Germany Anemia Therapeutics Market Analysis

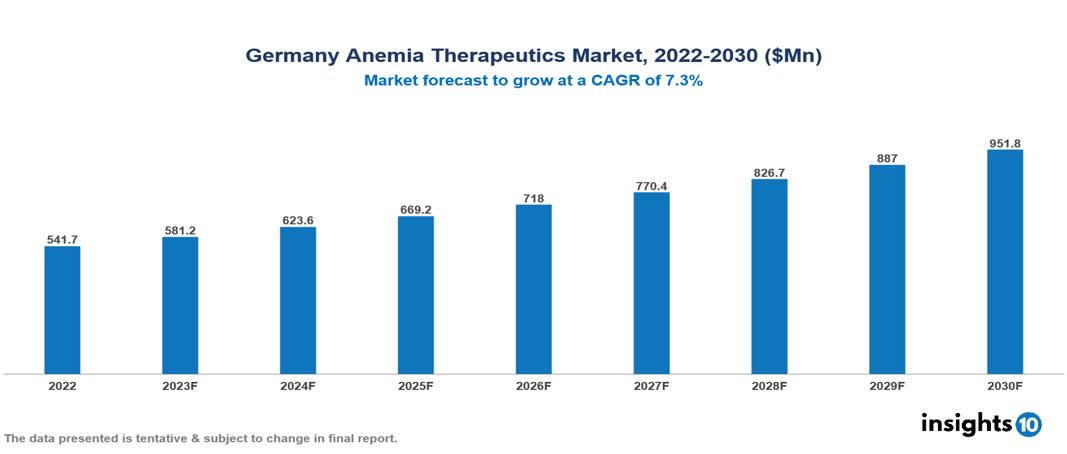

The Germany Anemia Therapeutics Market is anticipated to experience a growth from $542 Mn in 2022 to $952 Mn by 2030, with a CAGR of 7.30 % during the forecast period of 2022-2030. The key drivers for market growth in Germany's healthcare sector are the aging population, advances in diagnosis and treatment, and growing awareness with increased patient empowerment. The Germany Anemia Therapeutics Market encompasses various players across different segments, including Amgen, AbbVie, Roche, Pfizer, AstraZeneca, Novartis, 1A Pharma, 3B Pharmaceuticals, AbZ-Pharma, Dr. Reddy's Laboratories, etc, among various others.

Buy Now

Germany Anemia Therapeutics Market Analysis Executive Summary

The Germany Anemia Therapeutics Market is anticipated to experience a growth from $542 Mn in 2022 to $952 Mn by 2030, with a CAGR of 7.30 % during the forecast period of 2022-2030.

Anemia is characterized by a reduction in red blood cells or hemoglobin, leading to symptoms like fatigue, weakness, and pallor. It encompasses various types, such as iron deficiency, vitamin B12 or B9 deficiency, chronic inflammatory diseases, chronic renal disease, and autoimmune hemolytic anemia. Iron deficiency anemia, the most prevalent type globally, affects individuals of all ages, including infants, adolescents, and pregnant women. Treatment involves dietary guidance, oral, or intravenous iron supplements. Vitamin B12 or B9 deficiency anemia can be managed with iron or vitamin supplements, potentially requiring infusions in severe cases. Anemia associated with chronic inflammatory diseases, chronic renal diseases, and autoimmune hemolytic anemia necessitates addressing the underlying conditions for symptom relief. Sickle cell anemia and thalassemia, hereditary forms of anemia, lack recognized therapies, while iron-rich foods and a balanced diet serve as preventive measures for iron deficiency anemia.

In Germany, Iron Deficiency Anemia (IDA) is the most prevalent kind of anemia, affecting primarily adults and the elderly. Anemia affects around 10% of non-pregnant women aged 15 to 49 in Germany. For children aged 6-59 months, it is around 5%. Although Germany's anemia prevalence is lower compared to many other developed nations, impoverished individuals are particularly susceptible to suffering from anemia owing to a lack of healthcare access and adequate food availability. The key drivers for market growth in Germany's healthcare sector are the aging population, advances in diagnosis and treatment, and growing awareness with increased patient empowerment.

Amgen has a substantial market share with its ESA products, primarily Aranesp for chronic renal disease and Epogen for various anemia types. AbbVie offers a diverse portfolio that includes the well-known Humira (iron replacement medication) and Femibion (folic acid supplement), both of which are used to treat various kinds of anemia.

Market Dynamics

Market Growth Drivers

Aging Population: Germany's demographic transition is a key factor. By 2030, the proportion of persons aged 65 and older is expected to reach 31.7%. This aging population is more vulnerable to chronic illnesses such as CKD and cancer, both of which commonly cause anemia. The German Kidney Foundation estimates that 8.5 Mn Germans suffer from renal disease, with many developing anemia as a result. This equates to a vast and constantly expanding patient pool boosting market demand.

Advances in Diagnosis and Treatment: The German healthcare environment is seeing significant improvements in anemia diagnosis and treatment. Innovative diagnostic techniques enable earlier detection, resulting in more effective treatment options. Furthermore, the introduction of biosimilar ESAs, which are less expensive than their original equivalents, makes treatment more affordable and accessible to a larger patient group. These improvements drive market expansion by fostering a dynamic environment in which demand responds to changing treatment alternatives.

Growing Awareness and Patient Empowerment: Public awareness efforts and simple access to information are encouraging Germans to take control of their health. This leads to self-diagnosis and early consultation with healthcare experts, which increases demand for therapeutic measures. This trend to proactive patient involvement results in a more educated and engaged patient base, which contributes to market growth.

Market Restraints

Price Pressure and Reimbursement Policies: Germany's stringent healthcare rules and emphasis on cost-cutting pose hurdles for pricey newer pharmaceuticals. While biosimilar ESAs provide relief, competition is severe, resulting in possible price erosion. This can hinder market expansion for novel cures that need higher prices. The German Institute for Health and Social Affairs (G-BA) is responsible for deciding medication reimbursement, and its choices have a substantial influence on market access for innovative medicines.

Focus on Generic Medications: Germany's thriving generic market encourages healthcare professionals and patients to choose cost-effective alternatives. While this improves cost-effectiveness, it may postpone the introduction of newer, possibly more effective medicines that lack generic alternatives. However, this obstacle encourages innovation in the production of more inexpensive branded solutions, pushing the industry toward accessible yet advanced solutions.

Limited Access to Specialists and Healthcare differences: Geographic differences in access to specialist healthcare experts prevent patients from receiving optimal treatment, particularly in rural regions. This hinders market expansion, particularly for severe anemias that need competence beyond primary care providers.

Healthcare Policies and Regulatory Landscape

Germany has long been praised for its strong and comprehensive healthcare system, which is founded on the values of social solidarity and universal access. German healthcare policies are distinguished by a combination of public and private sector participation, ensuring that all individuals have access to high-quality medical treatment. Germany's drug regulatory body is critical to ensuring the safety and efficacy of drugs on the market. The Federal Institute for Drugs and Medical Devices (BfArM) is at the forefront of this regulatory structure. It is in charge of approving, monitoring, and assessing medications to ensure they fulfill stringent quality, safety, and effectiveness requirements. The organization works closely with the European Medicines Agency (EMA) to standardize rules and contribute to the review of new medications. The German drug regulatory authority's commitment to sustaining strict standards reflects the country's commitment to protecting public health and preserving the integrity of its healthcare system.

Competitive Landscape

Key Players:

- Amgen

- AbbVie

- Roche

- Pfizer

- AstraZeneca

- Novartis

- 1A Pharma

- 3B Pharmaceuticals

- AbZ-Pharma

- Dr. Reddy's Laboratories

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Germany Anemia Therapeutics Market Segmentation

By Type of Disease

- Iron Deficiency Anemia

- Megaloblastic Anemia

- Pernicious Anemia

- Hemorrhagic Anemia

- Hemolytic Anemia

- Sickle Cell Anemia

By Population

- Pediatrics

- Adults

- Geriatrics

By Therapy Type

- Oral Iron Therapy

- Parenteral Iron Therapy

- Red Blood Cell Transplantation

- Others

By Distribution Channel

- Hospital Pharmacies

- Drug Stores & Retail Pharmacies

- Online Pharmacies

By End User

- In-Patient Centres

- Out-Patient Speciality Clinics

- Homecare

- Others

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.