India Bariatric Surgery Devices Market Analysis

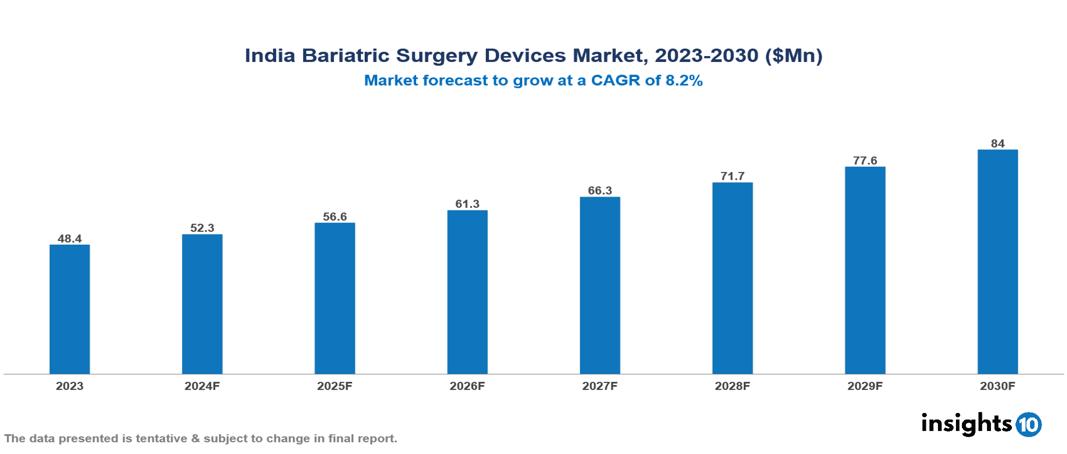

The India Bariatric Surgery Devices Market was valued at $48 Mn in 2023 and is projected to grow at a CAGR of 8.2% from 2023 to 2023, to $84 Mn by 2030. Major factors driving the market for bariatric surgical devices include the rising incidence of adult obesity brought on by altered lifestyle patterns and excessive calorie consumption. The demand for bariatric operations is also anticipated to rise over the forecast period due to increased government backing and growing public awareness of the market's unhealthy food and beverage offerings and how they affect BMI, thus driving the market growth of the Bariatric Surgery Devices. The prominent players in the market are Meril Life Sciences, Poly Medicure, Biopore Surgicals, Medtronic, B. Braun, Asenus Surgical, Johnson & Johnson, Cousin Surgery among others.

Buy Now

India Bariatric Surgery Devices Market Executive Summary

The India Bariatric Surgery Devices Market is at around $48.4 Mn in 2023 and is projected to reach $84 Mn in 2030, exhibiting a CAGR of 8.2% during the forecast period 2023-2030.

The purpose of gastric bypass and other weight-loss surgeries, often known as bariatric or metabolic surgery, is to alter your digestive system in order to help you lose weight. Bariatric surgery is done if diet and exercise haven't improved your weight-related health problems. The amount of food you can eat is limited by some diet plans. Some work by reducing the body's ability to absorb fat and calories. Certain methods serve both purposes. While there are numerous advantages to bariatric surgery, there are risks and adverse effects associated with any large weight-loss procedure. For bariatric surgery to be successful in the long run, you must also engage in regular exercise and make long-term, healthy dietary modifications. Bariatric surgery poses potential health risks, both in the short term and the long term. Bariatric surgery risks can include excessive bleeding, infection, reactions to anaesthesia, blood clots, lung or breathing problems etc. Longer-term risks and complications of weight-loss surgery vary depending on the type of surgery. they can include bowel obstruction, dumping syndrome, a condition that leads to diarrhoea, flushing, light-headedness, nausea or vomiting, gallstones, hernias, hypoglycaemia, malnutrition, ulcers etc.

According to Global Obesity Observatory 2023, the prevalence of obesity is more common in females than men, in females the prevalence rate is 6.7% and males it is 4.3%. In urban area the prevalence rate is approximately around 25% which is greater than the rural area which is approximately around 18%. Therefore, the market is driven by various factors such as increasing demand for minimally invasive surgeries, rising incidence of obesity, technological advancements, rising awareness about bariatric surgery.

The prominent players in the market are Meril Life Sciences, Poly Medicure, Biopore Surgicals, Medtronic, B. Braun, Asenus Surgical, Johnson & Johnson, Cousin Surgery among others.

Market Dynamics

Market Drivers

Growing obesity rates in India: India's obesity rates have been steadily rising. According to Global Obesity Observatory 2023, the prevalence of obesity is more common in female than men, in females the prevalence rate is 6.7% and males it is 4.3%. In urban area the prevalence rate is approximately around 25% which is greater than the rural area which is approximately around 18%. It is probable that this pattern will persist, expanding the pool of candidates for bariatric procedures and stimulating the market for associated equipment.

Technological Advancements in Surgical Devices: Innovations in bariatric surgery devices, including the introduction of minimally invasive techniques and advanced implantable devices (like gastric balloons), are enhancing the effectiveness and safety of procedures, thereby attracting more patients. Thus, boosting the market growth rate.

Product Launches and Collaborations: The introduction of new products, such as Allurion's swallowable gastric balloon capsule, and collaborations with bariatric surgery centers are driving the market forward. These developments enhance the range of available treatment options for patients. Ultimately boosting the market growth rate.

Market Restraints

Postoperative Complications: Concerns about potential complications associated with bariatric surgery, such as infections, nutritional deficiencies, and other health risks, can discourage patients from opting for these procedures.

Dependence on Imported Devices: India’s reliance on imported medical devices can pose challenges, including higher costs and supply chain issues, which may affect the availability of bariatric surgery devices in the market.

Shortage of Trained Surgeons: There is a limited number of trained and experienced bariatric surgeons in certain regions of India, particularly in rural areas, which can restrict patient access to quality surgical care.

Regulatory Landscape and Reimbursement Scenario

Central Drugs Standard Control Organization (CDSCO), under the Ministry of Health and Family Welfare, is the primary regulatory authority responsible for approving and monitoring medical devices, including those used in bariatric surgery. The Medical Devices Rules, 2017, governed by the Drugs and Cosmetics Act, 1940, provide the regulatory framework for medical devices in India.

The National Pharmaceutical Pricing Authority (NPPA) is responsible for fixing and revising the prices of controlled bulk drugs and formulations, which can impact the pricing of medical devices. The Insurance Regulatory and Development Authority of India (IRDAI) regulates the insurance industry and influences coverage policies for bariatric procedures.

The Ministry of Health and Family Welfare (MoHFW) plays a crucial role in shaping healthcare policies, including those related to obesity treatment and bariatric surgery. The Indian Council of Medical Research (ICMR) provides guidelines and conducts research that can influence the adoption of new medical technologies. The Obesity Surgery Society of India (OSSI) and the All-India Association of Advancement for Research in Obesity (AIAARO) provide professional guidelines and standards for bariatric procedures.

Regarding reimbursement, it's important to note that coverage for bariatric surgery in India is still evolving. Many procedures are paid for out-of-pocket, although some private insurance companies have started covering bariatric surgery under certain conditions.

Competitive Landscape

Key Players

Here are some of the major key players in the India Bariatric Surgery Devices Market:

- Meril Life Sciences

- Poly Medicure Ltd

- Hindustan Syringes

- Trivitron Healthcare

- Biopre Surgicals

- Medtronic plc.

- Siemens

- Adler Mediequip

- Ethicon, Inc. (Johnson & Johnson)

- Asenus Surgical US, Inc.

- B Braun Melsungen AG

- Cousin Surgery

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

India Bariatric Surgery Devices Market Segmentation

By Products

- Minimally invasive surgical devices

- Stapling Devices

- Vessel-sealing devices

- Suturing devices

- Others

- Non-invasive surgical devices

By Procedure

- Sleeve gastrectomy

- Gastric bypass

- Revision bariatric surgery

- Non-invasive bariatric surgery

- Adjustable gastric banding

- Others

End Users

- Hospitals

- Ambulatory surgical centers

- Specialty Clinics

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.