors Market:

- i- SENS

- SD Biosensor

- Fortune Biosolutions

- Glowvista Instruments

- Healthium Medtech

- Canary Biosensors

- Medtronic

- Abbott Laboratories

- Johnson & Johnson

- Siemens Healthcare

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

India Biosensors Market Segmentation

By Technology

- Electrochemical Biosensors

- Optical Biosensors

- Piezoelectric Biosensors

- Thermal Biosensors

- Nanomechanical Biosensors

By Product

- Wearable Biosensors

- Non-wearable Biosensors

By Application

- Medical Diagnostics

- Food Safety

- Environmental Monitoring

- Agriculture and Bioreactor Monitoring

- Other

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.