Germany Cancer Induced Bone Disease Therapeutics Market Analysis

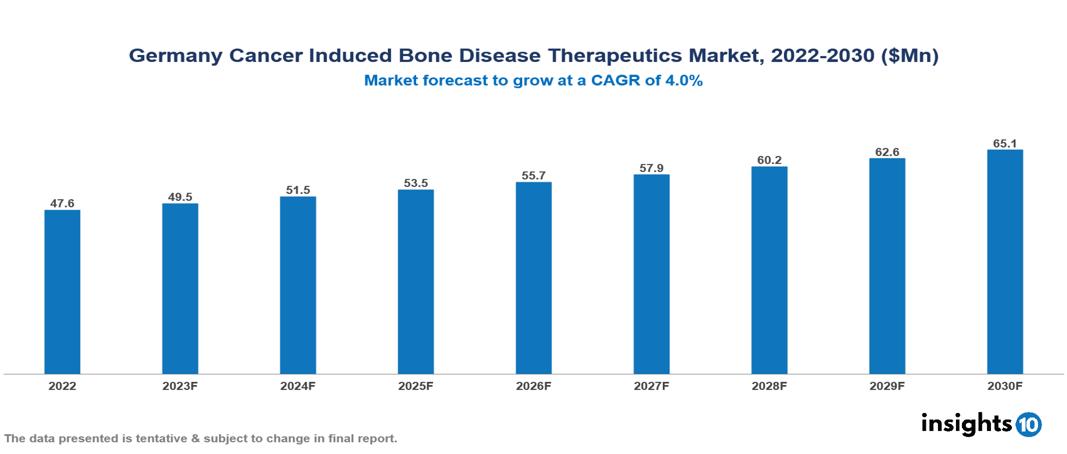

The Germany Cancer Induced Bone Disease Therapeutics Market was valued at $48 Mn in 2022 and is predicted to grow at a CAGR of 4% from 2023 to 2030, to $65 Mn by 2030. The key drivers of this industry include the rising prevalence of different cancers, advancements in diagnostics, and a robust healthcare system. The industry is primarily dominated by players such as Amgen, Novartis, Pfizer, Roche, Eli Lilly, Pharmalucence, and Bayer, among others.

Buy Now

Germany Cancer Induced Bone Disease Therapeutics Market Analysis Executive Summary

The German Cancer Induced Bone Diseases Therapeutics Market is at around $48 Mn in 2022 and is projected to reach $65 Mn in 2030, exhibiting a CAGR of 4% during the forecast period.

Cancer-associated bone disease refers to a condition that arises either due to the effect of cancer on the skeletal system or as a result of treatments administered to address the primary cancer, resulting in bone loss and fractures. The main symptom typically includes pain in the bones and joints, accompanied by potential signs such as swelling, stiffness, or tenderness in the affected bone, difficulties with movement, unexplained weight loss, a fractured bone, loss of sensation in the affected limb, and fatigue. Presently, treatment options for cancer-related bone disease involve the use of bone-modifying agents such as bisphosphonates and denosumab, known for their effectiveness in preventing and delaying the onset of issues associated with cancer-induced bone problems. Other treatment approaches include surgery, chemotherapy, radiation therapy, targeted therapy, and various drug therapies. Key companies actively engaged in the development and promotion of therapeutics for bone diseases include Amgen, Merck & Co., Roche, Novartis, Eli Lilly and Company, and Bayer AG.

Germany is experiencing an increasing prevalence of cancers like breast, prostate, and lung cancer that develop bone metastases. The market is being propelled by factors such as increasing cancer incidence, advancements in diagnostics, and a robust healthcare system. However, conditions such as limited reimbursement, complex regulatory systems, and increasing competition limit the growth and potential of the market.

Market Dynamics

Market Growth Drivers

Rising cancer incidence: Germany is experiencing a rise in its population size, with a notable increase in the elderly demographic, posing significant risks for cancer. This demographic shift contributes to a higher prevalence of several cancers like prostate (affecting around 23% population) and lung cancer (contributing to around 25% of deaths) prerequisites for bone metastases, a key factor in the development of cancer-induced bone diseases. Moreover, heightened awareness of cancer and the implementation of screening initiatives are resulting in earlier cancer diagnoses.

Advancements in diagnostics: Advancements in diagnostic methods such as advanced imaging and biomarkers are facilitating earlier and more precise identification of bone diseases, enabling timely intervention and enhancing treatment outcomes. The advent of targeted therapies, including bisphosphonates, RANKL inhibitors, and monoclonal antibodies, provides more efficient and personalized treatment alternatives in comparison to conventional chemotherapy. Ongoing research and development in fields like gene therapy and immunotherapy offer encouraging prospects for future breakthroughs in treatment.

Unmet medical need: Although advancements in therapeutics are driving the industry, the growing incidence of cancer and resulting bone disease results in a huge patient population requiring effective treatment which presents opportunities for market growth.

Market Restraints

Limited reimbursement: Securing reimbursement for novel therapeutics from German Krankenkassen (social health insurance funds) can be difficult due to rigorous assessments of cost-effectiveness and prolonged negotiation processes. This introduces uncertainty for manufacturers and has the potential to restrict the market acceptance of new, potentially costly medications.

Regulatory challenges: Securing marketing approval for novel therapeutics in the European Union, including Germany, can be a time-consuming and costly process owing to stringent demands for clinical trials and safety evaluations. This can result in delays in entering the market and elevated development expenses for pharmaceutical firms.

Increasing competition: Current treatments for pain control and fortification of bones are encountering generic competition, leading to pricing and profitability challenges for well-established companies. There is increasing competition in the pipeline as numerous pharmaceutical firms are working on novel therapies for cancer-induced bone diseases. This dynamic landscape poses potential difficulties for securing market share.

Healthcare Policies and Regulatory Landscape

In Germany, the primary regulatory agency overseeing pharmaceuticals, drugs, and medical products is the Federal Institute for Drugs and Medical Devices (BfArM), known in German as "Bundesinstitut für Arzneimittel und Medizinprodukte." BfArM operates under the jurisdiction of the German Ministry of Health and is responsible for the evaluation, authorization, and supervision of pharmaceuticals and medical devices. It ensures that these products meet the necessary standards of quality, safety, and efficacy before they can be made available to the public.

The process of obtaining a license for pharmaceuticals and medical products in Germany involves a comprehensive evaluation by BfArM. It conducts a rigorous assessment to ensure that the products meet the established regulatory standards. While this stringent approach can present challenges for new entrants, it fosters an environment that prioritizes the well-being of patients and ensures the reliability of healthcare products in the market.

Competitive Landscape

Key Players

- Amgen

- Eli Lilly

- Roche

- Bayer

- Novartis

- Pfizer

- Pharmalucence Inc

- Toshiba

- Siemens

- Bristol Myers Squibb Company

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Germany Cancer Induced Bone Disease Therapeutics Market Segmentation

By Cancer Type

- Breast cancer

- Prostate cancer

- Lung cancer

- Others

By Treatment Type

- Bisphosphonates

- Denosumab

- Radiation Therapy

- Pain Management Medications

- Surgical Intervention

- Targeted Therapy

By Distribution channel

- Hospitals

- Pharmacies

- Oncology clinics

- Others

By Stage of Treatment

- Early stage CIBD

- Advanced stage CIBD

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.