Germany Clinical Diagnostics Market Analysis

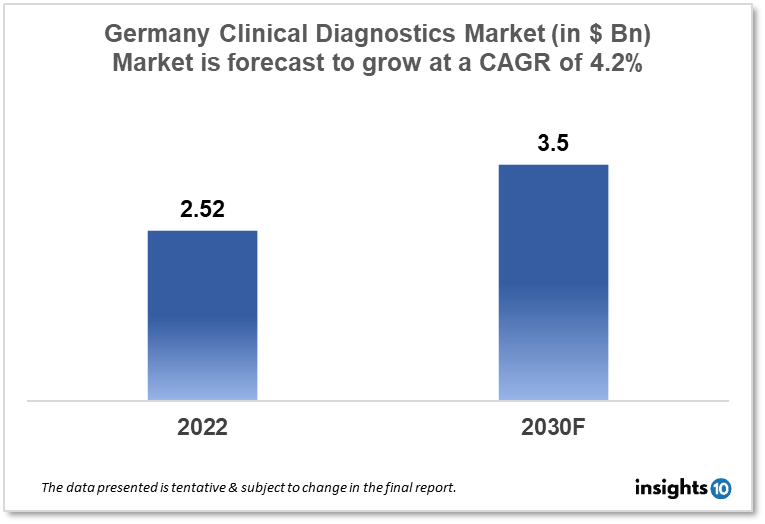

Germany's clinical diagnostic market was valued at $2.52 Bn in 2022 and is estimated to expand at a CAGR of 4.2% from 2022-30 and will reach $3.50 Bn in 2030. One of the main reasons propelling the growth of this market is an increase in chronic disease and government support. The market is segmented by type, drug, and distribution channel. Some key players in this market are Abbott, BD, bioMérieux SA, Bio-Rad Laboratories, Danaher Corporation, Siemens AG, Hologic, Qiagen NV, Quest Diagnostics, F. Hoffmann-La Roche Ltd, Merck and others.

Buy Now

Germany Clinical Diagnostic Market Executive Summary

The Germany Clinical Diagnostic market was valued at $2.52 Bn in 2022 and is estimated to expand at a CAGR of 4.2% from 2022 to 2030 and will reach $3.50 Bn in 2030. Clinical diagnostics is a discipline of medicine that involves the use of laboratory tests and other diagnostic tools to assess a patient's health and detect the presence of diseases or disorders. These tests, which can be performed on blood, urine, tissue samples, or other physiological fluids, can offer data on a variety of factors, including biochemical, genetic, and immunological indicators. Clinical diagnostics can be utilized for a number of objectives, including disease diagnosis, disease progression monitoring, disease risk screening, and therapeutic decision-making.

Immunochemistry, molecular diagnostics, clinical microbiology, hematology, and other sectors compose the German clinical diagnostics market. Immunochemistry is currently the market's largest category, accounting for the majority of sales. This is primarily because immunoassays are widely used in clinical laboratories for the diagnosis of infectious illnesses, malignancies, and autoimmune disorders in Germany.

Market Dynamics

Market Growth Drivers

The prevalence of chronic diseases such as diabetes, cardiovascular disease, and cancer is on the rise in Germany, which is driving the demand for diagnostic tests. According to the Federal Statistical Office of Germany, the number of people diagnosed with diabetes in Germany increased from 6.9 Mn in 2009 to 7.6 Mn in 2019, representing a growth of 10%. Similarly, the number of cancer cases in Germany is projected to increase from 492,000 in 2020 to 583,000 in 2040, representing a growth of 18%. The aging population in Germany is also a major driver of growth in the clinical diagnostics market, as elderly people are more prone to chronic diseases and require more frequent diagnostic tests.

According to the Federal Statistical Office of Germany, the proportion of the population aged 65 years and over is projected to increase from 21% in 2020 to 28% in 2040. The development of new and advanced diagnostic technologies is also driving the growth of the clinical diagnostics market in Germany. For example, the use of next-generation sequencing (NGS) is increasing in molecular diagnostics, allowing for faster and more accurate genetic testing. According to a report by Grand View Research, the NGS market in Germany is projected to grow at a CAGR of 14.5% from 2020 to 2027. Point-of-care testing (POCT) devices are becoming increasingly popular in Germany, as they allow for rapid diagnosis and monitoring of diseases.

Market Restraints

Germany has a strict regulatory environment for clinical diagnostics products, which can create barriers to entry for new players and slow down the approval process for new products. This can lead to delays in the commercialization of innovative products and limit the growth of the market. According to a report by Transparency Market Research, the regulatory hurdles in Germany have made it difficult for small and medium-sized enterprises to enter the market. The high cost of diagnostic tests can be a barrier to access for patients, particularly those who are uninsured or underinsured. This can limit the demand for diagnostic tests and slow down the growth of the market.

According to a report by the Organisation for Economic Co-operation and Development (OECD), the cost of healthcare in Germany is among the highest in Europe, with spending on healthcare accounting for 11.1% of GDP in 2019. There is a shortage of skilled labor in the clinical diagnostics industry in Germany, particularly in the areas of molecular diagnostics and bioinformatics. This can limit the ability of companies to innovate and develop new products, and can also impact the quality of diagnostic tests. According to a report by the German Federal Employment Agency, there is a shortage of skilled labor in the healthcare industry, with an estimated 100,000 vacancies in the sector in 2020. The COVID-19 pandemic has had a significant impact on the clinical diagnostics market in Germany, with disruptions to supply chains, delays in testing, and reduced demand for non-COVID-19 diagnostic tests. While the pandemic has also created opportunities for the market, such as the demand for COVID-19 testing, it has also created significant challenges that could impact the growth of the market in the short term.

Competitive Landscape

Key Players

- Abbott

- Bio-Rad Laboratories

- Danaher Corporation

- Siemens

- Qiagen NV

- Quest Diagnostics

- F. Hoffmann-La Roche

- Merk

- BD

- Nordwest Clinic

Healthcare Policies and Regulatory Landscape

Health Insurance Act (Sozialgesetzbuch - SGB) is the primary legislation governing healthcare in Germany, including the reimbursement of diagnostic tests by the statutory health insurance system. The SGB outlines the criteria for the reimbursement of medical services, including diagnostic tests, and establishes a system for negotiating reimbursement rates with healthcare providers and laboratories. German Medical Association (Bundesärztekammer - BÄK): The BÄK is the professional association representing physicians in Germany. The BÄK is responsible for setting professional standards for physicians, including standards for the use and interpretation of diagnostic tests.

Medical Devices Act (Medizinproduktegesetz - MPG) is the primary regulation governing medical devices in Germany, including diagnostic devices. The MPG outlines requirements for the safety, performance, and labeling of medical devices, as well as requirements for clinical evaluation and post-market surveillance. In 2017, the MPG was revised to align with the European Union's Medical Devices Regulation (MDR), which came into effect in 2021.

Reimbursement Scenario

The reimbursement scenario for clinical diagnostics in Germany is complex and can vary depending on the type of test, the indication, and the healthcare setting. Generally, diagnostic tests are reimbursed by the statutory health insurance system, which covers the majority of the population in Germany. The reimbursement system in Germany is based on a diagnosis-related group (DRG) system, which groups patients into categories based on their diagnosis and treatment. Diagnostic tests are typically reimbursed as part of the overall DRG payment for the patient's hospitalization or outpatient visit. In addition to the DRG system, there are also specific reimbursement codes for diagnostic tests, known as laboratory fee schedules. These codes are used to bill for laboratory tests performed in independent laboratories and can vary depending on the type of test and the region of the country. The reimbursement rates for diagnostic tests in Germany are negotiated between the statutory health insurance funds and the associations representing healthcare providers and laboratories. These negotiations can be complex and can consider factors such as the cost of the test, the clinical benefit, and the competitive landscape.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Clinical Diagnostics Market Segmentation

By Test

- Lab Test

- Imaging Test

- Other Tests

By Product

- Instruments

- Reagents

- Other Products

By End User (Revenue, USD Bn)

- Hospital Laboratory

- Diagnostic Laboratory

- Point-of-care Testing

- Other End Users

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.