Germany Biosensors Market Analysis

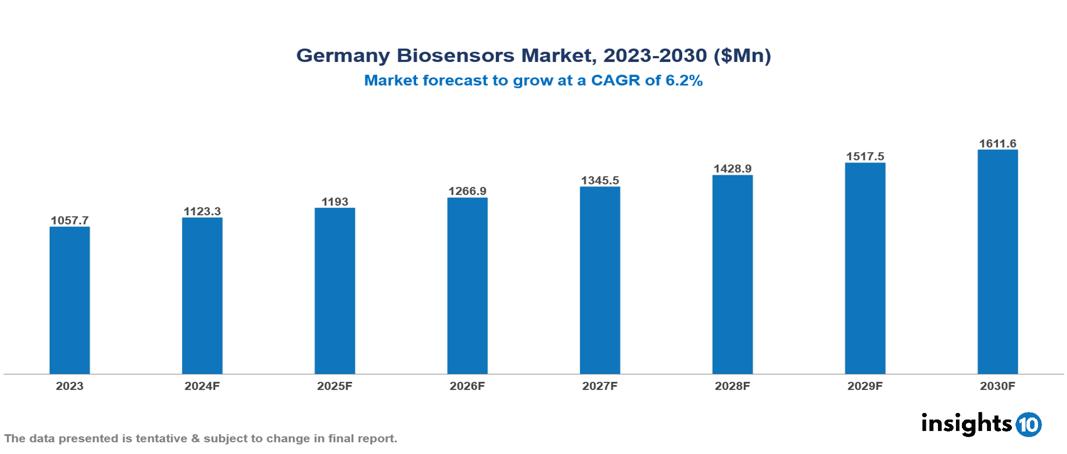

The Germany Biosensors Market was valued at $1057.7 Mn in 2023 and is predicted to grow at a CAGR of 6.2% from 2023 to 2030, to $1611.6 Mn by 2030. The key drivers of the market include increasing burden of chronic diseases, technological advancements, and growing demand for Point-of-Care (POC) testing. The prominent players of the Germany Biosensors Market are Lifesensors, Siemens Healthcare, B. Braun Melsungen AG, Meridian Bioscience, and Biosensors International, among others.

Buy Now

Germany Biosensors Market Executive Summary

The Germany Biosensors market is at around $1057.7 Mn in 2023 and is projected to reach $1611.6 Mn in 2030, exhibiting a CAGR of 6.2% during the forecast period.

Biosensors are devices that convert a biological response into a measurable electrical signal. They generate signals which are proportional to the concentration of the analyte in the reaction. Applications of biosensors include disease monitoring, drug discovery and development, and the identification of contaminants, pathogen-causing microorganisms, and disease-indicating markers in physiological fluids such as blood, urine, saliva, and sweat. A biosensor consists of components, namely the analyte, bioreceptor, transducer, electronics, and the display. 7Analyte is the target molecule which is to be detected in a sample. For instance, an analyte could be glucose which is to be measured in a diabetic patient. A bioreceptor is molecule that specifically recognises the analyte. Examples of bioreceptors include enzymes, cells, aptamers, DNA, and antibodies. Bio-recognition is the process of generating a signal in the form light, heat, pH, charge or mass shift when the bioreceptor and analyte interact. Another important component of biosensors is the transducer which functions to convert one form of energy into another, more specifically it converts the biological signal from the bioreceptor into an electrical signal in a process known as signalisation. Transducers can be electrochemical, optical, or piezoelectric. Electronics is the part of a biosensor that processes the transduced signal and prepares it for display. Lastly, the display consists of a user interpretation system such as the LCD of a computer or a direct printer which generates an output based on the requirements of the end user.

Germany’s epidemiologic transition towards chronic diseases is significantly affecting its society as a whole and the health system in particular. The Germany Biosensors Market is thus driven by significant factors such as the increasing burden of chronic diseases, technological advancements, and growing demand for Point-of-Care (POC) testing. However, stringent regulatory requirements, technical challenges, and data management issues restrict the growth and potential of the market.

The leading players of the Germany Biosensors Market are Lifesensors, Siemens Healthcare, B. Braun Melsungen AG, Meridian Bioscience, and Biosensors International, among others.

Market Dynamics

Market Growth Drivers

Increasing Burden of Chronic Diseases: The age standardized incidence rates of cancer among males and females were 306.5 and 249.0, respectively, according to the WHO in the year 2022. For chronic conditions patients such as oncology patients and hypertension patients, healthcare management is important for effective treatment outcomes. Biosensors are widely used because they offer numerous advantages for chronic diseases. For instance, continuous glucose monitors, or CGMs, assist people with diabetes in better managing their insulin dosages by monitoring blood sugar levels in real-time. Also, by identifying abnormalities early on, wearable biosensors can assist control illnesses like heart disease by tracking vital signals such as heart rate and ECG. Thus, through their many uses in these conditions, the Biosensors Market growth is driven.

Technological Advancements: The field of biosensors is witnessing rapid technological advancements. Fluorescence tagging and the use of nanomaterials such as graphene and carbon nanotubes have significantly improved sensitivity and detection limits. The employment of aptamers and nucleotides as recognition elements is propelling innovative biosensor development. Advances in nanotechnology, materials science, and microfabrication have led to the creation of smaller, more effective biosensors with enhanced sensitivity, specificity, and reaction times. Wearable biosensors now use biocompatible materials to minimize rejection risks and improve patient comfort. The integration of biosensors with AI and ML algorithms has revolutionized data analysis, facilitating personalized healthcare strategies and early disease detection. Overall, these advancements are enhancing biosensor performance and fuelling market growth.

Growing Demand for Point-Of-Care (POC) Testing: The demand for Point-Of-Care (POC) testing is a major driver of growth in the biosensors market for several key reasons. Biosensors are ideally suited for POC testing, offering advantages such as portability, ease of use, and quick results, which conventional lab-based methods often lack. Moreover, POC testing with biosensors enhances healthcare accessibility, even in remote areas or for patients with limited mobility. The COVID-19 pandemic highlighted the vital role of POC testing, where biosensors were crucial in managing the situation. Consequently, the rising demand for POC testing is contributing to the growth of the biosensors market.

Market Restraints

Stringent Regulatory Requirements: Biosensors have the potential to greatly affect health, particularly in medical applications. Biosensor companies need to comply with GDPR and HIPAA regulations. Country-specific regulatory bodies rigorously test medical devices for accuracy, safety, and risks such as data security and biocompatibility. While stringent guidelines ensure patient safety and market trust, the lengthy and costly approval process can delay the launch of innovative biosensors. This can hinder innovation and limit patient access to these technologies. Additionally, strict regulatory requirements lead to higher development costs, increasing the price of biosensors and limiting market expansion.

Technical Challenges: Although advancements in biosensor technology are transforming healthcare, significant technical challenges remain. Enhancing the sensitivity, specificity, and accuracy of biosensors is critical for accurate diagnostics. A primary issue is the ability of biosensors to differentiate the target analyte from other sample components. Additionally, detecting low concentrations of analytes is essential for early disease diagnosis and environmental monitoring, but achieving this high sensitivity in complex biological samples is difficult. Ensuring reproducibility of biosensor results is also crucial but challenging. These hurdles slow the growth of the biosensors market.

Data Management Issues: The health data produced by biosensors is abundant and valuable, necessitating effective storage, organization, and analysis. Achieving this requires a robust data management infrastructure and advanced solutions, which can be costly and difficult to manage. Accurate and precise data is crucial for effective analysis and decision-making, particularly in the medical field, where poor data quality can lead to incorrect and harmful patient decisions. Additionally, integrating data from multiple biosensors can be challenging due to varying formats, standards, and protocols, hindering data sharing and interoperability across departments. Consequently, these data management challenges can hinder the growth of the biosensors market.

Regulatory Landscape and Reimbursement Scenario

The Federal Institute for Drugs and Medical Devices (BfArM, Bundesinstitut für Arzneimittel und Medizinprodukte) is the primary regulating body in Germany for pharmaceuticals. The main goal of BfArM is to protect public health in Germany by guaranteeing the efficacy, safety, and quality of pharmaceuticals and medical equipment. BfArM reviews and grants marketing authorizations for new drugs and medical devices for ensuring strict safety and efficacy requirements. Clinical trials carried out in Germany are also supervised to ensure they follow ethical principles and protect the rights of study participants.

For approval, the pharmaceutical companies must submit a completed MAA (Marketing Authorization Application) which can be used for drugs meant for the France market (National Procedure) or for the drugs intended for commercialization throughout the European Union (EU) through the EMA (European Medicines Agency). Through the EMA, products can be authorized through the National Procedure, the Centralised Procedure (CP), Decentralised Procedure (DCP) or Mutual Recognition Procedure (MRP). In this case, BfArM acts as a national competent authority (NCA) within the EMA framework. It then issues a final decision of either approval, conditional approval or refusal after conducting a review and evaluation of the MAA based on safety, efficacy, quality, and risk-benefit ratio.

The majority of people in Germany are covered by statutory health insurance (SHI), which is based on the social insurance model of healthcare delivery. A wide range of services are covered by statutory health insurance (SHI), including hospital stays, doctor visits, specialist consultations, preventive care, and rehabilitation. Employer and employee contributions provide the funding for SHI. Some people have the option of purchasing private health insurance (PHI), which has lower co-payments and more comprehensive coverage than SHI.

Competitive Landscape

Key Players

Here are some of the major key players in the Germany Biosensors Market:

- Lifesensors

- Siemens Healthcare

- B. Braun Melsungen AG

- Meridian Bioscience

- Biosensors International

- Nix Biosensors

- Abbott Laboratories

- Medtronic

- Siemens Healthcare

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Germany Biosensors Market Segmentation

By Technology

- Electrochemical Biosensors

- Optical Biosensors

- Piezoelectric Biosensors

- Thermal Biosensors

- Nanomechanical Biosensors

By Product

- Wearable Biosensors

- Non-wearable Biosensors

By Application

- Medical Diagnostics

- Food Safety

- Environmental Monitoring

- Agriculture and Bioreactor Monitoring

- Other

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.