Hong Kong Dental Care Market Analysis

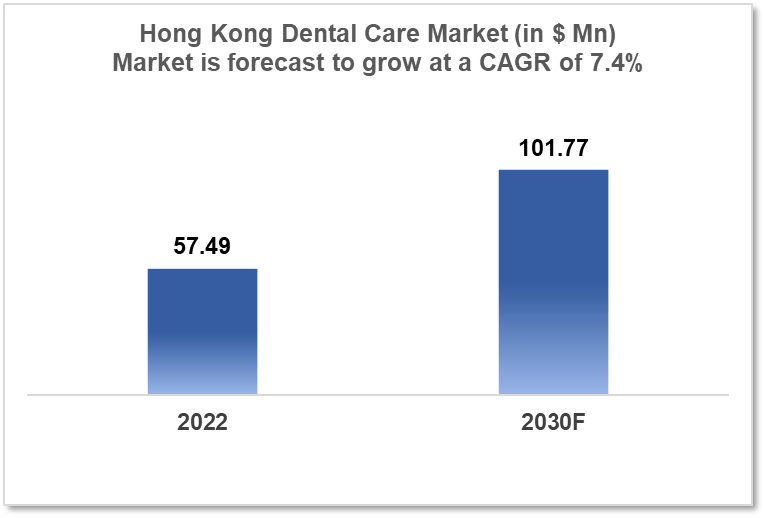

Hong Kong Dental Care Services Market is expected to be worth $57.49 Bn in 2022 and $101.77 Bn in 2030, growing at a 7.4% CAGR during the forecast period. With the special administrative region's high-income status, the industry is driven by ex-pats, an ageing population, rising internet marketing channels, and high-brand status corporate chains such as Pacific Dental, Quality HealthCare Medical Services, and Raffles Medical Group. This report by Insights10 is segmented by treatment type, age group, clinical setup, and by demography and provides rich insights for those seeking new avenues in this domain.

Buy Now

Hong Kong Dental Care Services Market Executive Summary

Hong Kong Dental Care Services Market is expected to be worth $57.49 Bn in 2022 and $101.77 Bn in 2030, growing at a 7.4% CAGR during the forecast period. Hong Kong, as a special administrative region of the People’s Republic of China, is a metropolitan city in Asia with a population of approximately 7.41 Mn. Healthcare services in Hong Kong Healthcare expenditures in Hong Kong are relatively high compared to other countries in the region. According to data from the World Health Organization (WHO), total healthcare expenditure in Hong Kong as a percentage of GDP was around 5.5% in 2019. This is higher than the average for countries in the Asia-Pacific region, which is around 5.2%. However, the majority of this expenditure (about 85%) is financed by the government through taxes, which helps to keep healthcare costs relatively affordable for individuals.

Healthcare services in Hong Kong are generally considered to be high quality and widely available. The city has a public healthcare system that provides affordable and accessible medical care to residents, as well as a number of private hospitals and clinics that offer more specialized and advanced treatments. Hong Kong has a high density of doctors and hospitals, with a physician-to-population ratio of 1:450 and a bed-to-population ratio of 2.6 per 1000 people. The public healthcare system is funded by taxes and run by the government, while private healthcare is paid for out-of-pocket or by private insurance. The public healthcare system is well-regarded for its efficiency and accessibility, with a wide range of services offered, including general practice, specialist care, and emergency services.

Oral health is a component of overall health. It impacts chewing, nutrient intake, communication, and involvement in social events. The oral health status of elderly persons can affect their quality of life and well-being. Although Hong Kong is an economically prosperous city, the dental health of its older adult population is far from satisfactory. According to an Inisghts10 survey, 47.8% and 55.2% of community-dwelling persons have untreated active dental caries. In terms of periodontal health, virtually all of the dentate community-dwelling older persons had bleeding gums, and nearly half (48.1%) had periodontal pockets of 4 mm or larger. Oral diseases are common among older adults in Hong Kong, indicating a high normative need for professional dental care services. Less than 40% of the surveyed older adults who suffered from a severe toothache that disturbed sleep sought help from dentists. Their most commonly reported access barrier was the financial burden related to dental treatments.

Market Dynamics

Market Growth Drivers

Hong Kong has the world's fourth-highest human development index score and the world's longest life expectancy, at 84.9 years. With a low birth rate of less than 2100 per 1000 women over the past decades, the number and proportion of senior persons (those aged 60 or over) in Hong Kong have increased, presently totaling 1.9 Mn, raising worries about the burden of oral sickness. According to government forecasts, the proportion of older adults in the Hong Kong population will climb from 26.2% in 2020 to 37.7% in 2040. It is also estimated that by 2050, the elderly dependency ratio will be 71 for every 100 adults aged 20 to 64. Age-related dental solutions are a potentially huge market with a 23.5% rise in prosthodontic and periodontic services projected for 2030. Dental and peri-ostem implants alone account for 46.7% of this anticipated growth. With a projected 23.5% increase in prosthodontic and periodontic treatments by 2030, age-related dental solutions have the potential to be a massive industry. Dental and peri-osteal implants account for 46.7% of the expected growth. The Expat population (700,000 as of 2021) is more accessible to dental corporations over native professional lead practices favoring the proliferation of these corporations with individuals of high-paying capacity.

Market Restraints

Due to hefty rent, salary, and equipment costs, running a dental clinic in Hong Kong can be costly. These expenses can make it difficult for dental service companies to expand their operations. Hong Kong's population is tiny and closely packed, which may limit the potential market size for dental services firms. The dental services industry in Hong Kong is very competitive, with a significant number of both public and private clinics providing identical services. This might make it tough for dental care companies to stand out from the crowd and acquire new consumers. Dental service corporations in Hong Kong are subject to stringent government rules governing practitioner credentials and treatment standards. This makes it harder for new dental services firms to enter the market and raises costs for current corporations. Many dental treatments are not covered by insurance, which limits the potential market size for dental service firms because customers may be unable to finance the treatments. In Hong Kong, there is a lack of dental experts, making it difficult for dental service firms to attract and retain skilled workers, particularly specialists.

Competitive Landscape

Key Players

- Pacific Dental

- Quality HealthCare Medical Services

- Raffles Medical Group

- Union Medical Healthcare

- Dr. Ko Dental Clinic

Notable Recent Updates

December 2022 - The Ayala Group is increasing its healthcare investments, with Healthway Philippines aiming to build three more locations in Metro Manila and Cavite by the end of the year. The new locations, according to Ayala Healthcare Holdings Inc., are Estancia Mall, Ayala Malls Cloverleaf, and The District Imus. Within the grounds, the new clinics will provide a variety of outpatient services, specialty consulting services, imaging, laboratory, diagnostics, ambulatory surgical services, dental services, physical therapy, and an outpatient pharmacy. Healthway has 7 primary branches in key Metro Manila cities and a network of over 800 specialists. Ayala bought Healthway from HKR International Ltd. in 2019.

December 2022 - SmileDirectClub (SDC), is a corporation with multiple country operations in dental services including the UK and Hong Kong. SDC currently has a market capitalization of $136.71 Mn and has attracted several investors over the years, including Commonwealth Equity Services (which saw a rise in 62.7% ownership of shares valued at $42,000 collectively in 2022), the Swiss National Bank (which owns a total of 253,600 shares currently worth $657,000), the Wintons Group Ltd. (which now owns 61,528 shares valued at $159,000 following the acquisition of additional shares), the Bank of New York The one unit share has ranged from $0.35 to $3.10 in the last year.

Reimbursement Scenario

Economically, Hong Kong is a high-income region, with a gross national income per capita of $63,000 in 2019. Nonetheless, nearly one-third of the elderly are poor, making them a financially susceptible cohort. The Outreach Dental Care Programme (ODCP), Comprehensive Social Security Assistance (CSSA), Elderly Health Care Voucher Scheme (HCVS), and The Community Care Fund (CCF) are some of the government initiatives in Hong Kong that help people with financial difficulties access dental services through public or private care facilities by providing grants and care centers. Private dental insurances in Hong Kong typically cover the costs of root canal treatment, bridgework, prosthetic dental devices, dentures, emergency dental treatment for pain relief, wisdom teeth extraction, apicectomy, routine dental treatment and examinations, cleaning and polishing, tooth extractions, fillings, and crowns and inlays – depending on the risk premium and dental health status of the individual.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Dental Care Market Segmentation

By Product (Revenue, USD Billion):

In terms of product category, the toothbrush had the highest revenue share (26% in 2020). The rising incidence of cavities, sensitivity, and gingivitis has increased toothpaste usage significantly in both emerging and wealthy countries. As a result, toothpaste is now an essential part of good dental health. In the oral care sector, toothpaste thus commands the biggest market share.

- Toothbrush

- Toothpaste

- Mouthwash

- Dental Floss

- Denture Care

By Age Group (Revenue, USD Billion):

Adults lead the oral care market over the projection period based on age group. The overall expansion of the oral care industry is being driven by adults' increasing consumer knowledge of mouth cleanliness and care. Adult oral care products come in a variety on the market.

- Children

- Adults

- Geriatric

By Sales Channel (Revenue, USD Billion):

The specialty stores dominate the oral care market over the projection period based on the sales channel. Specialty shops carry a broad selection of goods. The employees of specialty businesses provide customers with precise product information. With the aid of specialty shops, customers can also find all types of dental care items under one roof.

- Hypermarkets/Supermarkets

- Specialty Stores

- Drug Stores &Pharmacies

- Convenience Stores

- Online Sales Channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.