Germany Dialysis Market Analysis

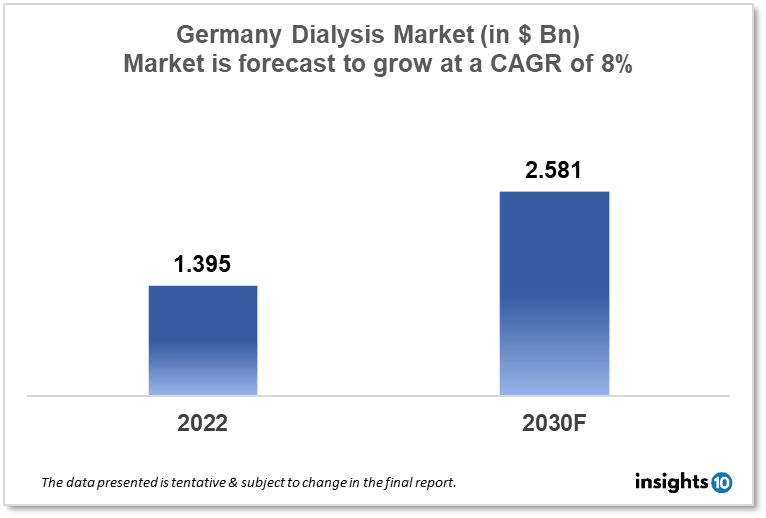

Germany's dialysis market is projected to grow from $1.395 Bn in 2022 to $2.581 Bn by 2030, registering a CAGR of 8% during the forecast period of 2022-2030. One of the main reasons propelling market growth in Europe is the expanding elderly population. In 2020, 91% of the dialysis market in Europe was accounted for by the hemodialysis segment. Due to its increased dialysis efficacy, patients choose hemodialysis (HD). Additionally, the emergence of less complicated hemodialysis machines has made home hemodialysis easy. With the right training and assistance from a friend or family member, one may be able to perform hemodialysis at home.

Buy Now

Germany Dialysis Market Executive Summary

Germany's dialysis market is projected to grow from $1.395 Bn in 2022 to $2.581 Bn by 2030, registering a CAGR of 8% during the forecast period of 2022-30.

PPP GDP for Germany is $4.0 Tn, but the nominal GDP is $3.5 Tn. The GDP calculated using purchasing power parity (PPP) comes in fifth, whereas the nominal GDP comes in fourth. In 2015, the GDP grew at a positive rate of 1.7%. PPP estimates place the GDP per capita at $48,000 and the nominal GDP at $42,000. The highest GDP composition by end users, accounting for 54.1% of the GDP, is consumed by households. According to estimates, the GDP contribution of services is 69.1%, followed by that of industries at 30.2% and agriculture at 0.7%. With an unemployment rate of 4.2% and one of the lowest inflation rates—around 0.5%—in Germany. 15.5% of people in the country are considered to be poor. There are 45 Mn persons in the labour force, of whom 73.8% work in the service industry, 24.6% in manufacturing, and 1.6% in agriculture. According to estimates, the national debt is 72% of the GDP. Revenue in Germany is $1.1 Tn, while expenses total $1.1 Tn. According to estimates, the nation's foreign reserves total $0.4 Tn.

The market for pharmaceuticals in Germany is predicted to grow as a result of an increase in patent applications that are concentrated on the development of novel drug delivery technologies, new medications, and formulations. The number of pharmaceutical patent applications increased by 4.4% in 2018, according to the European Patent Office's (EPO) 2019 Patent Index. Therefore, it is predicted that an increase in patent applications will speed up innovation in the pharmaceutical sector. Additionally, it is projected that the Federal Republic of Germany's expanding export of pharmaceuticals to a number of nations will accelerate the expansion of the pharmaceutical market.

Europe's dialysis market was headed by Germany, which saw 3% CAGR growth through 2027. Favorable reimbursement rules and the presence of major corporations will accelerate the development of the industry at the national level. Additionally, one of the nations with a high frequency of kidney failure in Germany. There are around 80,000 people in the nation who have the end-stage renal disease (ESRD). Hemodialysis or peritoneal dialysis are used to treat these patients. One of the main reasons propelling market growth in Germany is the growing elderly population. For instance, according to Eurostat statistics, 20.6% of the EU's population is 65 years of age or older in 2020, while the percentage of persons in that age group is projected to increase from 5.9% in 2020 to 14.6% in 2100. Diabetes, heart issues, and high blood pressure are just a few of the additional health issues that senior individuals may have as a result of renal illnesses or disturbances in normal kidney function. Thus, it is extremely important to treat renal problems as soon as possible.

Market Dynamics

Market Growth Drivers Analysis

ESRD and CKD have one of the greatest overall costs and healthcare service burdens. Renal failure and chronic kidney disease are becoming more common, which is one of the main drivers of market expansion. When one or both kidneys permanently stop functioning adequately, a patient has the end-stage renal disease (ESRD), which necessitates long-term renal infusion therapy or a kidney transplant. Therefore, increasing ESRD prevalence is increasing the financial burden of kidney disorders in Germany and is a major driver of rising service revenue.

Market Restraints

One alternative form of treatment for those with ESRD and stage III CKD is a kidney transplant, in which the patient receives a healthy kidney from a donor, and the diseased kidney is replaced. The superior treatment outcomes linked to kidney transplantation and the procedure's cost due to favorable reimbursement policies are anticipated to have an impact on the market's growth during the forecast period. Because kidney transplantation has long-term advantages versus renal infusion, patients with ESRD prefer it over the latter. The market growth may be adversely impacted by this.

Competitive Landscape

Key Players

The biggest companies in the dialysis market in Germany are

- DaVita

- Baxter

- Medtronic

- B. Braun

- Fresenius Kabi

- Physidia

- Diaverum

- Nxstage Medical Inc.

- Merck Kgaa

- Cantel Medical

- and others

Healthcare Policies and Regulatory Landscape

Germany presents a lot of economic potential for pharmaceutical and medical device firms thanks to its universal healthcare system. The regional Regulatory operations are supervised/regulated by the Federal Institute for Drugs and Medical Devices, Bundesinstitut für Arzneimittel und Medizinprodukte (BfArM). The regulatory structure in Germany, which has the oldest healthcare system in the world and has undergone numerous revisions, is one of the most difficult to navigate when applying for the required registrations and permissions.

Reimbursement Scenario

All patients insured by the SHI are typically entitled to adequate medical care, including the delivery of medications. The provision of rewards in kind is the foundation of the SHI system. This implies that people do not need to pay for their own medical care before requesting reimbursement from their personal SHI. In contrast, patients receive medical care in-kind, including prescription drugs, without having to make any payments of their own (aside from statutorily required co-payments), and the SHI then pays the pharmacists.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Dialysis Market Segmentation

The Dialysis Market is segmented as mentioned below:

By Type (Revenue, USD Billion):

- Hemodialysis (HD)

- Conventional Hemodialysis

- Short daily hemodialysis

- Nocturnal hemodialysis

- Peritoneal dialysis (PD)

- Continuous Ambulatory Peritoneal Dialysis (CAPD)

- Automated Peritoneal Dialysis (APD)

By Product & Services (Revenue, USD Billion):

- Equipment

- Dialysis Machines

- Water Treatment Systems

- Others Dialysis Equipment

- Consumables

- Dialyzers

- Catheters

- Other Dialysis Consumables

- Dialysis Drugs

- Services

By End User (Revenue, USD Billion):

- In-center dialysis

- Home dialysis

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.