Germany Radiotherapy Market Analysis

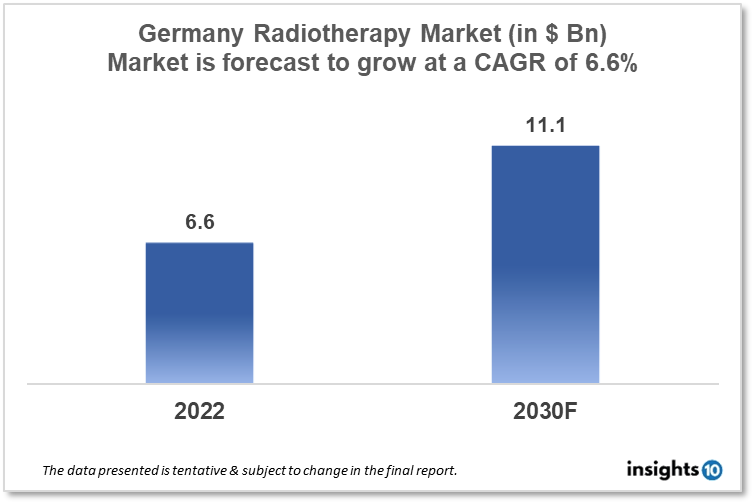

By 2030, it is anticipated that the German radiotherapy Market will reach a value of $11.1 Bn from $6.6 Bn in 2022, growing at a CAGR of 6.6% during 2022-30. The Radiotherapy Therapeutics Market in Germany is dominated by a few domestic players such as Brainlab, Eckert & Ziegler, and Ziehm Imaging. The radiotherapy market in Germany is segmented into different types, technologies, procedures, applications, and end-users. The major risk factors associated with awareness of radiotherapy shortage of skilled staff, government initiatives, and reimbursement policy. The demand for German radiotherapy is increasing on account of the rise in cancer cases in the country.

Buy Now

Germany Radiotherapy Market Analysis Summary

By 2030, it is anticipated that the German radiotherapy Market will reach a value of $11.1 Bn from $6.6 Bn in 2022, growing at a CAGR of 6.6% during 2022-30.

Germany is a developed, high-income country in the center of Western Europe. In 2019, roughly 502,655 new cancer cases were discovered in Germany. Cancer is the second most common cause of mortality, accounting for 25% of all deaths. Radiation therapy equipment refers to machines that use X-rays or radionuclides to treat patients. Linear accelerators, Cobalt-60 units, Caesium-137 therapy units, low to orthovoltage x-ray units, high-dose and low-dose-rate brachytherapy units, and traditional brachytherapy units are all examples of this.

Radiation therapy (or radiation) is most commonly used to treat cancer, although it can also be used to treat some rare, non-cancerous disorders. Germany has the most radiation facilities in Europe. Germany's government spent 12.8 % of its GDP on healthcare in 2020.

Market Dynamics

Market Growth Drivers Analysis

Since 2020, the number of radiation therapy units in Germany has increased (+2.07%). In 2020, the total number of radiation therapy units was 394 units. A decrease in the number of radiation therapy units preceded this increase. The amount of radiation therapy units have fluctuated across the studied time period. Radiation oncology is a widely available resource in the German healthcare system. According to the German Society for Radiation Oncology, there are currently approximately 700 radiotherapy institutes in Germany. Radiotherapy is an essential component of current cancer treatment, with half of all cancer patients in Europe receiving it at least once. These aspects could boost Germany's, Radiotherapy Market.

Market restraints

In Germany, radiotherapy is prohibitively expensive. It ranges in price from $1,110 to $21,000. While the majority of radiotherapy treatment takes place in an outpatient setting, inpatient treatment is essential when it comes to radio chemotherapy or the management of patients in poor condition. The total effort of inpatient care may have grown, with a greater emphasis on more complex illnesses. This may place a strain on the country's healthcare system. These factors may deter new entrants into the Germany Radiotherapy Market.

Competitive Landscape

Key Players

- Brainlab: A German-based company that provides radiosurgery and radiotherapy solutions, including linear accelerators and treatment planning systems

- Eckert & Ziegler: A German-based company that provides brachytherapy equipment, including radioactive sources and after loaders

- PTW Freiburg: A German-based company that provides dosimetry equipment and solutions for quality assurance in radiotherapy treatment planning and delivery

- Ziehm Imaging: A German-based company that provides mobile C-arm imaging systems for intraoperative imaging in radiotherapy and other medical applications

- iRT Systems: A German-based company that provides advanced software solutions for radiotherapy treatment planning and delivery, including AI-powered tools

- MED-EL Elektromedizinische Geräte: A German-based company that provides electronic equipment and software for the planning and delivery of radiation therapy treatments

Recent Notable Updates

January 2023: 3T Biosciences and Boehringer Ingelheim announced a strategic collaboration and licencing agreement to study and develop next-generation cancer therapies to address large unmet patient needs. The collaboration will bring together 3T Biosciences' best-in-class 3T-TRACE (T-Cell Receptor Antigen and Cross-Reactivity Engine) discovery platform and Boehringer Ingelheim's two-pronged research strategy that combines cancer cell-directed and immune cell-targeting compounds, bolstering the company's pipeline.

Healthcare Policies and Reimbursement Scenarios

In Germany, radiotherapy is regulated by the Federal Ministry of Health (Bundesministerium für Gesundheit) and the Federal Joint Committee (Gemeinsamer Bundesausschuss or G-BA). The G-BA is responsible for determining which medical services are reimbursed by statutory health insurance funds. These regulations are established by the German Society for Radiation Oncology (DEGRO) and the Federal Office for Radiation Protection (Bundesamt für Strahlenschutz or BfS). The reimbursement for radiotherapy in Germany is generally covered by statutory health insurance funds, as long as it is deemed medically necessary and provided by a licensed physician.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Radiotherapy Segmentation

By Type (Revenue, USD Billion):

- External Beam Radiation Therapy

- Linear Accelerators

- Compact Advanced Radiotherapy Systems

- Cyberknife

- Gamma Knife

- ?Tomotherapy

- Proton Therapy

- Cyclotron

- ?Synchrotron

- Internal Beam Radiation Therapy

- Brachytherapy

- Seeds

- Applicators and Afterloaders

- Electronic Brachytherapy

- Systemic Radiation Therapy

- ?Others

?By Technology (Revenue, USD Billion):

- External Beam Radiotherapy

- Intensity-Modulated Radiation Therapy (IMRT)

- Image-Guided Radiation Therapy (IGRT)

- Stereotactic Radiation Therapy (SRT)

- 3D Conformal Radiation Therapy (3D-CRT)

- Particle Therapy

- Internal Beam Radiotherapy

- Brachytherapy

- High-Dose Rate Brachytherapy

- Low-Dose Rate Brachytherapy

- Image-Guided Brachytherapy

- Pulse-Dose Rate Brachytherapy

- Systemic Radiation Therapy

- Intravenous Radiotherapy

- Oral Radiotherapy?

By Application (Revenue, USD Billion):

- Breast Cancer

- Cervical Cancer

- Colon and rectum Cancers

- Stomach Cancer

- Lung Cancer

- Prostate Cancer

- Skin Cancer

- Liver Cancer

- Other types of cancer

By End User (Revenue, USD Billion):

- Hospitals

- Radiotherapy Centers & Ambulatory Surgery Centers

- ?Cancer Research Institutes

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.

By 2030, it is anticipated that the Germany Radiotherapy market will reach a value of $11.1 Bn from $6.6 Bn in 2022, growing at a CAGR of 6.6% during 2022-2030.

In Germany, radiotherapy is regulated by the Federal Ministry of Health (Bundesministerium für Gesundheit) and the Federal Joint Committee (Gemeinsamer Bundesausschuss or G-BA).

The Radiotherapy Therapeutics Market in Germany is dominated by a few domestic players such as Brainlab, Eckert & Ziegler, and Ziehm Imaging.