Germany 3D Printing Medical Devices Market Analysis

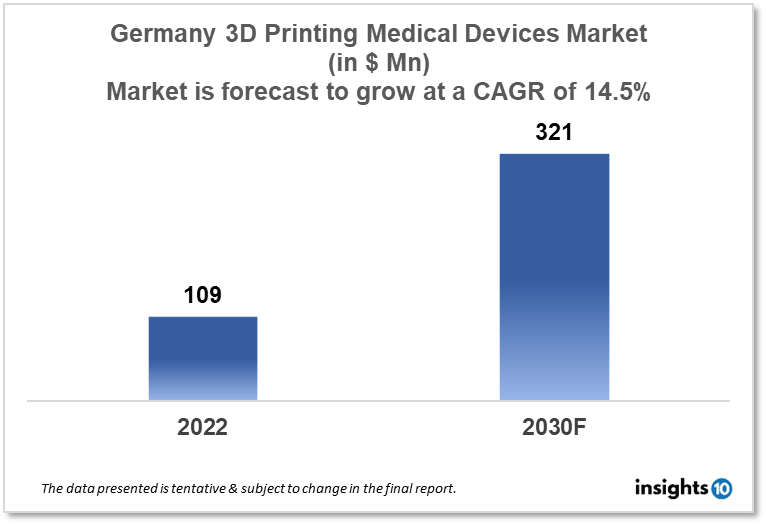

Germany's 3D printing medical devices market size was valued at $109 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 14.5% from 2022 to 2030 and will reach $321 Mn in 2030. The market is segmented by component, application, technology, and end user. The Germany 3D printing medical devices market will grow as 3D printing technology has made a significant impact in the medical industry by enabling the production of personalized and complex medical devices. The key market players are Some of the key players in the market include SLM Solutions Group AG, EOS GmbH, Concept Laser GmbH, Materialise NV, Stratasys Ltd, 3D Systems Corporation, and others.

Buy Now

Germany 3D Printing Medical Devices Market Executive Summary

Germany's 3D printing medical devices market size was valued at $109 Mn in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 14.5% from 2022 to 2030 and will reach $321 Mn in 2030.

According to data from the Organization for Economic Cooperation and Development (OECD), Germany's healthcare expenditure was 11.2% of GDP in 2019. This is slightly above the average for OECD countries, which was 8.8% in the same year. Germany has a comprehensive healthcare system that is funded through a combination of public and private sources. The majority of funding comes from public sources, such as statutory health insurance contributions and taxes, while private health insurance covers a smaller portion. The German healthcare system provides universal coverage, meaning that all residents have access to healthcare services regardless of their income or employment status. The system also places a strong emphasis on prevention and primary care, with a network of general practitioners serving as the first point of contact for most patients. Germany's healthcare system is widely regarded as one of the best in the world, with high levels of patient satisfaction and good health outcomes. However, there are ongoing debates and challenges around issues such as rising costs, the aging population, and access to care in certain regions.

The Germany has a strong presence in the medical technology industry and has been a leader in the adoption of 3D printing technology for medical device applications. German companies are actively involved in developing 3D printing medical devices for various medical fields, including orthopedics, cardiology, neurology, and dentistry. These devices range from patient-specific implants and prosthetics to surgical guides and anatomical models.

In addition to companies, academic institutions, and research organizations in Germany are also actively involved in 3D printing medical devices research and development. This includes the development of new materials, printing techniques, and software tools that can enable the creation of more complex and personalized medical devices. Germany has a vibrant and growing 3D printing medical device industry, with a focus on improving patient outcomes, reducing costs, and increasing efficiency in the healthcare system.

This market in Germany is growing rapidly, with a large number of companies involved in the development, manufacture, and distribution of 3D-printed medical devices. The market is expected to continue to expand in the coming years, driven by factors such as technological advancements, increasing demand for personalized medical devices, and the growing need for cost-effective healthcare solutions. The orthopedic segment is the largest market for 3D printing medical devices in Germany, with a wide range of patient-specific implants and prosthetics being developed and used. Other key markets for 3D printing medical devices in Germany include cardiology, dentistry, neurology, and ophthalmology.

The market for 3D printing medical devices in Germany is highly competitive, with both domestic and international companies competing for market share. Regulatory approval is a critical factor for the success of 3D printing medical devices in Germany. The country has a rigorous regulatory framework in place for medical devices, and companies must obtain certification from the relevant authorities before their products can be sold in the market.

The 3D printing medical device market in Germany is a rapidly growing and highly competitive industry that is poised for further growth in the coming years. The focus on personalized medical devices, cost-effectiveness, and innovation is expected to drive continued growth in this market.

Market Dynamics

Market Growth Drivers

- Technological Advancements: Germany is known for its advanced technology and engineering capabilities. 3D printing technology has made a significant impact on the medical industry by enabling the production of personalized and complex medical devices. This has driven the growth of the 3D printing medical device market in Germany

- Increasing Demand for Customized Medical Devices: 3D printing allows for the creation of customized medical devices that are tailored to individual patient needs. This has increased the demand for 3D-printed medical devices in Germany

- Growing Incidence of Chronic Diseases: With the increasing incidence of chronic diseases, the demand for medical devices that can improve the quality of life for patients has increased. 3D printing allows for the production of complex medical devices that can help in the treatment of chronic diseases, thereby driving market growth

Market Restraints

- High Cost: The cost of 3D printing medical devices is relatively high compared to traditional manufacturing methods. This can be a major restraint in the adoption of 3D printing technology for medical devices

- Regulatory Challenges: The regulatory requirements for 3D-printed medical devices are strict in Germany, which can be a significant barrier to entry for new players in the market. This can also lead to delays in the approval process for new 3D printed medical devices

- Lack of Skilled Workforce: The production of 3D-printed medical devices requires specialized skills and expertise. The lack of a skilled workforce can be a major challenge for companies looking to enter the market and scale their operations

Competitive Landscape

Key Players

- SLM Solutions Group AG

- EOS

- Concept Laser

- Materialise NV (German subsidiary)

- Voxeljet AG

- Trumpf

- Renishaw

- Ultimaker

- BigRep

- Nanoscribe

- Prodways Germany

- Sharebot Deutschland

- 3Dmensionals

- Admatec Europe BV (German subsidiary)

Recent Developments

2021: SLM Solutions Group AG announced a collaboration with Safran Landing Systems to develop and produce 3D-printed components for the aerospace industry.

2021: EOS GmbH partnered with RPS, a UK-based manufacturer, to develop a 3D printing system for the mass production of medical devices.

Healthcare Policies and Regulatory Landscape

In Germany, 3D printing medical devices are subject to regulation by the Federal Institute for Drugs and Medical Devices (BfArM) and the Medical Devices Act (MDR). According to the MDR, a medical device is defined as "any instrument, apparatus, appliance, software, implant, reagent, material or other article intended by the manufacturer to be used alone or in combination for human beings for one or more of the specific medical purposes." Therefore, 3D-printed medical devices fall under this definition and are subject to regulations.

The BfArM is responsible for reviewing and approving medical devices in Germany. Before a 3D-printed medical device can be marketed in Germany, it must undergo a conformity assessment procedure, which involves testing and evaluation to ensure that it meets the requirements of the MDR. The manufacturer of the device must also obtain a CE marking, which indicates that the device complies with the relevant EU regulations.

In addition, manufacturers of 3D-printed medical devices must also adhere to specific standards for materials and manufacturing processes. For example, the ISO 13485 standard outlines requirements for quality management systems in the design and production of medical devices. The regulation of 3D-printed medical devices in Germany is strict, with a focus on ensuring patient safety and the effectiveness of these devices. Manufacturers must adhere to strict guidelines and standards to ensure that their devices are safe and effective for use in medical settings.

1. Executive Summary

1.1 Device Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Regulatory Landscape for Medical Device

1.6 Health Insurance Coverage in Country

1.7 Type of Medical Device

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Germany 3D Printing Medical Devices Market Segmentation

By Component

The Germany market is divided into three categories based on the component: equipment, materials, and software & services. End customers frequently employ software and services for designing and processing control of 3D-printed medical devices, particularly for bespoke items. The cost-effectiveness, utility, uniformity, and precision given by services for medical device 3D printing, together with a rise in demand for personalized 3D printed medical equipment among hospitals and surgical centers, are driving the market demand for software & surgical guides.

- Equipment

- 3D Printers

- 3D Bioprinters

- Materials

- Plastics

- Thermoplastics

- Photopolymers

- Metals and Metal Alloys

- Biomaterials

- Ceramics

- Paper

- Wax

- Other Materials

- Services & Software

By Application

The Germany market is divided into surgical guides, surgical tools, tissue-engineered goods, hearing aids, wearable medical devices/implantable medical devices, standard prostheses and implants, custom prosthetics and implants, and other medical devices based on the application. Due to the widespread adoption of 3D printing technology in the production of prosthetics and implants, the increased availability of high-quality biomaterials and ceramics for 3D printing, and ongoing industry investment in the development of novel 3D printers, the custom prosthetics and implants segment is expected to hold a larger share of the market in 2022.

- Surgical Guides

- Dental Guides

- Craniomaxillofacial Guides

- Orthopedic Guides

- Spinal Guides

- Surgical Instruments

- Surgical Fasteners

- Scalpels

- Retractors

- Standard Prosthetics & Implants

- Orthopedic Implants

- Dental Prosthetics & Implants

- Craniomaxillofacial Implants

- Bone & Cartilage Scaffolds

- Ligament & Tendon Scaffolds

- Custom Prosthetics & Implants

- Tissue-engineered Products

- Hearing Aids

- Wearable Medical Devices

- Other Applications

By Technology

According to technology, the global market has been divided into three categories: three-dimensional printing (3DP) or adhesion bonding; electron beam melting (EBM); laser beam melting (LBM); photopolymerization; droplet deposition or extrusion-based technologies; and other technologies. The laser beam melting (LBM) segment is anticipated to hold the greatest market share in 2022, in large part due to the growing use of this technology in the dental sector and for the production of implants for minimally invasive surgery.

- Laser Beam Melting

- Direct Metal Laser Sintering

- Selective Laser Sintering

- Selective Laser Melting

- LaserCUSING

- Photopolymerization

- Digital Light Processing

- Stereolithography

- Two-photon Polymerization

- PolyJet 3D Printing

- Fused Deposition Modeling

- Multiphase Jet Solidification

- Low-temperature Deposition Manufacturing

- Microextrusion Bioprinting

- Droplet Deposition/Extrusion-based Technologies

- Electron Beam Melting

- Three-dimensional Printing/Adhesion Bonding/Binder Jetting

- Other Technologies

By End User

The Germany market has been divided into hospitals and surgical facilities, dental and orthopedic clinics, academic institutions and research labs, pharma-biotech and medical device firms, and clinical research organizations based on end users. In 2022, hospitals and surgical centers are anticipated to hold the greatest market share. The high proportion of this market may be due to the ongoing expansion of internal 3D printing capabilities, the expansion of existing 3D printing laboratories, the rising affordability of 3D printing services, and the quick uptake of cutting-edge technology by hospitals in developed markets.

- Hospitals & Surgical Centers

- Dental & Orthopedic Clinics

- Academic Institutions & Research Laboratories

- Pharma-Biotech & Medical Device Companies

- Clinical Research Organizations

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.