Germany Depression Therapeutics Market Analysis

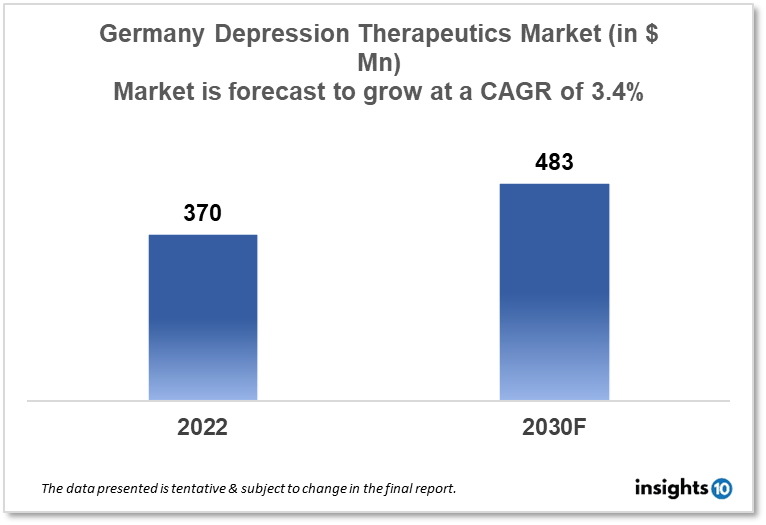

The German depression therapeutics market is expected to witness growth from $370 Mn in 2022 to $483 Mn in 2030 with a CAGR of 3.4% for the forecasted year 2022-2030. The growing awareness of depression and the rising technological advancements like telemedicine and digital therapeutics are the major market drivers. The German depression therapeutics market is segmented by drug type, therapies, indication, and by end users. ix Therapeutics, Denk Pharma, and AstraZeneca are the major players in the German depression therapeutics market.

Buy Now

Germany Depression Therapeutics Market Executive Analysis

The German depression therapeutics market size is at around $370 Mn in 2022 and is projected to reach $483 Mn in 2030, exhibiting a CAGR of 3.4% during the forecast period. The minister of health in Germany is requesting an increase of $33 Bn in the 2023 budget. This year, the central government will spend a total of $531 Bn. One of the most challenging legal areas in the world of life sciences legislation is undoubtedly the German regulation of pharmaceutical pricing and reimbursement. The draft Act for the Financial Stabilization of the German Statutory Health Insurance System ("GKV-FinStG") was approved by the German Parliament on October 20, 2022. The German healthcare system is experiencing rising costs while also dealing with a decrease in funding, so the new law includes substantial cost-containment measures.

Over the past few years, German social insurance carriers have observed a substantial rise in the prevalence of depression in health services, which has been accompanied by rising public awareness. The greatest %age of sick days in Germany is attributed to depression, and this %age is steadily increasing. According to population-based studies, the prevalence of depression over a year and a lifespan range from 6% to 10% and 12% to 17%, respectively.

Integrated and collaborative care models represent a potential strategy to enhance the treatment of depression. However, the funding and service structure for mental health care in Germany does not sufficiently encourage intersectoral cooperation between hospitals and providers of outpatient treatment. The tradition of integrating psychoanalysis with medicine was the initial foundation of the German psychosomatic approach. However, German psychosomatic medicine also has another foundation that served as a separate precursor to contemporary bio-psycho-social medical theories. Inpatient and outpatient treatment programs for psychosomatic disorders are frequently multimodal therapy programs that mix individual and group psychotherapy and are informed by research on effective practices. Psychodynamic and cognitive-behavioural approaches are frequently combined in a single, well-rounded paradigm.

Market Dynamics

Market Growth Drivers

With an estimated 4.1 Mn patients in Germany, depression is a prevalent mental health problem. As more people seek therapy for their symptoms, the rising prevalence of depression is a significant market driver for depression therapeutics. More people are getting treatment for depression in Germany as a result of rising mental health awareness. Additionally, this is increasing the need for efficient depression treatments. Technology advancements like telemedicine and digital therapeutics are making it simpler for people to obtain depression treatment. The German depression therapeutics market is expanding as a result.

Market Restraints

Innovative treatments may not constantly be available due to Germany's harsh regulatory setting for depression therapeutics. Moreover, it can take longer and charge more to bring innovative drugs to market, which may discourage industries from making R&D funds. In Germany, generic medicines are commonly used to treat depression because they are often not as much of expensive as name-brand medicines. This might make it more problematic for businesses to contest on price with generic medications, which might limit the German depression therapeutics market development.

Competitive Landscape

Key Players

- MorphoSys (DEU)

- Medigene (DEU)

- Ethris (DEU)

- iOmx Therapeutics (DEU)

- Denk Pharma (DEU)

- AstraZeneca

- Bristol-Myers Squibb

- Cipla

- Eli Lily

- GlaxoSmithKline

- Johnson & Johnson

Healthcare Policies and Regulatory Landscape

In Germany, health insurance typically pays for the treatment of depression. Many different types of treatments for melancholy, including psychotherapy and medication, are covered by the statutory health insurance system. However, patients and healthcare professionals should be informed of specific reimbursement policies and limitations. For instance, psychotherapy is typically covered by health insurance, but due to lengthy waiting lists, patients may have to wait several weeks or months before they can receive treatment. In some instances, patients might need to foot the bill for psychotherapy on their own if they want treatment more swiftly. Additionally, health insurance typically pays for depression medicine, though there may be limitations on the kinds of medications that are covered. For instance, patients may have to attempt older, less expensive medications first before they can access newer, more expensive antidepressants if those medications are not covered.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Depression Therapeutics Segmentation

By Drug Type (Revenue, USD Billion):

- Antidepressants

- Anxiolytics

- Anticonvulsants

- Noradrenergic Agents

- Atypical Antipsychotics

By Therapies (Revenue, USD Billion):

- Electroconvulsive Therapy (ECT)

- Cognitive Behaviour Therapy (CBT)

- Psychotherapy

- Deep Brain Stimulation

- Transcranial Magnetic Stimulation (TMS)

- Cranial electrotherapy stimulation (CES)

By Indication (Revenue, USD Billion):

- Major Depressive Disorder (MDD)

- Bipolar Disorder

- Dysthymic Disorder

- Postpartum Depression

- Seasonal Affective Disorder (SAD)

- Premenstrual Dysphoric Disorder (PMDD)

- Others

By End Users (Revenue, USD Billion):

- NGOs

- Asylums

- Hospitals

- Mental Healthcare Centers

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.