France Oral Care Market Analysis

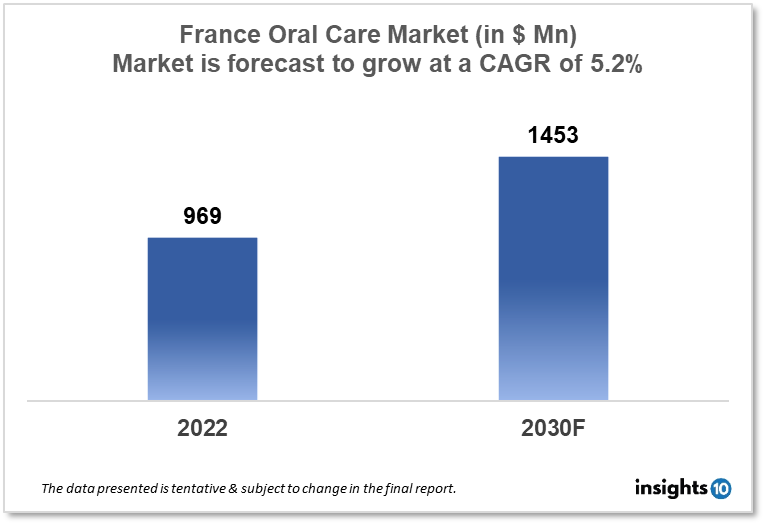

France's oral care market was valued at $969 Mn in 2022 and is estimated to expand at a CAGR of 5.2% from 2022 to 2030 and will reach $1453 Mn in 2030. One of the main reasons propelling the growth of this market is E-commerce Growth, the aging population. The market is segmented by type, drug, and distribution channel. Some key players in this market are Pierre Fabre Oral Care, GUM, Laboratoires Septodont, Elgydium, Biotech Dental, 3M, Carestream Dental, and Periosystem.

Buy Now

France Oral Care Market Executive Summary

France's oral care market was valued at $969 Mn in 2022 and is estimated to expand at a CAGR of 5.2% from 2022 to 2030 and will reach $1453 Mn in 2030. The oral care market in France is a significant segment of the French healthcare market. The market consists of a range of products, including toothpaste, toothbrushes, mouthwash, dental floss, and other oral hygiene products. The oral care market in France is driven by a growing awareness of the importance of oral health, a high prevalence of dental caries, and an aging population

Toothpaste is the largest product segment in the French oral care market, accounting for more than half of the total market revenue. In recent years, there has been a trend towards natural and organic oral care products in France, with consumers increasingly seeking out products that are free from synthetic chemicals and have eco-friendly packaging. Overall, the French oral care market is characterized by strong competition among established players and growing demand for natural and eco-friendly products. The market is expected to continue growing in the coming years as consumers become more aware of the importance of oral health and seek out high-quality products to meet their needs.

Market Dynamics

Market Growth Drivers

There is a growing awareness among the French population about the importance of oral hygiene for overall health. This is driving demand for oral care products such as toothpaste, toothbrushes, mouthwash, and dental floss. The French population has a relatively high prevalence of dental caries, which is contributing to the demand for oral care products. According to the French Society of Dental Health, nearly 95% of French people have had at least one dental caries. France has an aging population, with a significant proportion of people aged 65 and over. This demographic group tends to have higher dental care needs, including more frequent dental check-ups and greater use of oral care products. The oral care market in France is characterized by a high degree of product innovation, with manufacturers introducing new products that are designed to address specific oral health concerns, such as sensitivity, gum disease, and bad breath. The growth of e-commerce in France is also driving growth in the oral care market. Consumers are increasingly purchasing oral care products online, which offers greater convenience and a wider selection of products.

Market Restraints

The oral care market in France is highly competitive, with many international and local players competing for market share. This high level of competition can make it difficult for new entrants to establish themselves and for existing companies to maintain their market share. Consumers in France are becoming more health-conscious and are increasingly seeking natural and organic oral care products. This shift in consumer preferences can make it challenging for companies that are focused on traditional oral care products to adapt and remain competitive. The oral care market in France is subject to strict regulations, including those related to product labeling, advertising, and claims. These regulations can make it challenging for companies to bring new products to market and to promote their products effectively. The economic downturn in recent years has led to a decrease in consumer spending in France. This can make it challenging for companies in the oral care market to maintain their revenue streams and profitability. Despite the high level of competition in the oral care market in France, there is still a lack of consumer awareness about the importance of oral care and the availability of products that can help maintain oral health. This can make it challenging for companies to expand their market share and reach new customers.

Competitive Landscape

Key Players

- Pierre Fabre Oral Care

- GUM

- Laboratoires Septodont

- Elgydium

- Biotech Dental

- 3M.

- Carestream Dental

- Periosystem

- Dental Monitoring

- Rendez-vous Facile

- Euroteknika

Healthcare Policies and Regulatory Landscape

The oral care market in France is subject to regulations set by the European Union, including the EU Cosmetics Regulation, which sets safety and labeling requirements for cosmetic products including oral care products.

- French National Health Agency (ANSM) is responsible for regulating medical devices and other health products, including oral care products. The agency ensures that these products are safe, effective, and of high quality

- The French Society of Dental Health (SFCD) is a professional organization that provides guidance and recommendations on oral health practices and standards in France. Its recommendations often influence government policy on oral health

- National Health Insurance Fund (CNAM) is a public insurance scheme that covers a portion of the cost of dental care for French citizens. The fund sets reimbursement rates for dental care services and products

- The French Dental Association (ADF) is a professional organization representing dentists in France. It provides guidance and recommendations on dental practices and standards in France and advocates for the interests of its members

Reimbursement Scenario

In France, the cost of dental care is partially covered by the national health insurance scheme, which is administered by the National Health Insurance Fund (CNAM). The reimbursement rates for dental care services and products are set by the CNAM and vary depending on the type of treatment or product. For example, basic dental care services such as dental exams, cleanings, and fillings are partially covered by the national health insurance scheme, with reimbursement rates ranging from 70% to 100% of the cost of the treatment. However, more complex procedures such as root canals, crowns, and dental implants are only partially covered, with reimbursement rates ranging from 30% to 70%.

Patients can choose to visit a dentist who is either contracted or not contracted with the national health insurance scheme. Contracted dentists agree to charge the set reimbursement rates for their services, while non-contracted dentists are free to charge their own fees, which may be higher than the set reimbursement rates.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

France Oral Care Market Segmentation

By Product Type (Revenue, USD Billion):

- Toothpaste

- Toothbrush

- Mouthwash

- Dental Accessories

- Denture Products

- Others

By Distribution Channel (Revenue, USD Billion):

- Retail Pharmacies

- Online Channels

- Supermarkets

- Dental Dispensaries

By Demographics

- Age (children, adults and geriatric population)

- Gender

- Income

- Education

- Occupation

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.