Germany Acne Therapeutics Market Analysis

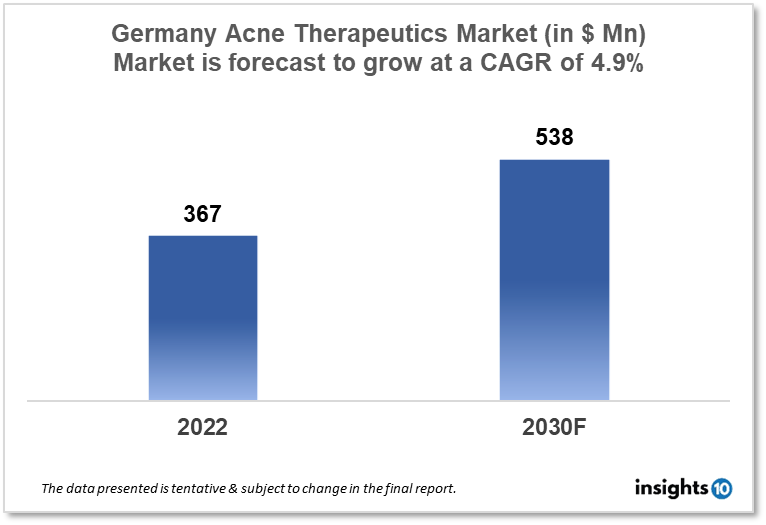

Germany acne therapeutics market is projected to grow from $367 Mn in 2022 to $538 Mn in 2030 with a CAGR of 4.9% for the forecast year 2022-2030. The market is anticipated to grow as most of the German population is becoming aware of acne and its treatment options. The Germany acne therapeutics market is segmented by treatment, route of administration, age group, and distribution channel. Pharall, Oranis, and Teva Pharmaceuticals are some of the key competitors in the market.

Buy Now

Germany Acne Therapeutics Market Executive Analysis

The Germany acne therapeutics market size is at around $367 Mn in 2022 and is projected to reach $538 Mn in 2030, exhibiting a CAGR of 4.9% during the forecast period. In 2020, Germany's current health expenditure was paid for by transfers and subsidies from the government. According to the Federal Statistical Office (Destatis), this represents a rise of $17.37 Bn, or 31.5%, from the previous year. As a consequence, 15.7% of the $460.07 Bn in current health expenditure was made up of government transfers and subsidies, an increase of 3.0 % in age points from the previous year. In the world, the German healthcare system dates back to the 1880s, making it one of the oldest. The public and private health insurance sectors make up the system's two main organizational groups. The idea of solidarity serves as the foundation for the public health care system in Germany. No matter their financial situation, everyone who is covered by a public health insurer receives the same level of medical treatment. This is accomplished with the help of an income-based common fund to which everyone pays.

Acne vulgaris is a chronic skin disease that is most common in adolescents. Relapse and recovery periods are frequent and can last even into adulthood. Acne vulgaris is a significant financial burden and has a significant effect on a patient's quality of life in terms of their health. The most prevalent type of acne, acne vulgaris, was the eighth most prevalent illness worldwide in 2010. Acne inversa, tropical acne, acne mechanica, excoriated acne, acne aestivalis, acne cosmetic, acne rosacea, acne neonatorum, industrial acne, drug-induced acne, acne necrotica, hyperandrogenic acne, and acne necrotica are additional types of acne. Germany has a greater reported prevalence of acne, with 26.8% of the 896 participants. According to reports, acne peaks between the ages of 14 and 29. Rural and non-Westernized nations have reduced rates of acne prevalence.

Topical medications (such as retinoids, benzoyl peroxide [BPO], azelaic acid, antibiotics, and dapsone) and/or systemic medications can be used to treat acne vulgaris (antibiotics, zinc, antiandrogens, and isotretinoin). In randomized, controlled clinical trials conducted in Germany, daily parallel application of adapalene and nadifloxacin was also found to be effective and well tolerated in patients with acne vulgaris. In order to maximize effectiveness and boost patient compliance, current therapeutic advancements for acne concentrate on set combinations of substances with complementary effects. These include topical clindamycin and benzoyl peroxide, an approach that also slows the spread of Propionibacterium acnes-resistant strains, and the fixed combination of retinoids with antimicrobials, specifically a clindamycin phosphate 1.2%/tretinoin 0.025% and an adapalene 0.1%/benzoyl peroxide 2.5% gel. Topical dapsone 5% or triethyl citrate and ethyl linoleate are two novel treatment options that have been studied in clinical studies.

Market Dynamics

Market Growth Drivers

In Germany, a sizable portion of the population suffers from acne, a common skin condition. The Germany acne therapeutics market is anticipated to rise as more people turn to treatment for their acne. People are more likely to seek treatment for acne as a way to enhance their appearance and boost their confidence as the significance of skincare is becoming more widely recognized. Effective acne remedies are now in greater demand as a result of this.

Market Restraints

Alternative acne therapies like over-the-counter medicines or natural cures may be preferred by some patients. This might reduce the need for prescribed acne treatments. Some acne treatments may have unpleasant side effects, which may reduce patient adherence and happiness. This may lead to a decline in the Germany acne therapeutics market.

Competitive Landscape

Key Players

- Adragos Pharma (DEU)

- Vifor Pharma Deutschland (DEU)

- Pharmainitiative Bayern (DEU)

- Pharall (DEU)

- Oranis (DEU)

- Teva Pharmaceuticals

- L'Oréal

- Sun Pharmaceuticals

- Johnson & Johnson

- Abbvie

Healthcare Policies and Regulatory Landscape

A federal higher body under the Federal Ministry of Health's purview is the Federal Institute for Drugs and Medical Devices (Bundesinstitut für Arzneimittel und Medizinprodukte, BfArM). Section 2 of the German Medicinal Products Act (Arzneimittelgesetz, AMG) specifies the legal meaning of a medicinal product. The goal of this legislation is to guarantee the security of pharmaceuticals. Therefore, homeopathic medicinal products require a German or European registration, whereas finished medicinal products as specified by the AMG may only be marketed after receiving the appropriate German or European marketing authorization.

The BfArM's primary duties include the registration of pharmaceuticals as well as the marketing authorization of those goods. After a medication has been given marketing authorization, the BfArM's responsibilities do not stop. The results regarding a medicinal product's safety are incomplete at the time of first licensure. As a result, following the granting of the marketing authorization, experiences relating to the use of a medicinal product must also be gathered and assessed sequentially and systematically. This is the pharmacovigilance division's most significant duty. This division will coordinate the required steps to avert the risk if the evaluation of the drug risks indicates that the licensing status of a medicinal product needs to be adjusted to the current state of knowledge in science.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Acne Therapeutics Market Segmentation

By Treatment (Revenue, USD Billion):

- Therapeutics

- Retinoid

- Antibiotics

- Hormonal Agents

- Anti-Inflammatory

- Other Agents

- Other Treatments

By Route of Administration (Revenue, USD Billion):

- Oral

- Topical

- Injectable

By Age Group (Revenue, USD Billion):

- 10 to 17

- 18 to 44

- 45 to 64

- 65 and above

By Distribution Channel (Revenue, USD Billion):

- Hospital Pharmacies

- Retail and Online Pharmacies

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.