Germany Cardiovascular Diseases Therapeutics Market Analysis

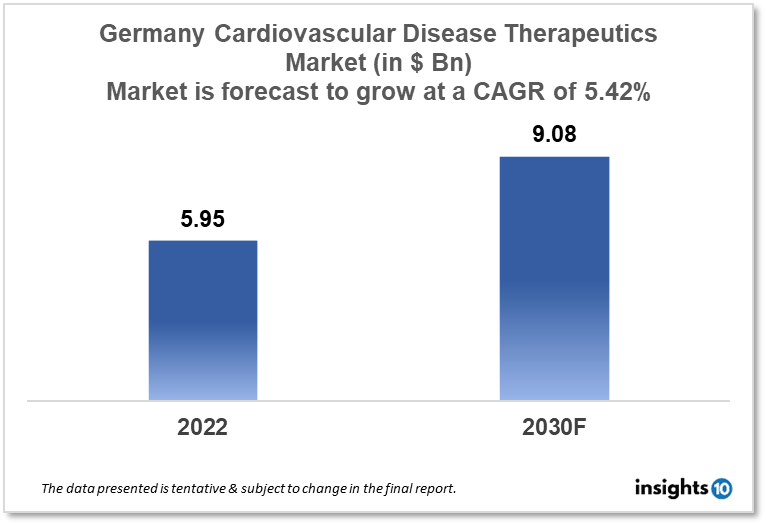

Germany's cardiovascular disease therapeutics market is expected to witness growth from $5.95 Bn in 2022 to $9.08 Bn in 2030 with a CAGR of 5.42% for the year 2022-2030. Technological advancements and supportive government policies in terms of cardiovascular diseases in Germany are responsible for the growth of the market. The Germany cardiovascular disease therapeutics market is segmented by disease indication, drug type, route of administration, drug classification, mode of purchase, and by the end user. Waypharm, Cordes Pharma, and Pfizer are the major players in the Germany cardiovascular disease therapeutics market.

Buy Now

Germany Cardiovascular Disease Therapeutics Market Executive Analysis

Germany's cardiovascular disease therapeutics market size is at around $5.95 Bn in 2022 and is projected to reach $9.08 Bn in 2030, exhibiting a CAGR of 5.42% during the forecast period. In 2022, Germany's present health expenditure was paid for by transfers and subsidies from the government. According to the Federal Statistical Office (Destatis), this represents a rise of $18.5 Bn, or 32%, from the previous year. Therefore, 16% of the $483,5 Bn in current health expenditure was made up of government transfers and subsidies, an increase of 3% points from the previous year. Since the calculations started in 1992, that was the biggest increase in this kind of financing. Direct federal subsidies to combat the Covid-19 pandemic were the cause of the rise in government transfers and subsidies, which include, for instance, the yearly federal grant to the umbrella health fund and the subsidies from public employers.

The health of the majority of Germans continues to be significantly impacted by cardiovascular disease. For many years, it has been the main cause of mortality in Germany, accounting for 36.1% of deaths in men and 43.9% of deaths in women. The majority of the expenses associated with disease directly affecting the German healthcare system are also attributable to cardiovascular disease. The four most significant cardiovascular diseases - Coronary Heart Disease (CHD), myocardial infarction, stroke, and heart failure - are responsible for more than two-thirds of cardiovascular mortality and roughly half of all cardiovascular hospital diagnoses and total disease expenses.

In addition to serving as an intermediary molecule between DNA and proteins, RNA also functions as a dynamic and adaptable regulator of gene translation, according to a number of lines of evidence. In order to achieve this, biotechnology firms in Germany are presently developing RNA-targeting therapies for use in clinical settings, broadening the universe of "drug-able" targets. The endogenous regulators of gene silencing, small interfering RNAs (siRNAs), and microRNAs (miRNAs) have been researched as possible therapeutics. While miRNA-based therapeutics include miRNA inhibitors and miRNA mimics that, respectively, antagonize and imitate the function of an endogenous miRNA, synthetic siRNAs are used to suppress the expression of the mRNA target. Several clinical trials are presently investigating the therapeutic potential of RNA-targeting therapies in the context of cardiovascular disease therapeutics.

Market Dynamics

Market Growth Drivers

Technology advancements have made it simpler to identify and manage Cardiovascular Disease (CVD). For instance, improved imaging methods are enabling faster and more precise heart disease diagnosis, while minimally invasive techniques are simplifying heart surgery. The efficacy of CVD therapeutics is anticipated to increase due to these technological developments, which will also increase demand. To mitigate the strain that CVD is placing on the healthcare system, the German government is taking action. This includes programs that support healthy lifestyles, such as those that encourage exercise and wholesome eating, as well as funding for studies into CVD. It is anticipated that these efforts will increase the demand in the Germany cardiovascular disease therapeutics market.

Market Restraints

As the patents on the current CVD therapeutics end, generic versions of these medications become accessible. Competing prices and decreased revenue for the pharmaceutical companies that designed the initial drugs can result from this. The regulatory procedure for drug clearance in Germany is stringent and time-consuming. This could slow down the pace at which new medications are introduced to the market and raise the price of developing new medications. The quantity of funding available for CVD therapeutics in Germany may be constrained by the country's limited healthcare budgets. This may make it difficult for some patient populations to obtain care or may reduce the amount of study and development that can be done.

Competitive Landscape

Key Players

- Walter Ritter (DEU)

- AqVida (DEU)

- Vivatis Pharma (DEU)

- Waypharm (DEU)

- Cordes Pharma (DEU)

- Pfizer

- Bayer

- Janssen Pharmaceuticals

- AstraZeneca

- Sanofi

- Novartis

Healthcare Policies and Regulatory Landscape

In Germany, public and private insurance schemes are used to provide healthcare. The bulk of people is covered by the public system, also known as statutory health insurance (SHI), while people who choose private insurance are covered by the private system. The SHI system offers a variety of medical services, including the detection and management of cardiovascular disease (CVD). The Federal Joint Committee (G-BA) and the Institute for Quality and Efficiency in Health Care (IQWiG) have stringent rules governing the coverage and payment for treatments for CVD. These groups offer recommendations on the efficacy and value of CVD treatments, which the SHI system uses to determine coverage and reimbursement. For instance, the SHI program pays for the expense of medications used to treat high blood pressure, cholesterol, and antiplatelet agents. The SHI system also includes diagnostic procedures like cardiac catheterization, echocardiograms, and ECGs. Coverage and payment for treatments for CVD are subject to restrictions in some circumstances, though. For instance, there might be waiting lists for certain procedures or eligibility requirements that patients must fulfill before receiving certain treatments. Furthermore, some treatments might not be covered by the SHI system; in such cases, patients might have to pay out of cash or choose private insurance in order to receive these services.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Germany Cardiovascular Disease Therapeutics Segmentation

By Disease Indication (Revenue, USD Billion):

- Hypertension

- Coronary Artery Disease

- Hyperlipidaemia

- Arrhythmia

- Others

By Drug Type (Revenue, USD Billion):

- Antihypertensive

- Anticoagulants

- Antihyperlipidemic

- Antiplatelet Drugs

- Others

By Route of Administration (Revenue, USD Billion):

- Oral

- Parenteral

- Others

By Drug Classification (Revenue, USD Billion):

- Branded Drugs

- Generic Drugs

By Mode of Purchase (Revenue, USD Billion):

- Prescription-Based Drugs

- Over-The-Counter Drugs

By End Users (Revenue, USD Billion):

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.