Germany Autologous Matrix-induced Chondrogenesis Market Analysis

Germany Autologous Matrix-induced Chondrogenesis Market is projected to grow from $xx Mn in 2022 to $xx Mn by 2030, registering a CAGR of xx% during the forecast period of 2022 - 2030. The AMIC market is driven by increasing knee injuries and cartilage defects, advancements in regenerative medicine, and the growing geriatric population. However, limited awareness and high costs are restraints. Ongoing research, collaborations, and investments are expected to address restraints and drive further advancements in the AMIC market. Key players globally in AMIC market are Geistlich Pharma AG, Arthrex, Zimmer Biomet Holdings, Smith & Nephew plc, Vericel Corporation, and B. Braun Melsungen AG, among others.

Buy Now

Germany Autologous Matrix-induced Chondrogenesis Market Analysis Summary

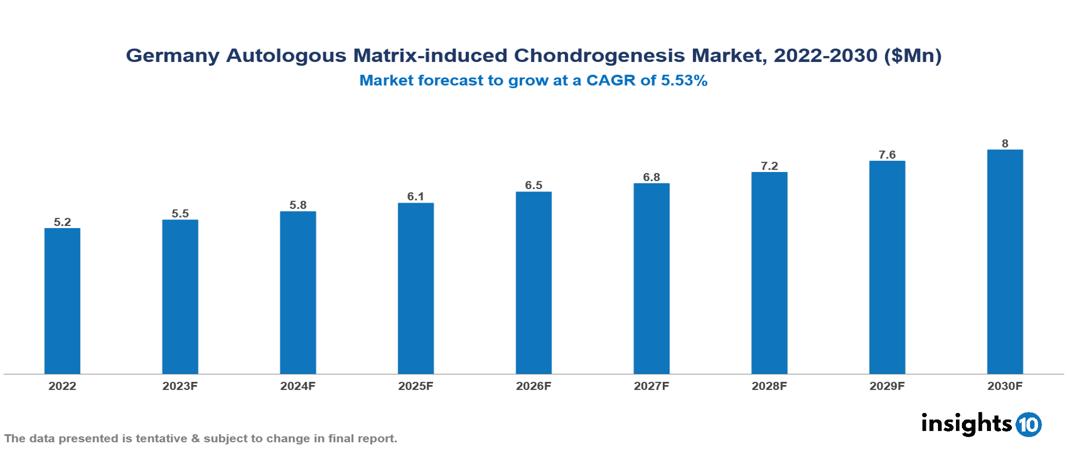

Germany Autologous Matrix-induced Chondrogenesis Market is valued at around $5.2 Mn in 2022 and is projected to reach $8 Mn by 2030, exhibiting a CAGR of 5.53% during the forecast period 2023-2030.

Autologous Matrix-induced Chondrogenesis (AMIC) is a regenerative medicine approach used for the treatment of knee injuries and cartilage defects. It involves the use of the patient's cells and a biomaterial matrix to stimulate cartilage repair and regeneration. AMIC offers a promising solution for patients seeking effective and long-lasting cartilage repair options. The procedure combines advancements in tissue engineering, biomaterials, and surgical techniques to improve outcomes and success rates. The AMIC market is driven by increasing knee injuries and cartilage defects, advancements in regenerative medicine, and the growing geriatric population. However, limited awareness and high costs are restraints. Ongoing research, collaborations, and investments are expected to address restraints and drive further advancements in the AMIC market. Key players globally in the AMIC market are Geistlich Pharma AG, Arthrex, Zimmer Biomet Holdings, Smith & Nephew plc, Vericel Corporation, and B. Braun Melsungen AG, among others.

Market Dynamics

Market Growth Drivers

The autologous matrix-induced chondrogenesis (AMIC) market analysis reveals several key factors driving its growth. Firstly, there is an increasing prevalence of knee injuries and cartilage defects, leading to a growing demand for effective treatment options. AMIC, a regenerative medicine approach, offers a promising solution by utilizing the patient's own cells and a biomaterial matrix to stimulate cartilage repair and regeneration. Secondly, advancements in tissue engineering and regenerative medicine have led to the development of improved biomaterials and surgical techniques for AMIC procedures. This has enhanced the outcomes and success rates of AMIC treatment, further driving its adoption. Moreover, the rising geriatric population, coupled with the growing participation in sports and physical activities, has contributed to a higher incidence of knee injuries and the need for cartilage repair procedures like AMIC. Additionally, favorable reimbursement policies and insurance coverage for AMIC procedures in certain regions have facilitated patient access to this innovative treatment option. Positively, ongoing research and development efforts, collaborations between pharmaceutical companies and healthcare providers, and increasing investments in regenerative medicine are expected to drive further advancements in the AMIC market, addressing the current restraints and expanding its potential for cartilage repair and regeneration.

Market Restraints

One of the key restraints in the Autologous Matrix-induced Chondrogenesis (AMIC) market is the limited awareness among patients and healthcare professionals about the availability and benefits of this regenerative medicine approach. Many individuals may not be familiar with AMIC as a treatment option for knee injuries and cartilage defects, leading to underutilization. Additionally, the high cost associated with AMIC procedures can be a significant restraint. The specialized equipment required and the need for skilled surgeons contribute to the overall expenses, making it less accessible to certain patient populations. These cost considerations can pose challenges in terms of affordability and insurance coverage, hindering the broader adoption of AMIC in clinical practice.

Competitive Landscape

Key Players

- Geistlich Pharma AG

- Arthrex

- Zimmer Biomet Holdings

- Smith & Nephew plc

- Vericel Corporation

- B. Braun Melsungen AG

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Germany Autologous Matrix-induced Chondrogenesis Market Segmentation

By Material Type

- Hyaluronic Acid

- Polyethylene glycol (PEG)

- Collagen

- Polylactic-co-glycolic Acid

- Others

By Application

- Knee Cartilage Repair

- Elbow Cartilage Repair

- Hip Cartilage Repair

- Others

By End User

- Hospitals

- Clinics

- Ambulatory Surgical Centers (ASCs)

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.