France Mouth Ulcer Therapeutics Market Analysis

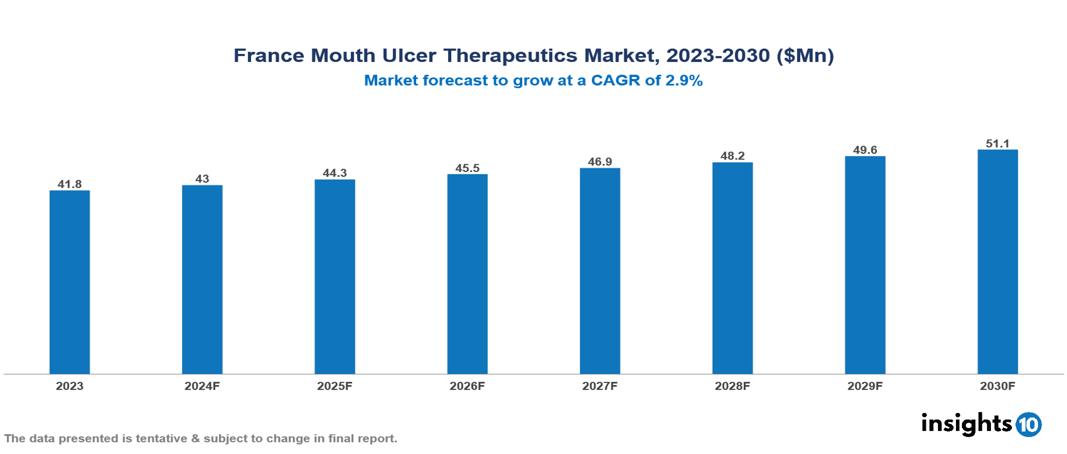

The France Mouth Ulcer Therapeutics Market was valued at $41.8 Mn in 2023 and is projected to grow at a CAGR of 2.9% from 2023 to 2023, to $51.1 Mn by 2030. The key drivers of this industry are rising awareness about oral hygiene, increasing demand for rapid healing products, growing geriatric population, rise in tobacco consumption, increasing incidence of oral diseases, chemical-based toothpaste and unhealthy lifestyles etc. The industry is primarily dominated by players such as Servier, Teva, Mylan, Bayer, Pfizer, Takeda Pharmaceuticals and GSK among others.

Buy Now

France Mouth Ulcer Therapeutics Market Executive Summary

The France Mouth Ulcer Therapeutics Market was valued at $41.8 Mn in 2023 and is projected to grow at a CAGR of 2.9% from 2023 to 2023, to $51.1 Mn by 2030.

Mouth ulcers, also known as canker sores, are painful and uncomfortable lesions that can appear in various areas of the mouth and gums. Symptoms include one or more painful sores with red edges and a yellow, white, or gray centre, fever, sluggishness, and swollen glands during extreme outbreaks. Causes include stress, anxiety, or hormonal changes, minor mouth injuries, dental appliances or poorly fitting dentures, certain medications, genetic predisposition, nutritional deficiencies, specific medical conditions, allergic reactions to certain foods, toothpastes, or mouthwashes, and vitamin deficiencies. Treatment involves symptomatic relief with topical gels containing anaesthetics, antiseptics, and antibiotics, as well as supportive care with multivitamins or vitamin supplements, antipyretics, and antibiotics. Medications include antibiotics, oral painkillers, oral steroids, antiseptics, chlorhexidine gluconate mouthwash, and sucralfate. Home care includes good oral hygiene, avoiding trigger foods, warm saline gargles, ice packs, and a balanced diet. Medical attention is necessary if the ulcers fail to heal within a week or two, are unusual, spreading, or large, or if there is severe pain, fever, or difficulty while chewing, talking, or swallowing.

The prevalence rate of mouth ulcers in France is 14.8%. The market therefore is driven by significant factors like the increasing prevalence rate mouth ulcers, rising awareness about oral hygiene, and supportive government initiatives, however, factors such as limited accessibility, availability of substitute treatments and budgetary constraints limit market growth.

The industry is primarily dominated by players such as Servier, Teva, Mylan, Bayer, Pfizer, Takeda Pharmaceuticals, AstraZeneca, Sanofi and GSK among others.

Market Dynamics

Market Growth Drivers

Increasing Awareness: Growing awareness of the significance of proper oral hygiene and the range of treatment options for mouth ulcers is fuelling market expansion. Public health campaigns and educational efforts are raising knowledge about the causes, symptoms, and risks of mouth ulcers. As more individuals become educated, they are more inclined to pursue suitable treatments, resulting in increased demand for effective solutions.

Government Support: The French government has implemented initiatives and campaigns aimed at promoting oral health education and raising awareness about various oral health issues, including mouth ulcers. These efforts play a crucial role in educating the public, encouraging early diagnosis, and promoting the adoption of effective treatment options. Government support through policies, programs, and resource allocation contributes to market growth by increasing accessibility and affordability of treatments.

Rise in Prevalence: The rise in the prevalence of mouth ulcers due to various factors, such as tobacco consumption, unhealthy lifestyles, and stress, contributes to market growth. In 2021, 10.2% of youths in France smoke tobacco. As the number of individuals affected by mouth ulcers increases, the demand for effective treatment options also rises.

Market Restraints

Competition from Home Remedies: The availability of home remedies and over-the-counter medications provides more affordable alternatives to pharmaceutical treatments for mouth ulcers. These alternatives can be appealing to individuals with limited financial resources or those seeking more natural approaches. The competition from these alternatives constrains the growth of the pharmaceutical mouth ulcer treatment market.

Limited Accessibility to Pharmaceuticals: In some areas of France, access to pharmaceutical treatments for mouth ulcers may be limited due to cost or availability issues. Factors such as geographical location, healthcare infrastructure, and affordability can restrict access to these treatments. This limited accessibility can hinder market growth and limit the reach of effective pharmaceutical treatments.

Budget Constraints: Financial limitations can greatly affect a person's capacity to pay for medications for mouth ulcers. Patients might choose to spend their money on more urgent needs rather than on treatments for mouth ulcers, resulting in reduced demand for these drugs. Budgetary constraints can prevent people from accessing and using effective treatments, thereby hindering market expansion.

Regulatory Landscape and Reimbursement Scenario

In France, marketing authorization for drugs can be obtained at the national or European level. The French regulatory agency for drugs is the National Agency for the Safety of Medicine and Health Products (ANSM) previously known as the French Agency for the Medical Safety of Health Products. In Europe, the regulatory agency for drugs is the European Medicines Agency (EMA).

The National Agency for the Safety of Medicine and Health Products (ANSM) is the French regulatory agency for drug approval at the national level and at the European level, the European Medicines Agency (EMA) grants marketing authorization. The Transparency Committee (CT) of the French National Authority for Health (HAS) assesses a new drug's medical benefit (SMR) and improvement of medical benefit (ASMR). Based on the ASMR, the Economic Committee on Healthcare Products (CEPS) sets drug prices through negotiations with pharmaceutical companies. The National Healthcare Insurances (UNCAM) determines the reimbursement rate, ranging from 100% for major SMR to no reimbursement for insufficient SMR, based on the SMR level. The Health Ministry makes the final decision on including the drug in the reimbursable medicines list for 5 years, subject to reevaluation.

In France, the percentage of individuals covered by private health insurance is about 95%, and public health insurance expenses are shifting toward private health insurance, resulting in a continuous increase in copayments.

Competitive Landscape

Key Players

Here are some of the major key players in the France Mouth Ulcers Therapeutics Market:

- Servier

- Pfizer, Inc.

- GlaxoSmithKline plc.

- Reckitt Benckiser

- Teva

- Takeda Pharmaceuticals

- Bayer

- Mylan

- AstraZeneca

- Sanofi

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

France Mouth Ulcer Treatment Market Segmentation

By Treatment Drug Class

- Corticosteroid

- Antihistamine

- Antimicrobial

- Analgesic

- Anesthetic

- Anti-inflammatory Agents

By Treatment Formulation Type

- Gel

- Mouthwash

- Ointment

- Spray

- Lozenges

Mouth Ulcer Treatment Indications

- Aphthous Stomatitis

- Oral Lichen Planus

- Others

By End Users

- Pharmacy

- Online Stores

- Hospitals and Clinics

- Home care

Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.