Germany Alzheimer’s Therapeutics Market Analysis

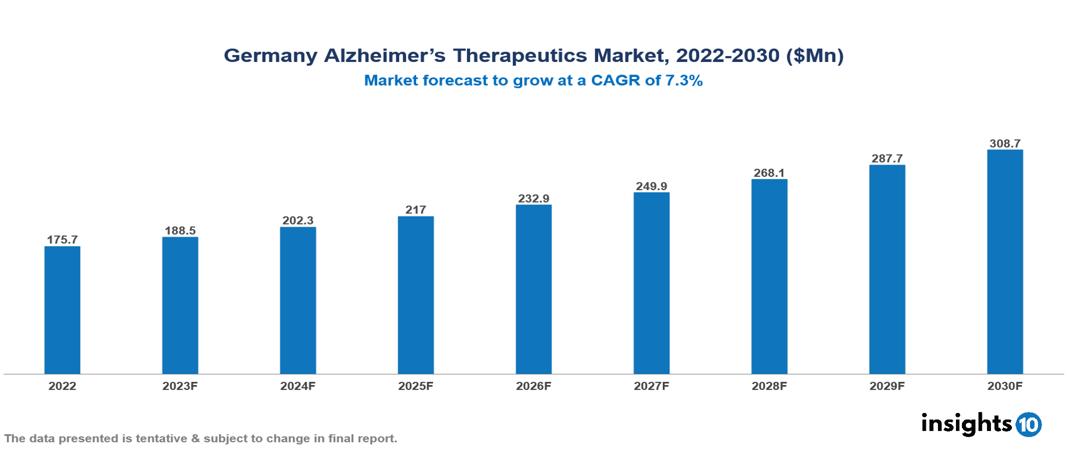

Germany alzheimer’s therapeutics market valued at $176 Mn in 2022, projected to reach $309 Mn by 2030 with a 7.3% CAGR. One major driver of the market's expansion is the rising need for drugs used to treat Alzheimer's disease, which is mostly due to the disease's rising incidence in elderly population. Eisai, Pfizer, Janssen, Novartis, Biogen, Roche, Lundbeck, Otsuka Pharmaceutical, Teva Pharmaceutical and Sun Pharmaceutical are leading pharmaceutical companies presently operating in the market.

Buy Now

Germany Alzheimer’s Therapeutics Market Executive Summary

Germany alzheimer’s therapeutics market valued at $176 Mn in 2022, projected to reach $309 Mn by 2030 with a 7.3% CAGR.

Alzheimer's is a neurological condition that impairs memory, behavior, and mental health. Usually, it starts slowly, gets worse with time, and makes it harder for the individual to do daily tasks. Nerve cells in Alzheimer's disease die as a result of abnormal brain alterations such as plaque and tangle formation. Alzheimer's disease does not currently have a cure. In contrast, some drugs can help manage symptoms and enhance quality of life. To treat memory and cognitive issues, these medications, which include donepezil, rivastigmine, and memantine, modulate specific neurotransmitters in the brain. Furthermore, non-pharmacological approaches including maintaining a healthy lifestyle, engaging in social and cognitive activities, and fostering a supportive environment might improve overall illness management.

In Germany, there are currently about 1.7 Mn people who suffer from dementia, primarily Alzheimer's disease. By 2070, there could be an increase to 3 Mn, highlighting the significant influence this illness has on the populace. Notable is the age-specific prevalence of dementia, which is approximately 1.91% for people 65-69 and rises to 3.43% for people 80 years of age and older. This pattern of prevalence is consistent with an increasing tendency in Alzheimer's cases, a condition mainly ascribed to the aging of the German population. The changing picture of Alzheimer's prevalence highlights the urgent need for comprehensive policies and preventative actions to address the healthcare issues brought on by an aging population.

In December 2023, BASF and Alector jointly launched a Phase 2b clinical trial for AL001, covering Germany and the US, marking a significant advancement in the treatment of Alzheimer's disease. To slow or stop the progression of the disease, this novel medication directly targets the build-up of Tau protein. It has the potential to be a disease-modifying therapy.

The ongoing Phase 2a trial of ANVS419 by Elan Pharmaceuticals, which was initiated in September 2023 throughout Germany and Belgium, is another significant milestone. This medication is a fresh strategy that shows promise for the treatment of Alzheimer's in the future: it works by inducing the brain's natural processes for eliminating amyloid plaques.

Market Dynamics

Market Growth Drivers

Rising Prevalence of Alzheimer's Disease: Over 1 Mn people in Germany currently suffer from Alzheimer's, placing it among the European countries with the highest burden of the disease. There will be a greater number of people at risk of Alzheimer's as a result of this demographic trend.

Emerging Disease-Modifying Therapies: Research has made significant progress toward ground-breaking discoveries that have opened the door to the development of new medications that aim to address the underlying causes of the illness, raising hopes for the possibility of slowing or even reversing the course of the disease. Promising prospects in the development pipeline in addition to authorized Disease-Modifying Therapies (DMTs) like Leqembi and Aduhelm are notably igniting industry excitement and driving market expansion. These advancements highlight a paradigm-shifting period in the treatment of Alzheimer's disease, indicating a move toward more successful interventions.

Increased Awareness and Early Diagnosis: Due to rising public awareness brought about by proactive initiatives from organizations and advancements in diagnostic technologies, more and more people are seeking therapy for Alzheimer's disease. Thanks to modern diagnostic techniques that allow for early diagnosis, there is a longer window of opportunity for improvement when prospective disease-modifying medications are begun early.

Market Restraints

High Cost of Drugs: The high cost of branded Alzheimer's medications like Exelon and Aricept places a significant financial burden on patients and their families, which may lead to treatment noncompliance, treatment abandonment, or a delayed diagnosis. The lack of reasonably priced generic substitutes further restricts access for those with lower incomes.

Limited Efficacy and Uncertain Long-Term Benefits: The long-term sustainability and effectiveness of existing drugs, like Leqembi and Aduhelm, to delay cognitive deterioration is under question. Hesitancy can be caused by several things, including the lack of a convincing cure or solid proof of improved health.

Lack of Awareness and Stigma: The ongoing social stigma attached to dementia and Alzheimer's disease keeps many people from getting a diagnosis and treatment, especially despite the increasing number of awareness campaigns. This stigma is a major obstacle keeping the market from reaching a larger customer base.

Healthcare Policies and Regulatory Landscape

The Paul-Ehrlich-Institut (PEI) and the Bundesinstitut für Arzneimittel und Medizinprodukte (BfArM) are in charge of regulating the therapeutic drug market in Germany. Pharmaceutical companies must obtain marketing authorization from these regulatory organizations to introduce therapeutic medications into the German market. This requires the submission of extensive data about safety, efficacy, and quality. Clinical trials are carried out to confirm the drug's safety and efficacy before approval, and regulatory bodies like the BfArM closely examine the trial findings. After a drug is made available to the general public, BfArM oversees post-marketing surveillance, which keeps an eye on its continued safety and effectiveness. Pharmacovigilance operations are carried out to identify, assess, and avoid harmful effects, and the Federal Joint Committee (Gemeinsamer Bundesausschuss, or G-BA) influences reimbursement policies.

Competitive Landscape

Key Players

- Eisai

- Pfizer

- Janssen

- Novartis

- Biogen

- Roche

- Lundbeck

- Otsuka Pharmaceutical

- Teva Pharmaceutical

- Sun Pharmaceutical

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Germany Alzheimer’s Therapeutics Market Segmentation

By Drug Name

- Early-Onset Alzheimer's

- Late-Onset Alzheimer's

- Familial Alzheimer's disease

By Drug Name

- Donepezil

- Rivastigmine

- Memantine

- Galantamine

- Manufactured a combination of memantine and donepezil

By Drug Class

- Cholinesterase Inhibitors

- NMDA Receptor Antagonists

- Manufactured Combination

By End-Users

- Hospitals

- Specialty Clinics

- Homecare

- Others

By Distribution Channel

- Hospital pharmacies

- Drug stores

- Retail pharmacies

- Online pharmacies

- Other distribution channel

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.