India Artificial Intelligence (AI) in Medical Imaging Market Analysis

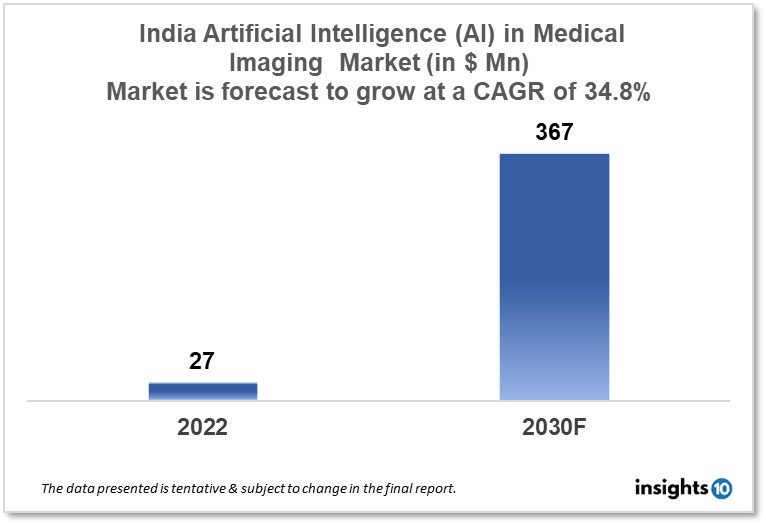

India artificial intelligence (AI) in medical Imaging market size was valued at $27 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 38.4% from 2022 to 2030 and will reach $367 Mn. The market is segmented by AI technology, solution, modality, application, and end User. Due to developments in AI and machine learning algorithms that are enabling the creation of more precise and effective medical imaging software, the India Artificial Intelligence (AI) in the Medical Imaging market will expand. Some of the key players in this market Niramai Health Analytix, Qure.ai, Predible Health, 4C Medical Technologies, Perfint Healthcare, GE Healthcare, Siemens Healthineers, Philips Healthcare, Fujifilm India and others.

Buy Now

India Artificial Intelligence (AI) in Medical Imaging

Market Executive Summary

India artificial intelligence (AI) in medical Imaging market size was valued at $27 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 38.4% from 2022 to 2030 and will reach $ 367. India's healthcare industry has advanced significantly in recent years thanks to the adoption of artificial intelligence (AI) technologies, particularly in the field of medical imaging. Through the use of AI in medical imaging, it is now possible to improve patient outcomes, make more accurate diagnoses, and manage medical practises more successfully. India's government has aggressively promoted the development of AI technology in healthcare through policies and initiatives aimed at fostering collaboration between business, academia, and research organisations. The nation's fast growing economy, sizable population, and ageing population have created a significant need for cutting-edge healthcare solutions, including AI in medical imaging. As a result, numerous domestic and international companies are investing substantial sums of money in this industry in India, fostering the development of a thriving ecosystem of startups, academic institutions, and well-established organisations.

In the past, a physical exam was one of the few imaging diagnostic procedures available, but today there are several, including x-ray, CT, MRI, and (3D) ultrasound. The market for the technology is being driven by the use of AI in medical imaging to increase precision, speed up interpretation, and decrease repetition for radiologists.

There are several initiatives and projects underway in different parts of India to develop and deploy AI in medical imaging. For instance, the Indian Institute of Technology (IIT) Delhi has developed an AI-powered low-cost portable ultrasound machine for use in rural areas. Additionally, the All India Institute of Medical Sciences (AIIMS) in Delhi has partnered with a startup to develop an AI-powered tool for detecting diabetic retinopathy, a leading cause of blindness.

Moreover, researchers from the Indian Institute of Technology (IIT) Madras have developed an AI-powered system to detect lung cancer in its early stages. The government of Karnataka has launched an AI-based radiology diagnosis scheme in 42 government hospitals across the state. The Tata Memorial Centre in Mumbai has partnered with a startup to develop an AI-powered tool for detecting oral cancer. Throughout the projected period, India is anticipated to increase at a profitable pace. The frequency of illnesses and the growing population might be blamed for the rise. Additionally, the market is growing due to the rapidly modernizing healthcare infrastructure across the India.

Market Dynamics

Market Growth Drivers

- Escalating need for cutting-edge medical imaging equipment to improve patient care. AI technology is becoming more widely used in medical imaging to increase diagnosis precision and speed. Government programs and financial support to encourage the creation and application of AI in healthcare.

- Chronic diseases like cancer, diabetes, and cardiovascular conditions are becoming more common; these conditions call for prompt and effective diagnosis and treatment. Private businesses are making more investments in AI-based medical imaging technologies.

Market restraints:

- Absence of regulatory oversight for AI-based medical imaging technologies can raise questions about their efficacy and safety. High-quality medical imaging data are not widely available for AI algorithm training.

- The high expense of creating and implementing AI-based medical imaging technologies may prevent some healthcare settings with limited resources from adopting them. Healthcare professionals and patients' reluctance to adopt modern technologies. worries about the security and privacy of medical imaging data used by AI systems.

Competitive Landscape

Key Players

- Niramai Health Analytix - Bangalore-based Niramai Health Analytix is a startup that has developed an AI-powered solution for early breast cancer detection.

- Qure.ai - Mumbai-based Qure.ai has developed AI-powered solutions for radiology that are designed to help healthcare providers improve diagnostic accuracy and workflow efficiency.

- Predible Health - Bangalore-based Predible Health has developed AI-powered solutions for radiology and is focused on improving the accuracy of lung cancer diagnosis.

- 4C Medical Technologies - Bangalore-based 4C Medical Technologies has developed an AI-powered medical imaging solution for heart diagnostics.

- Perfint Healthcare - Chennai-based Perfint Healthcare has developed AI-powered solutions for image-guided interventions.Canon Medical Systems Corporation (JPN)

- GE Healthcare - GE Healthcare is a global leader in medical imaging and has a strong presence in India with a range of AI-powered medical imaging solutions.

- Siemens Healthineers - Siemens Healthineers is another major player in medical imaging and has a significant presence in India with a range of AI-powered solutions.

- Philips Healthcare - Philips Healthcare is a global leader in medical imaging and has a range of AI-powered solutions for medical imaging available in India.

- Fujifilm India - Fujifilm India has a range of AI-powered solutions for medical imaging available in India, including AI-powered mammography systems.

- IBM Watson Health - IBM Watson Health has a range of AI-powered solutions for healthcare, including medical imaging solutions, that are available in India.

Recent Developments

January 2021: Researchers from IIT Kharagpur developed an AI system to detect diabetic retinopathy with an accuracy of up to 90%.

February 2021: Researchers from IIT Bombay developed an AI-based system to analyze chest X-rays and provide a diagnosis with an accuracy of up to 97%.

Healthcare Policies and Regulatory Landscape

India does not currently have specific regulations governing the use of artificial intelligence (AI) in medical imaging. However, the government is in the process of developing a national strategy for AI, which is expected to include guidelines for the use of AI in healthcare. In addition, the Medical Council of India and the National Board of Examinations have issued guidelines for the use of AI in medical education and practice, which may have implications for the use of AI in medical imaging.

At present, medical devices and diagnostics are regulated by the Central Drugs Standard Control Organization (CDSCO) and the Medical Devices Rules, 2017. However, these regulations do not specifically address the use of AI in medical imaging. It is expected that as the use of AI in healthcare becomes more widespread in India, there will be a need for more specific regulations to govern its use, particularly in sensitive areas such as medical imaging.

1. Executive Summary

1.1 Digital Health Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Digital Health Policy in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Artificial Intelligence (AI) in Medical Imaging Market Segmentation

By AI Technology

- Deep Learning

- Natural Language Processing (NLP)

- Others

By Solution

- Software Tools/ Platform

- Services

- Integration

- Deployment

By Modality

When compared to CT scans, magnetic resonance imaging can produce pictures that are free of imperfections. Due to its efficiency in obtaining details and better-quality pictures of soft tissues, the MRI is frequently seen as a superior alternative to X-rays. Utilizing optical coherence tomography, three-dimensional interactions between the retina and membranes are made possible in order to control the vitreoretinal disease.

- CT Scan

- MRI

- X-rays

- Ultrasound Imaging

- Nuclear Imaging

By Application

The market is dominated by the digital pathology segment, which can be linked to pathologists' rising productivity. A validation tool for image analytics is provided by digital pathology, helping pathologists process more slides in less time. This facilitates early illness identification and quicker therapy initiation. AI and digital pathology also assist doctors in making patient-centered decisions. The oncology market is also expected to grow in popularity as more individuals become aware of cancer and its increased incidence in the public. Personalized therapy is made possible by artificial intelligence algorithms that identify and comprehend the nature of malignancies. The second section focUses on AI-driven diagnostic imaging for the heart, brain, breast, and mouth.

- Digital Pathology

- Oncology

- Cardiovascular

- Neurology

- Lung (Respiratory System)

- Breast (Mammography)

- Liver (GI)

- Oral Diagnostics

- Other

By End Use

The market is dominated by the healthcare sector. This is becaUse hospitals are widely dispersed and accessible; hence, many patients like hospitals. The market for medical imaging AI is also anticipated to benefit from favorable reimbursement regulations. During the anticipated time, diagnostic centers are anticipated to grow in popularity. This may be attributable to elements including rising patient awareness and a desire for diagnostic procedures and tests, all of which are fueling the market's expansion. Due to its ease in providing high-quality medical facilities in remote places, particularly rural ones, the ambulatory category is expected to develop at a quicker CAGR throughout the projection period. The availability of qualified surgeons and a surplAustralia of the necessary equipment are contributing to the expansion of the hospital market. Government assistance in emerging nations is likely to boost hospital infrastructure and technologies throughout the forecast period, which is anticipated to caUse the hospital segment to see growth.

- Hospital and Healthcare Providers

- Patients

- Pharmaceuticals and Biotechnology Companies

- Healthcare Payers

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.