France Infectious Disease Drugs Market Analysis

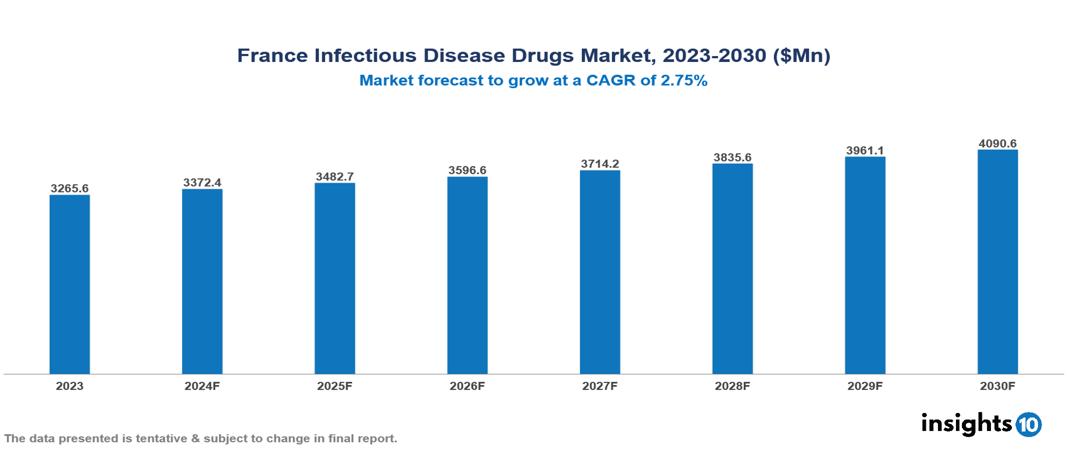

France Infectious Disease Drugs Market valued at $3.26 Bn in 2023, projected to reach $4.09 Bn by 2030 with a 3.27% CAGR. The market is driven by partnerships and collaborative research, awareness and education, and the aging population. The market is dominated by key players like Institut Merieux, AbbVie Inc., Gilead Sciences, GlaxoSmithKline plc, Merck & Co., F. Hoffman-La Roche Ltd., Boehringer Ingelheim International GmbH, Janssen Pharmaceuticals, Novartis AG, and Sanofi S.A.

Buy Now

France Infectious Disease Drugs Market Executive Summary

France Infectious Disease Drugs Market valued at $3.26 Bn in 2023, projected to reach $4.09 Bn by 2030 with a 3.27% CAGR.

France infectious disease drugs include the research and development of pharmaceuticals used to treat infectious diseases in the French healthcare system. It involves clinical trials, regulatory frameworks unique to France, and research into innovative medicinal ingredients. It investigates methods to tackle infectious diseases such as tuberculosis, HIV/ AIDS, influenza, and new pathogens using medication interventions tailored to the French population's requirements and healthcare system.

The market for infectious illness drugs in France is expanding steadily, propelled by both an increase in the prevalence of infectious diseases and an increasing need for efficient treatment alternatives. The market is expanding due to factors like rising awareness about infectious diseases, drug development breakthroughs, and higher expenditure on healthcare. Major firms in the industry are spending money on R&D to bring novel treatments to market and seize new opportunities.

In 2023, the global market for drugs utilized for treating infectious diseases was projected to be worth $118.75 Bn. Both an increase in diagnoses and government campaigns to inform the public about infectious disease prevention and control contribute to this growth. The increasing level of generic competition is indicative of a changing market environment. Long-term growth requires removing financial barriers and improving treatment accessibility, especially in developing nations. This will stimulate additional industry innovations and breakthroughs.

With a market share of over 50% in the French HIV treatment market, Gilead has a strong position owing to its extensive line of antiretroviral medications. With a rising share, the company is rapidly entering the hepatitis C market and offering efficient treatments. Gilead works with regional healthcare organizations and institutions to increase French patients' access to their cutting-edge therapies.

Market Dynamics

Market Growth Drivers:

Aging Population: Due to weakening immune systems and comorbidities, an aging population is more vulnerable to infectious diseases. Drugs for infectious diseases are in higher demand as a result, especially those that address age-related illnesses.

Awareness and Education: Campaigns for public awareness and educational programs raise public awareness of infectious diseases. Increased knowledge results in earlier diagnosis, treatment, and adherence to recommended regimens, which propels market expansion.

Collaborative Research and Partnerships: Research on drugs is expedited and innovation is fostered when government, business, and academic organizations work together, thus growing the market.

Market Restraints:

Regulatory Obstacles: Pharmaceutical companies may face difficulties bringing new infectious disease medications to market due to strict regulatory criteria for drug approval and pricing limitations.

Generic Competition: When an infectious disease drug's patent expires and a generic version enters the market, the original manufacturer's market share may decline and prices may erode.

Supply Chain Disruptions: The availability of raw materials and finished goods can be impacted by disruptions in the global supply chain. This can result in shortages and price variations.

Healthcare Policies and Regulatory Landscape

The Agence nationale de sécurité du médicament and des produits de santé (ANSM) is an official body that operates under the Ministry of Health's administration. It provides access to cutting-edge treatments and ensures the security of medical supplies on behalf of the French government. The European Medicines Agency (EMA) partnership facilitates a more sophisticated centralized approvals process that requires adherence to both national and EU regulatory standards. The process of negotiating reimbursement following approval contributes to the total complexity of the French drug approval process.

Competitive Landscape

Key Players:

- Institut Merieux

- AbbVie Inc.

- Gilead Sciences

- GlaxoSmithKline plc

- Merck & Co.

- F. Hoffman-La Roche Ltd.

- Boehringer Ingelheim International GmbH

- Janssen Pharmaceuticals

- Novartis AG

- Sanofi S.A.

1. Executive Summary

1.1 Disease Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Patient Journey

1.6 Health Insurance Coverage in Country

1.7 Active Pharmaceutical Ingredient (API)

1.8 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Epidemiology of Disease

2.2 Market Size (With Excel & Methodology)

2.3 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Diagnosis

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Infectious Disease Drug Market Segmentation

By Disease

- HIV

- Influenza

- Hepatitis

- Tuberculosis

- Malaria

- Other

By Treatment

- Antibacterial

- Antiviral

- Antiparasitic

- Other

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.