Global Clinical Trial Patient Recruitment Services Market Analysis

The Global clinical trial patient recruitment services market is projected to grow from $ 0.84 Mn in 2022 to $1.56 Bn by 2030, registering a CAGR of 8% during the forecast period of 2022-30. The Global clinical trial patient recruitment services market is a rapidly growing market that provides services to support the recruitment of patients for clinical trials. Some key players in the global clinical trial patient recruitment services market include IQVIA, Parexel International, PRA Health Sciences, Syneos Health, and WCG Clinical. Other important players include ICON plc, Medpace, Charles River Laboratories, and Premier Research.

Buy Now

Global Clinical Trial Patient Recruitment Services Market Executive Summary

The Global Clinical Trial Patient Recruitment Services Market is projected to grow from $ 0.84 Bn in 2022 to $1.56 Bn by 2030, registering a CAGR of 8% during the forecast period of 2022 - 2030.

The Global Clinical Trial Patient Recruitment Services Market is a rapidly growing market that provides services to support the recruitment of patients for clinical trials. Clinical trial sponsors and research organizations face significant challenges in identifying and recruiting the appropriate patients for their trials. Patient recruitment services offer solutions to these challenges by providing specialized expertise, technologies, and strategies to efficiently identify, engage, and retain patients for clinical trials.

Clinical trial patient recruitment services are specialized services that help researchers and pharmaceutical companies identify and recruit eligible participants for their clinical trials. These services may use a variety of strategies to find potential participants, such as advertising, outreach to medical professionals and patient advocacy groups, and leveraging social media and other digital platforms. The goal is to ensure that trials can recruit enough participants to meet their enrollment goals, while also ensuring that the participants are representative of the broader population that the trial is targeting.

The market is driven by factors such as the increasing demand for clinical trials to support drug development, rising complexities in patient recruitment, and the need for specialized expertise and technologies to support efficient patient recruitment and retention. The market is highly competitive, with numerous companies providing a variety of patient recruitment services. These services may include patient identification, patient engagement, advertising and outreach, patient screening and enrollment, and retention strategies.

The market is expected to continue to grow in the coming years as the need for clinical trials and patient recruitment services increases. However, the market may also face challenges such as regulatory hurdles, data privacy concerns, and the high cost of patient recruitment services. Nonetheless, the increasing adoption of digital technologies and personalized patient engagement strategies are expected to drive the growth of the market in the future.

Use of Electronic Health Records for Recruitment in Clinical Trials

The use of electronic health records (EHRs) in recruitment for clinical trials has the potential to streamline the recruitment process and increase efficiency. By utilizing EHRs, researchers can more easily identify potential study participants and determine their eligibility for a study.

One of the benefits of using EHRs for recruitment is that they can provide a large pool of potential participants who have previously consented to have their medical information used for research purposes. This can reduce the time and effort required to identify eligible participants and gain their consent.

Additionally, EHRs can provide a more complete picture of a patient's health history, including information about previous treatments, diagnoses, and other relevant medical conditions. This information can be used to identify patients who are eligible for a study and to ensure that they meet the study's inclusion criteria.

However, there are also some challenges associated with using EHRs for recruitment. For example, privacy and security concerns must be addressed to ensure that patient's medical information is protected. Additionally, EHR systems are not always interoperable, meaning that data from one system may not be easily transferred to another.

In conclusion, the use of EHRs in recruitment for clinical trials has the potential to improve efficiency and accuracy. However, it is important to carefully consider the benefits and challenges associated with this approach and to ensure that patient's privacy and security are protected.

Pharmacies Step into Trial Space

Large retail pharmacy chains are increasingly acting as clinical trial recruitment sites due to their widespread presence, patient reach, and convenience. These pharmacies have a large customer base that visits them regularly, and many of their customers may be eligible for participation in clinical trials. Additionally, these pharmacies often have established relationships with healthcare providers, which can facilitate referrals for clinical trials.

CVS Health, one of the largest retail pharmacy chains in the United States, has recently entered the clinical trial services market by launching its own clinical trial network called the CVS Health Research Institute in 2021. The goal of this network is to bring clinical trial services to patients in their local communities, leveraging the company's extensive retail pharmacy network and its expertise in managing patient health data.

CVS Health's entry into the clinical trial services market has the potential to expand patient access to clinical trials and improve clinical trial efficiency. By leveraging its existing retail pharmacy network, CVS Health can potentially reach a large number of patients who may be interested in participating in clinical trials. The company can also leverage its health data expertise to support the recruitment and management of clinical trial participants, as well as the collection and analysis of clinical trial data.

CVS Health's approach to clinical trial services is also unique in that it emphasizes the importance of patient-centricity and convenience. For example, the company plans to offer virtual visits and home healthcare services for clinical trial participants, which can make it easier for patients to participate in clinical trials and reduce the burden of travel and other logistical considerations.

Walmart, one of the largest retail corporations in the world, has also recently entered the clinical trial services market by launching its own clinical trial platform called Walmart Health Care Research Institute. The goal of this platform is to provide patients with access to clinical trials and other healthcare services at select Walmart locations.

Walmart's entry into the clinical trial services market has the potential to expand patient access to clinical trials and improve clinical trial efficiency. Similar to CVS Health, Walmart can leverage its existing retail network to reach a large number of potential clinical trial participants. Walmart also plans to offer telemedicine services to support virtual visits with healthcare providers and clinical trial coordinators, which can increase convenience and reduce the burden of travel for clinical trial participants.

Walmart's approach to clinical trial services is also unique in that it emphasizes the importance of reducing healthcare costs and improving health equity. For example, the company plans to offer clinical trial services to underserved and rural communities that may not have access to traditional clinical trial sites or healthcare services.

However, as with any new entrant into the clinical trial services market, there are potential challenges that Walmart may face. For example, there may be concerns about the quality and consistency of data collected from these sites, as well as regulatory and ethical considerations that need to be addressed to ensure the safety and privacy of clinical trial participants.

Walgreens, a pharmacy and retail company that offers a range of healthcare services, including immunizations, health screenings, and medication management also announced the launch of its clinical trial business in June 2022 with the goal of improving access to and participation in sponsor-led drug development research while also redefining the patient experience. In order to overcome obstacles to engaging larger and more varied groups, Walgreens has developed a flexible clinical trial model that integrates the company's extensive foundation of patient information, partner-enabled health and technology capabilities, and in-person and virtual care alternatives.

The launch of Walgreens' clinical trial offerings coincides with recent initiatives by the U.S. Food and Drug Administration to broaden racial and ethnic diversity in clinical trials. Despite the fact that 20% of medications have different responses in different ethnic groups, 75% of clinical trial participants are white, compared to 11% of Hispanic participants and less than 10% of Black and Asian participants.

Market Dynamics

Key Drivers

The global clinical trial patient recruitment services market is driven by several key factors, including:

- Increasing demand for clinical trials: The growing need to develop new treatments for diseases and the rise in the number of clinical trials being conducted globally are driving the demand for patient recruitment services.

- Technological advancements: The use of digital technologies and social media platforms is improving patient recruitment and retention rates, thereby driving the growth of the clinical trial patient recruitment services market.

- Aging population: As the global population ages, the prevalence of chronic diseases increases, leading to a higher demand for clinical trials and patient recruitment services.

- Increasing awareness among patients: The growing awareness among patients about the benefits of clinical trials and the availability of new treatments is driving the demand for patient recruitment services.

- Increasing outsourcing of clinical trial activities: Many pharmaceutical and biotech companies are outsourcing their clinical trial activities, including patient recruitment services, to specialized service providers, which is driving the growth of the market.

Overall, the global clinical trial patient recruitment services market is expected to continue to grow in the coming years, driven by these and other key factors.

Challenges in Clinical Trial Patient Recruitment

- 37% of clinical trials are stopped before testing even begins due to under enrollment

- 85% of trials fail to retain enough patients, and

- 11% are unable to enroll even a single patient

- 30% of patients who do register leave the experiment before it is finished

Clinical trial investigators have long struggled with patient recruiting, which is the leading reason trials are canceled. According to a study review, inadequate recruiting results in the early termination of clinical trials in 19% of cases. Only one-third of US clinical trials with 41 NIH registrations reach their patient recruitment targets, according to one analysis. The same analysis discovered that up to 24% of all NIH-registered trials fall short of obtaining even a partial patient sample.

Because it involves a multitude of circumstances that are outside the control of study sponsors, clinical trial patient recruiting is undoubtedly the most challenging part of pharmaceutical research. Sponsors, investigators, and service providers are nonetheless coming up with inventive new methods to locate and enlist patients despite this loss of control, made feasible by developments in medical technology.

The COVID-19 pandemic has sped up the adoption of these technologies, and now the disruptors and innovators in charge of developing tools for patient recruitment predict that additional technological advancements and improved procedures will remove obstacles to trial participation and hasten research. Here are a few of the novel approaches being used by sponsors and contract research organizations (CROs) to recruit patients.

Competitive Landscape

These clinical trial recruitment companies are some of the best in the business

- IQVIA: With unprecedented patient data and insight, combined with machine learning, IQVIA Direct-to-Patient Recruitment helps eliminate obstacles that add time, cost, and uncertainty to recruitment efforts

- Antidote: Antidote’s mission is to connect sponsors and research sites with informed, engaged patients who are interested in participating in a clinical trial. Services include validated referrals, customized outreach plans, access to a 300+ nonprofit and patient advocacy partner network, and other premium services for trial sponsors

- AutoCruitment: AutoCruitment makes use of more than 1,500 digital channels to connect with patients searching for medical information online. It is also known for its speed and advertises a three-day setup time

- BBK Worldwide: With over 30 years of experience in patient recruitment, BBK Worldwide has a vast library of whitepapers and ebooks to share what they have learned throughout the years

- Clariness: Clariness is an internationally focused recruitment company that has enrolled patients in more than 1,000 trials in 50 countries

- ClinicalConnection: ClinicalConnection works with a database of patients and also features study centers on the website for potential participants to find

- CSSi: As part of their patient recruitment strategy, CSSi connects with local patient organizations to find eligible participants

- Curavit: With decentralized clinical trial execution, Curavit specializes in connecting with patients via telehealth and trial technology platforms

- Elligo Health Research: Elligo Health Research has a time-tested “Elligo Direct” approach that makes it simple for physicians and their patients to take part in clinical trials

- Langland: An advertising agency with branding and clinical trial marketing expertise, Langland is able to blend patient, protocol, disease, and media insights with data and technology to provide recruitment and retention solutions

- MMG: With several decades worth of experience, MMG refers to itself as a team of global recruitment strategists and emphasizes its strategy support capabilities

- Praxis: By offering a range of service options, Praxis allows customers to pick and choose what they need, from digital advertising to community outreach

- Science37: A technology-focused company, Science37 is a virtual clinical trials company that can provide full trial execution or supplemental technology in addition to change management services

- StudyKik: After seeing advertising for the service across Facebook and other platforms, potential participants can sign up for Studykik and be notified when a trial is created for which they may be eligible

- TrialSpark: By partnering with physicians and pharmaceutical companies, TrialSpark reduces the time and expense of clinical trials by providing technology, equipment, and staffing

- TrialX: In addition to patient recruitment services, TrialX also creates mobile apps for trials

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Clinical Trials Regulation in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

6. Methodology and Scope

Global Clinical Trial Patient Recruitment Services Market Segmentation

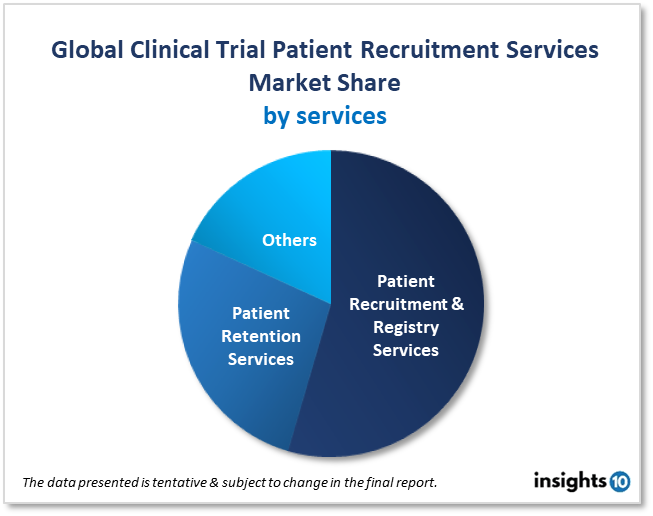

By Service Type

- Patient Recruitment & Registry Services

- Patient Retention Services

- Others

Patient recruitment management offers services for patient registration, patient retention, and other things (analytics, marketing). In 2022, patient recruitment and registry services held a 67.7% market share. It has been shown that 86% of studies do not meet enrollment deadlines, and 30% of phase III trials do not because of enrollment issues.

The most expensive part of clinical trials is patient recruitment, which accounts for 32% of overall costs. Involving patients in the design of new therapies and clinical trials, as well as in the development and post-market processes, helps with patient recruitment and retention and also provides undeniable proof of the worth of medicines in practical applications.

The analysis timeframe is expected to have a significant growth rate of 8.2% for patient retention services. Technology is used in a variety of outreach methods, such as social media, digital marketing, and online health forums. The environment for clinical trials is quickly changing as a result of these activities.

Sponsors, providers for hiring, advertisers, and others can observe behavioral trends when these people are actively engaged online. This is crucial if organizations want to know where to invest money to reach their target patient population when employing online outreach to help with retention.

By Trial Phases

- Phase I

- Phase II

- Phase III

- Phase IV

The market was dominated by the phase III patient recruitment services sector, which required a 57.1% revenue share in 2022. Phase III clinical studies, which are the most costly and involve the most participants, are to blame for this growth. Due to the sample size and the need for sophisticated dosing at an optimum level in the research design, this phase has the highest failure rate. The majority of failures are brought on by noncompliance with safety and efficacy criteria, which result in both human and financial loss.

A growing number of investigational pharmaceuticals are moving forward to phase IV clinical trials, which means that 35.0% of phase III clinical trials are outsourced. This percentage is anticipated to rise.

On the other hand, the phase I segment is predicted to experience a significant growth rate of 9.5% over the course of the projection year. One of the main drivers of the lucrative growth rate of phase I patient recruiting services is the growing number of medicines being investigated for the management and treatment of rare diseases. Additionally, because investigative studies are longer and more likely to result in dropouts, the rate of patients recruited in the first phases is higher and tends to decline throughout the other phases.

By Therapeutic Areas

- Respiratory Diseases

- Pain and Anesthesia

- Oncology

- Central Nervous System

- Cardiovascular

- Endocrine

- Anti-Infective

- Others

The market for clinical trial patient recruiting services is segmented according to therapeutic areas as follows: respiratory diseases, pain and anesthesia, oncology, cardiology, endocrine, respiratory, central nervous system, pain, and others. 13.7% of the market was occupied by the category of pain and anesthesia in 2022. Larger shares of the segment are mostly caused by the expensive clinical research connected to pain and anesthetic, which raises the price of patient recruiting services throughout the illness area.

The market for patient recruiting services connected to oncology is predicted to grow at a profitable CAGR of 9.2% over the forecast period. The segment has experienced rapid development in large part as a result of the recent increase in the number of cancer treatments being developed, which has also increased the need for patient enrolment in such studies. For instance, oncology therapies represented $143 Bn in branded pharmaceutical sales in 2019 or around 20% of all pharmaceutical sales worldwide.

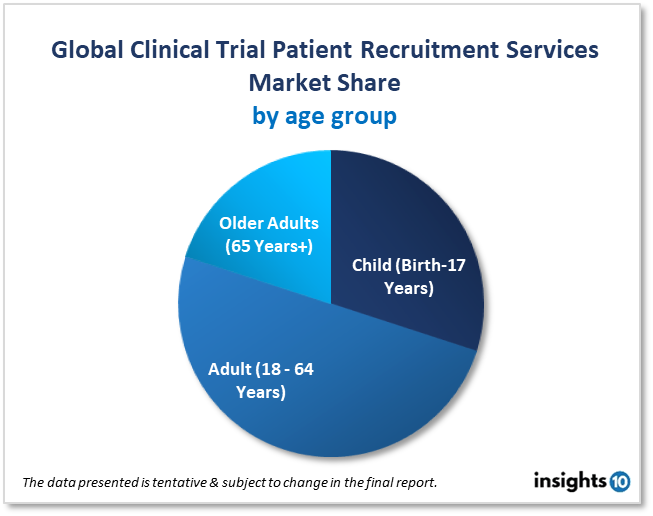

By Age Group

- Child (Birth-17 Years)

- Adult (18 - 64 Years)

- Older Adults (65 Years+)

Adult (18–64 Years) was the age group with the biggest market share in 2022, accounting for 49.5%. High shares of the segment are mostly caused by the fact that there were more participants in the age group overall in the clinical investigations that have been done so far. This is because the population in the aforementioned age bracket exhibits greater diversity in studies, and also because it is much safer and healthier for this age group to conduct tests than it is for children or older adults/boomers.

On the other hand, due to the rising prevalence of geriatric illnesses or diseases, the older people (65 Years+) category is expected to see a significant growth rate during the course of the analysis period. The age group has a number of health difficulties that make them a suitable population for clinical investigations, including high blood pressure, nerve damage, vision loss, kidney illness, orthopedic problems, etc.

By Region

- APAC

- Japan

- China

- India

- Australia

- Rest of Asia Pacific

- North America

- US

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- Middle East

- Africa

- Latin America

With a 50.4% sales share, North America dominated the global market in 2021. Due to the large number of clinical studies being undertaken in the area, this market is most likely to expand. Government funding for clinical trials and large R&D investments are furthering the market's expansion.

The growth of the North American clinical trial patient recruitment services market has been attributed to the presence of significant CROs providing support services like patient recruitment and multinational pharmaceutical & biopharmaceutical companies making significant investments in clinical research.

With a predicted CAGR of 9.1% during the forecast period, the Asia Pacific clinical trial patient recruitment services market is expected to experience the greatest growth in the region. Because of the low research expenses, simple regulatory compliance, growing patient population, and existence of a few elite clinical institutions serving as sites, the Asia Pacific area has emerged as a hub for conducting clinical trials.

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.