Global HIV Therapeutics Market Analysis

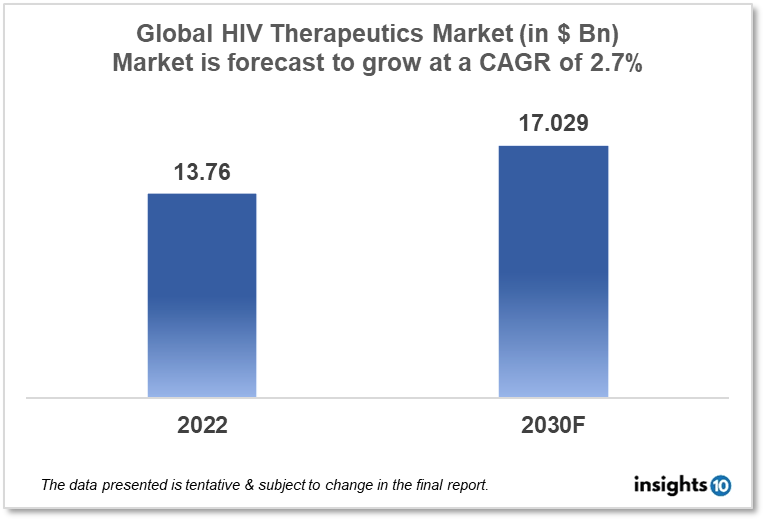

The Global HIV therapeutics market is expected to reach $17.029 Bn by 2030, up from $13.76 Bn in 2022, with a CAGR of 2.7% from 2022 to 2030. Global players such as ViiV Healthcare, AbbVie, Janssen Pharmaceuticals, and Gilead Sciences dominate the Global HIV therapeutics market. The global government policies, funding, poverty, and initiatives by international organizations to manage HIV infections propel the market. The Global HIV therapeutics market is divided into five segments type, product, geography, end user, and distribution channel.

Buy Now

Global HIV Therapeutics Market Analysis Summary

HIV is a worldwide problem. The World Health Organization (WHO) estimates that 38.4 Mn people (roughly 0.7 % population) will be living with HIV in 2021, with 1.5 Mn new cases. It also estimated that 73% of those cases were receiving ART, but that 680,000 people died from HIV-related causes (such as AIDS) that same year. The global HIV therapeutics market is expected to be worth $17.029 Bn by 2030, up from $13.76 Bn in 2022, with a 2.7 % CAGR from 2022 to 2030.

That translates to 9.7 Mn people still waiting. Access to HIV treatment is critical to the global effort to eliminate AIDS as a public health threat. People with HIV who are aware of their status, take ART as prescribed, and achieve and maintain an undetectable viral load can live long and healthy lives and will not transmit HIV through sex to HIV-negative partners. Through the use of antiretroviral therapy (ART) medicines, which can keep patients healthy for many years by reducing the amount of HIV (viral load) present in the body, HIV can be controlled and treated—though not fully cured. Many nongovernmental organizations (NGOs) are involved in the global response to HIV and AIDS, including The Global Fund, International AIDS Society, Kaiser Family Foundation, UNAIDS, and World Health Organization.

Market Dynamics

Market Growth Drivers Analysis

The 2021-2026 Global AIDS Strategy "End Inequalities. End AIDS" is a courageous new approach to closing the gaps that are impeding progress toward AIDS eradication. The Global AIDS Strategy seeks to address the inequalities that fuel the AIDS epidemic by prioritizing people who do not yet have access to life-saving HIV services. The President's Emergency Plan for AIDS Relief (PEPFAR) is the United States' response to the global HIV/AIDS epidemic, and it represents the largest commitment ever made by any nation to combat a single disease. These elements may entice new entrants into the Global HIV Therapeutics Market.

Market Restraints

Despite advances in our scientific understanding of HIV and its prevention and treatment, as well as years of significant effort by the global health community and leading government and civil society organizations, far too many people with HIV or at risk of HIV continue to lack access to prevention, care, and treatment, and there is no cure. Furthermore, the HIV epidemic affects not only individual health but also households, communities, and national development and economic growth. Many of the countries most affected by HIV also have other infectious diseases, food insecurity, and other serious issues.

Despite the availability of a growing number of effective HIV prevention tools and methods, as well as a massive scale-up of HIV treatment in recent years, UNAIDS warns that there has been unequal progress in reducing new HIV infections, increasing access to treatment, and ending AIDS-related deaths, with far too many vulnerable people and populations left behind. Stigma and discrimination, as well as other social inequalities and exclusion, are proving to be major impediments. These elements may deter new entrants into the Global HIV therapeutics market.

Competitive Landscape

Key Players

- Gilead Sciences

- Janssen Pharmaceuticals

- AbbVie

- Boehringer Ingelheim

- ViiV Healthcare

- Bristol Myers Squibb

- Merck & Co.

Recent Notable Updates

February 2023: The FY 2024 NIH HIV/AIDS Professional Judgment Budget requests $3.673 Bn, a $479 Mn, or 15%, increase over the FY 2022 enacted budget of $3.194 Bn. HIV/AIDS research funded by the NIH has resulted in remarkable scientific discoveries, clinical advances, novel programmatic approaches, and cross-disciplinary outcomes. Additional resources requested in the FY 2024 NIH HIV/AIDS Professional Judgment Budget are critical to capitalizing on those advances and spurring further innovation in the following areas, with several highlighted scientific opportunities.

July 2022: ViiV Healthcare, the global specialist HIV company majority owned by GSK, with Pfizer and Shionogi shareholders, and the Medicines Patent Pool (MPP) announced today the signing of a new voluntary licensing agreement for patents relating to cabotegravir long-acting (LA) for HIV pre-exposure prophylaxis (PrEP) to help enable access in the least developed, low-income, lower middle-income, and Sub-Saharan African countries. This agreement allows selected generic manufacturers to develop, manufacture, and supply generic versions of cabotegravir LA for PrEP, the first long-acting HIV prevention medicine, in 90 countries. This announcement comes just seven months after the US Food and Drug Administration approved cabotegravir LA for PrEP for the first time (US FDA).

Healthcare Regulations

The regulatory landscape for HIV therapeutics varies by country and region.

The Food and Drug Administration (FDA) in the United States is in charge of regulating the safety and efficacy of drugs. It reviews and approves all new HIV drugs before they are released to the public. European Medicines Agency (EMA) is in charge of regulating drug approval and use in the European Union. It reviews and approves all new HIV drugs before they are released to the public.

World Health Organization (WHO): The WHO provides global guidance and recommendations on HIV drug use. It collaborates with countries and organizations to increase access to and proper use of HIV medications. NRAs (National Regulatory Authorities): Individual countries' NRAs are in charge of regulating drug approval and use. They review and approve all new HIV drugs before they are sold on the market, and they monitor how these drugs are used in their respective countries.

Reimbursement Policies

The reimbursement of HIV therapeutics varies across different countries and healthcare systems. There are, however, some global initiatives aimed at increasing access to HIV treatment and ensuring reimbursement for those in need. The World Health Organization's (WHO) "treat all" policy, which recommends that all people living with HIV be offered antiretroviral therapy, is one such initiative (ART). Furthermore, some countries have national health insurance schemes or other reimbursement programs that cover the cost of HIV therapeutics such as ART and other medications used to treat HIV-related conditions.

The United States President's Emergency Plan for AIDS Relief (PEPFAR), is a U.S. government initiative that provides funding for HIV treatment, prevention, and care in low- and middle-income countries. the Global Fund to Fight AIDS, Tuberculosis, and Malaria, which is a non-profit international organisation that provides funding to support programs that address these three diseases, organisations worldwide.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

HIV Therapeutics Segmentation

By Types (Revenue, USD Billion):

- Nucleoside-Analog Reverse Transcriptase Inhibitors (NRTIs)

- Coreceptor Antagonists

- Entry and Fusion Inhibitors

- Integrase Inhibitors

- Protease Inhibitors (PIs)

- Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs)

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.