Germany Bio-implant Market Analysis

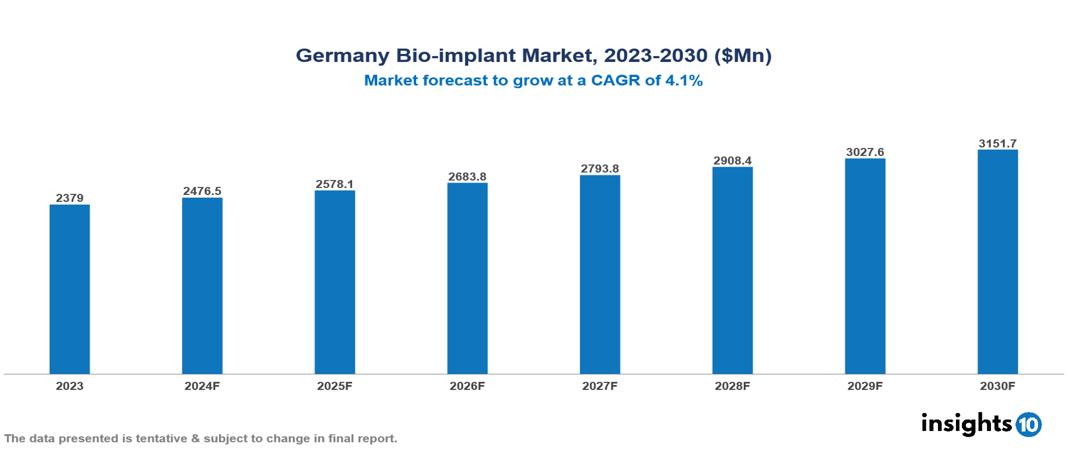

The Germany Bio-implant Market was valued at $2379 Mn in 2023 and is predicted to grow at a CAGR of 4.1% from 2023 to 2030, to $3151.7 Mn by 2030. The Germany Bio-implant Market is growing due to Technological Advancements, Healthcare Expenditure, and Increasing Surgical Procedures. The market is primarily dominated by players such as B. Braun Melsungen AG, Biotronik SE & Co. KG, Zimmer Biomet Holdings, Inc., Otto Bock HealthCare GmbH, Heraeus Holding GmbH, and Stryker Corporation.

Buy Now

Germany Bio-implant Market Executive Summary

Germany Bio-implant Market is at around $2379 Mn in 2023 and is projected to reach $3151.7 Mn in 2030, exhibiting a CAGR of 4.1% during the forecast period.

Bio-Implants are prosthetic devices that are intended to supplement, improve, or replace a biological structure. They are made of a variety of biosynthetic materials, including collagen and tissue-engineered products, such as artificial skin. Bio-implants, which are often composed of biocompatible materials, reduce the likelihood of rejection. The market for bio-implants has grown significantly over the years as a result of advancements in healthcare technology. The bio-implants market has become more complex due to the emergence of critical medical diseases, despite the fact that the healthcare sector has experienced substantial technological breakthroughs over time.

Germany bioimplant market is significantly influenced by its high prevalence of chronic diseases and aging population. About 40% of the population suffers from at least one chronic condition, such as cardiovascular disease or diabetes. The country has a substantial elderly demographic, with over 22% of its population aged 65 and above as of 2024. This aging population increases the demand for bioimplants due to age-related health issues. Therefore, the market is driven by significant factors like Technological Advancements, Healthcare Expenditure, and Increasing Surgical Procedures. However, Competition from Alternative Treatment, Regulatory Challenges, Pricing and Reimbursement Issues restrict the growth and potential of the market.

BIOTRONIK, a leading German company in the bio-implant sector, has been focusing on developing next-generation cardiovascular implants. Recently, they introduced new iterations of their Orsiro Mission drug-eluting stent, which offers improved deliverability and patient outcomes.

Market Dynamics

Market Growth Drivers

Technological Advancements: Germany is at the forefront of medical technology innovations. The country's robust R&D sector, supported by substantial government and private investments, has led to the development of advanced bioimplants. The German Medical Technology Association (BVMed) reported that the medtech industry invested around 9.5% of its revenue in R&D in 2022.

Healthcare Expenditure: Germany's high healthcare expenditure supports the bioimplant market. In 2021, Germany spent approximately 11.7% of its GDP on healthcare, among the highest in Europe. This substantial investment ensures better access to advanced medical treatments, including bioimplants.

Increasing Surgical Procedures: The number of surgical procedures involving bioimplants is rising. For instance, the German Society for Orthopedics and Trauma Surgery reported that around 450,000 hip and knee replacements were performed in 2022. This growing number of surgeries directly correlates with increased bioimplant demand.

Market Restraints

Competition from Alternative Treatments: Bioimplants face stiff competition from conventional treatments such as autografts, allografts, and synthetic implants. These alternatives are often perceived as more affordable and accessible. For example, autografts are considered the gold standard for bone grafting due to their high success rates, making it challenging for bioimplants to gain market share.

Regulatory Challenges: The stringent regulations and approval processes for bioimplants in Germany can delay product launches and increase costs. The European Medicines Agency (EMA) and the German Federal Institute for Drugs and Medical Devices (BfArM) require rigorous clinical trials and extensive documentation, which can be time-consuming and expensive for manufacturers.

Pricing and Reimbursement Issues: The pricing and reimbursement landscape in Germany is highly regulated, which can limit the profitability of bioimplants. The country's healthcare system often favors cost-effective treatments over innovative but expensive solutions. For instance, the reimbursement rates for bioimplants can be up to 30% lower compared to other European countries, affecting the financial viability of these products.

Regulatory Landscape and Reimbursement scenario

In Germany, the Federal Institute for Drugs and Medical Devices (BfArM) oversees compliance, ensuring that products meet rigorous standards before market entry. Additionally, manufacturers must navigate the CE marking process, indicating conformity with health, safety, and environmental protection standards. The regulatory landscape also requires adherence to ISO standards, particularly ISO 13485 for quality management systems. These stringent regulations, while ensuring high safety and quality, also pose challenges for market entry, particularly for smaller companies due to the increased costs and complexity of compliance.

Reimbursement scenario for the bioimplant market is complex, with coverage determined by statutory health insurance (SHI) and private health insurance (PHI). While SHI covers most medically necessary procedures, bioimplants may require prior authorization and justification of medical necessity. Reimbursement rates and coverage levels can vary, with newer and high-cost bioimplants facing stricter scrutiny. Additionally, supplementary private insurance often covers advanced and innovative bioimplants, filling gaps left by SHI and alleviating financial burdens on patients.

Competitive Landscape

Key Players

Here are some of the major key players in the Germany Bio-implant Market:

- B. Braun Melsungen AG

- Biotronik SE & Co. KG

- Otto Bock HealthCare GmbH

- Heraeus Holding GmbH

- Stryker Corporation

- Zimmer Biomet

- Medtronic

- Boston Scientific Corporation

- Johnson & Johnson Services, Inc.

- LifeNet Health

- Smith & Nephew

- Arthrex, Inc.

- Clinic Lemanic

- Alpha Bio Tec

- MiMedx Group

- St Jude Medical (Abbott)

- DePuy Synthes

- Exactech, Inc.

- Cochlear Ltd

- Straumann AG

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Germany Bio-implant Market Segmentation

By Material

- Ceramics

- Polymers

- Alloys

- Biomaterials Metals

By Type

- Dental Bio-implants

- Orthopedic Bio-implants

- Spinal Bio-implants

- Ophthalmology Bio-implants

- Cardiovascular Bio-implants

- Others

By Mode of Administration

- Surgical

- Injectable

By End User

- Hospitals

- Speciality Clinics

- Ambulatory surgical centers

By Origin

- Autograft

- Allograft

- Xenograft

- Synthetic

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.