Germany Oncology Drugs Market Analysis

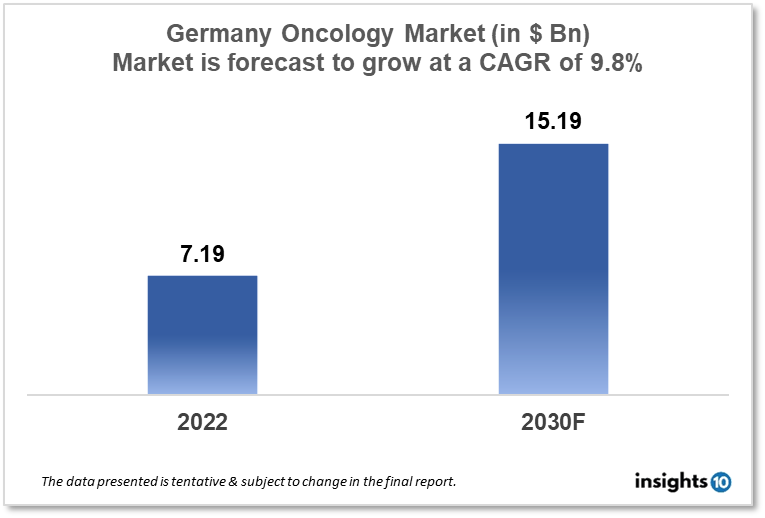

The oncology drugs market in Germany is a significant and growing market, as cancer is a major public health issue. According to a report published by Insights10, the oncology drugs market in Germany was valued at $7.19 Bn in 2022 and is expected to reach $15.19 Bn by 2030, at a CAGR of 9.8% during the forecast period. The market is highly competitive, with a large number of players like Baxter, Daiichi Sankyo Europe, Novartis etc offering a wide range of cancer treatment options.

Buy Now

Germany Oncology Drugs Market Executive Summary

The Germany oncology drugs market size is at around $7.19 Bn in 2022 and is projected to reach $15.19 Bn in 2030, exhibiting a CAGR of 9.8% during the forecast period. Germany spends an average of 11.1% of its GDP on healthcare and is one of the European nations with the highest healthcare expenditures. Health spending in Germany hit a record high of $462.96 Bn in the COVID-19 pandemic year of 2020. In Germany, healthcare costs accounted for 13.1% of GDP in 2020 and rose by 1.2% in 2021. Most of the diseases that are prevalent in Germany are comparable to those that are prevalent in other affluent nations. The World Health Organization (WHO) reports that cancer and cardiovascular diseases, including heart attacks and strokes, are the two major causes of fatalities in Germany.

Germany has an age-standardized incidence rate of cancer of roughly 430 cases per 100,000 people. A cancer diagnosis is made in roughly 4.3% of the population each year. The number of incident cases of cancer in 2020 was reported to be 538,140 by the World Cancer Research Fund International.

The oncology drugs market in Germany consists of a wide range of products and services related to the treatment and management of cancer. This includes drugs and medical devices used in cancer diagnosis and treatment, such as imaging equipment and radiation therapy machines. Services include pain management medications and home health care services for cancer patients. The government also plays an active role in the regulation of therapeutics in the oncology segment and excessive pressure on price regulation policies is a challenge among pharmaceutical manufacturers and the country frequently faces a shortage of medicines.

Market Dynamics

Market Growth Drivers

There are several factors that may be driving the market for oncology treatments in Germany. These may include:

- Increasing incidence of cancer: The incidence of cancer is increasing globally, and Germany is no exception. The age-standardized incidence rate of cancer in Germany is about 430 cases per 100,000 population.

- Increasing funding for cancer research: Governments and private organizations are increasing their funding for cancer research, which is expected to drive the development of new treatments and therapies. This, in turn, is expected to drive market growth.

- Increasing adoption of personalized medicine: The use of personalized medicine, which involves tailoring treatment plans to the specific characteristics of each patient's cancer, is increasing in Germany. This trend is expected to drive market growth as personalized medicine can improve treatment outcomes and reduce the risk of adverse effects.

Market Restraints

Some cancer therapies may not be accessible in Germany because they are either undergoing clinical trials or have not received national approval. Due to the extensive regulatory load and requirement for ethical approval, conducting clinical trials in Germany might be difficult. In 2011, the German government introduced an ‘Act on the Reform of the Market for Medicinal Products’ (AMNOG) which aimed at price regulation of cancer drugs that pushed manufacturers to opt out of the market. This created a shortage of medicines. New cancer therapies may take longer to develop as a result. Receiving payment for cancer treatments can be a difficult procedure that not always covers all of the associated costs. In Germany, there have been shortages of several cancer medications, which may have an impact on patient access to care. Branded cancer drug sales may be impacted by the introduction of generic medications to the market.

Competitive Landscape

Key Players

- Eckert & Ziegler BEBIG,

- Oncura Inc.

- GE Healthcare

- Medtronic PLC.

- Varian Medical Systems Inc

- Boehringer Ingelheim (GER)

- Baxter GmbH (GER)

- Daiichi Sankyo Europe GmbH (GER)

- Grifols Deutschland (GER)

- Mundipharma GmbH (GER)

- Pfizer Pharma

- Takeda Pharma

Notable Recent Updates

December 2022 - Pre-Clinical Oncology Program out licensed by MorphoSys - MorphoSys, a pharmaceutical company with headquarters in Germany, announced today that its fully owned subsidiary Constellation Pharmaceuticals, Inc. has signed a global licensing agreement with Novartis to conduct pre-clinical research, develop, and market its novel cancer target inhibitors. Following its purchase of Constellation Pharmaceuticals, Inc., MorphoSys expanded its portfolio of research initiatives by including this one.

August 2022 -To create novel immune-synthetic antibody-drug conjugates, Mersana Therapeutics, and Merck KGaA, Darmstadt, Germany, have announced a research collaboration and commercial license agreement. A leading science and technology company, Merck KGaA, Darmstadt, Germany, operates its biopharmaceuticals business in the United States and Canada as EMD Serono. Guardant Health, Inc. a leading precision oncology company, today announced an expanded collaboration with Merck KGaA to further leverage the GuardantInform Real-World E3vidence (RWE) platform to aid in accelerating development efforts for Merck the expanded strategic partnership will concentrate on developing therapies for key cancer indications with a high unmet need.

January 2021- BeiGene and Novartis $2,200 Mn Deal: Tislelizumab, an anti-PD1 mAb for classical Hodgkin's lymphoma and metastatic urothelial carcinoma, is licensed by Novartis from BeiGene under a contract. In addition to royalties and milestone payments, BeiGene will receive an upfront payment of $650 Mn.

Healthcare Policies and Regulatory Landscape

The Federal Joint Committee (Gemeinsamer Bundesausschuss), a public health agency authorized to establish binding regulations arising out of health reform laws voted by legislators, as well as routine decisions involving healthcare in Germany, regulates the German healthcare system. Promising new cancer research results must be implemented as soon as possible in clinical research and treatment. In order to further this objective, the German Cancer Consortium (DKTK), one of the six German Health Research Centres (DZG), was established in 2012. Germany has a medical regulating organization it is called the Federal Institute for Drugs and Medical Devices (BfArM, or Bundesinstitut für Arzneimittel und Medizinprodukte). The Federal Ministry of Health (BMG) oversees health operations.

Reimbursement Scenario

In Germany, statutory health insurance, which is required for all citizens, typically covers cancer treatment. Chemotherapy, radiation therapy, surgery, and supportive care are only a few of the cancer therapies that are covered by statutory health insurance. The particular coverage, however, may change based on the patient's insurance plan and the type of care being received. Certain therapies need the insurance provider's prior approval. In Germany, purchasing private health insurance is another alternative, which may provide additional cancer treatment coverage as well as coverage for procedures not included in the mandatory health insurance, such as some experimental therapies or complementary therapies. Private insurance plans, however, have more expensive premiums.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Oncology Drugs Market Segmentation

By Drug class

- Cytotoxic drugs

- Alkylating agents

- Antimetabolites

- Others

- Targeted drugs

- Monoclonal antibodies

- Others

- Hormonal drugs

- Others

By Therapy

- Chemotherapy

- Targeted therapy

- Immunotherapy

By Indication

- Lung cancer

- Stomach cancer

- Colorectal cancer

- Breast cancer

- Prostate cancer

- Others

By Dosage form

- Solid

- Tablets

- Capsules

- Liquid

- Injectable

- Prefilled syringes

- Others

By Distribution channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- ?Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.