France Healthcare Insurance Market Analysis

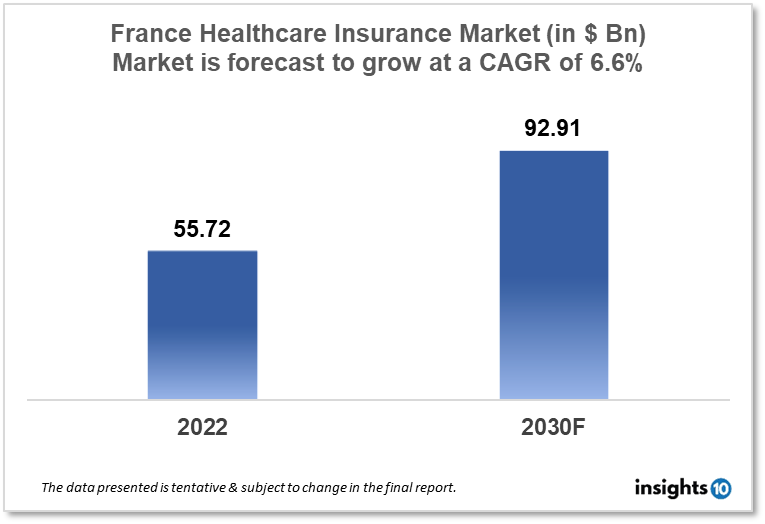

The France healthcare insurance market is projected to grow from $55.72 Bn in 2022 to $92.91 Bn by 2030, registering a CAGR of 6.6% during the forecast period of 2022 - 2030. The main factors driving the growth would be government support, the ageing population, technological innovation, increased awareness and demand for healthcare insurance. The market is segmented by component, provider, coverage, by health insurance plans and end-user. Some of the major players include Credit Agricole, Groupama, Harmonie Mutuelle, CNP and MGEN.

Buy Now

France Healthcare Insurance Market Executive Summary

The France healthcare insurance market is projected to grow from $55.72 Bn in 2022 to $92.91 Bn by 2030, registering a CAGR of 6.6% during the forecast period of 2022 - 2030. French healthcare spending in 2020 was $227 Bn, or around $3,364 per person. In terms of health spending as a proportion of GDP and per person in the past, France has outperformed the EU average. Prior to 2020, the GDP and health spending growth rates were essentially equal. But, in response to the COVID-19 pandemic, which resulted in an 8% decline in GDP, it expanded more quickly.

France has a statutory health insurance (SHI) system that provides residents with universal coverage. Employee and employer contributions, as well as a rising amount of specified taxes on a variety of incomes, are used to fund the system. The two main programmes that offer SHI have the same coverage and benefits policies and are both focused on the agriculture industry. At the national level, funds are consolidated with the potential for program-to-program subsidies. A significant part is also played by voluntary, supplemental private health insurance (VHI). About 95% of people have access to VHI, with 10.5% of people receiving means-tested subsidies and 8% of lower-income people receiving full subsidies.

In France, there are private health insurance options in addition to the public health insurance program. These private insurance plans can offer extra protection for services like dental care and alternative medicine that are not covered by the public health insurance program. A lot of French people can also take advantage of extra health insurance plans, which can offer more coverage for things like hospitalisation, dental work, and vision care. Employers frequently provide or let employees buy these insurance policies. With the top ten companies controlling 84% of premiums in 2020, the life insurance industry is highly concentrated. With 23.8 Bn in premiums or 13.7% of the total premium revenue, Credit Agricole Assurances is maintaining its position as the market leader.

Market Dynamics

Market Growth Drivers

The France healthcare Insurance market is expected to be driven by factors such as:

- Government support- The French government has supported the healthcare sector with programs that aim to widen access to treatment and raise the standard of available services. As a result of this support, insurers are able to provide coverage for new services and technologies, which is contributing to market expansion for healthcare insurance

- Ageing population- France has an ageing population, with a substantial proportion of its citizens over the age of 65. The market for healthcare insurance is expanding as a result of this demographic trend's increased need for healthcare services

- Technological innovation- In France, there is a rising need for technologically advanced healthcare solutions including telemedicine and wearable medical equipment. As insurers seek to provide coverage for these new services, this trend is fueling the expansion of the market for healthcare insurance

- Increased awareness and demand for healthcare insurance- In France, there is a growing awareness of the need for healthcare insurance, owing to reasons such as rising healthcare costs and the increasing frequency of chronic diseases. The industry is expanding as a result of the rising demand for healthcare insurance options

Market Restraints

The following factors are expected to limit the growth of the healthcare insurance market in France:

- Unequal access to healthcare- There are still substantial gaps in access to healthcare services in France, especially in rural areas, despite the extensive coverage offered by the national health insurance system. The overall demand for healthcare insurance solutions may be constrained as a result

- Changing political landscape- The development of the medical insurance market may be impacted by governmental policies and laws that have an impact on the French healthcare industry. Changes in governmental policies and laws may cause market uncertainty and volatility

- Regulatory barriers- France's heavily regulated healthcare insurance industry can make it difficult for new competitors to enter. This may reduce market innovation and competitiveness

Competitive Landscape

Key Players

- Credit Agricole (FRA)- All of Credit Agricole's French and worldwide insurance operations are included under Credit Agricole Assurances, including Predica, Pacifica, Credit Agricole Creditor Insurance, and affiliates including La Medicale and Spirica. The Credit Agricole Regional Banks and LCL are two of the largest banking networks that distribute products in France, along with a number of partner banks outside of France. Credit Agricole Assurances combines a specialised focus on insurance (life, property/casualty, and borrower insurance) with an integrated bancassurance model

- Groupama (FRA)- Groupama Health Insurance offers protection against any health problems that could develop as a result of an illness or accident. It is the second company in the individual health market with a portfolio of 1.1 Mn plans as of the end of 2021. The teams consistently invest time in creating cutting-edge goods in response to legislative developments that can upend the healthcare industry

- Harmonie Mutuelle (FRA)- Harmonie Mutuelle is a Paris-based insurance firm that provides pension-saving programs in addition to life, health, accidental, and loan insurance products. Customers in France are served by Harmonie Mutuelle.

- CNP (FRA)- CNP Assurances is a leading personal insurer in France, across Europe and Brazil. With life insurance, pension, personal risk insurance, health insurance and service offerings, it offers a response to the many changes affecting the policyholders' lives

- MGEN (FRA)- Since its founding in 1946, MGEN has worked to improve France's healthcare system and has helped to shape the French Social Security. The mandatory health insurance program for professionals in the domains of education, research, culture and communication, youth and sports, and environment, sea, and energy are currently managed by MGEN. The first non-profit healthcare network in France has been formed by MGEN

Healthcare Policies and Regulatory Landscape

To guarantee that healthcare services are available and affordable to everyone, the healthcare insurance industry is strictly controlled in France. The Department of Health and Human Services (HHS) and the Centers for Medicare and Medicaid Services (CMS) are some of the numerous government organisations that are involved in the complicated regulatory environment that governs health insurance coverage.

The Affordable Care Act (ACA), which requires that everyone have access to affordable health insurance, is one of the main laws governing healthcare insurance. The ACA also created the Health Insurance Marketplace, which provides a selection of health insurance policies that adhere to the criteria of the legislation. The Mental Health Parity and Addiction Equity Act (MHPAEA), which mandates that insurance companies give equitable coverage, is an important law that governs health insurance.

Reimbursement Scenario

Low-income individuals are eligible to free or heavily discounted health insurance, as well as free vision and dental care. If an individual earns $11,040 or less annually, they are regarded as having a poor income. With each additional member in a household, the qualifying income level rises. Almost 9% of the population is thought to be low-income beneficiaries overall, of whom 6% are given means-tested VHI vouchers and 3% are given free state-sponsored insurance.

1. Executive Summary

1.1 Service Overview

1.2 Global Scenario

1.3 Country Overview

1.4 Healthcare Scenario in Country

1.5 Healthcare Services Market in Country

1.6 Recent Developments in the Country

2. Market Size and Forecasting

2.1 Market Size (With Excel and Methodology)

2.2 Market Segmentation (Check all Segments in Segmentation Section)

3. Market Dynamics

3.1 Market Drivers

3.2 Market Restraints

4. Competitive Landscape

4.1 Major Market Share

4.2 Key Company Profile (Check all Companies in the Summary Section)

4.2.1 Company

4.2.1.1 Overview

4.2.1.2 Product Applications and Services

4.2.1.3 Recent Developments

4.2.1.4 Partnerships Ecosystem

4.2.1.5 Financials (Based on Availability)

5. Reimbursement Scenario

5.1 Reimbursement Regulation

5.2 Reimbursement Process for Services

5.3 Reimbursement Process for Treatment

6. Methodology and Scope

Healthcare Insurance Market Segmentation

By Provider (Revenue, USD Billion):

It mainly includes healthcare insurance that provides safety against the increasing cost of medical treatments and in case of health emergencies such as critical illnesses. Hence, it is the best way to safeguard medical expenses.

- Public

- Private

By Coverage Type (Revenue, USD Billion):

In terms of sales and market share, it is anticipated to rule the market over the projection period. This is explained by a number of benefits provided by life insurance, including guaranteed death payout and permanent coverage. Additionally, investing in these kinds of plans enables working professionals to save taxes

- Life Insurance

- Term Insurance

By Health Insurance Plans (Revenue, USD Billion):

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

- Point of Service (POS)

- High Deductible Health Plan (HDHP)

By Demographics (Revenue, USD Billion):

- Minors

- Adults

- Seniors

There is a high prevalence of lifestyle disease in the adult population that can increase health risks in the future. The population is more prone to cardiac and other diseases that require hospitalization. Healthcare insurance plans for seniors are more of a necessity, especially in the case of retirement. Also, it carries various advantages such as no medical screening before buying plans, includes coverage of the outpatient department, and provides the benefit of fee annual checkups along with lifetime renewability.

By End-user (Revenue, USD Billion):

- Individuals

- ?Corporates

A large number of people buy individual health plans as they are also customizable. Also, it gives more control over deductibles, co-pays, and benefits limits and is not dependent on employment status.

Methodology for Database Creation

Our database offers a comprehensive list of healthcare centers, meticulously curated to provide detailed information on a wide range of specialties and services. It includes top-tier hospitals, clinics, and diagnostic facilities across 30 countries and 24 specialties, ensuring users can find the healthcare services they need.

Additionally, we provide a comprehensive list of Key Opinion Leaders (KOLs) based on your requirements. Our curated list captures various crucial aspects of the KOLs, offering more than just general information. Whether you're looking to boost brand awareness, drive engagement, or launch a new product, our extensive list of KOLs ensures you have the right experts by your side. Covering 30 countries and 36 specialties, our database guarantees access to the best KOLs in the healthcare industry, supporting strategic decisions and enhancing your initiatives.

How Do We Get It?

Our database is created and maintained through a combination of secondary and primary research methodologies.

1. Secondary Research

With many years of experience in the healthcare field, we have our own rich proprietary data from various past projects. This historical data serves as the foundation for our database. Our continuous process of gathering data involves:

- Analyzing historical proprietary data collected from multiple projects.

- Regularly updating our existing data sets with new findings and trends.

- Ensuring data consistency and accuracy through rigorous validation processes.

With extensive experience in the field, we have developed a proprietary GenAI-based technology that is uniquely tailored to our organization. This advanced technology enables us to scan a wide array of relevant information sources across the internet. Our data-gathering process includes:

- Searching through academic conferences, published research, citations, and social media platforms

- Collecting and compiling diverse data to build a comprehensive and detailed database

- Continuously updating our database with new information to ensure its relevance and accuracy

2. Primary Research

To complement and validate our secondary data, we engage in primary research through local tie-ups and partnerships. This process involves:

- Collaborating with local healthcare providers, hospitals, and clinics to gather real-time data.

- Conducting surveys, interviews, and field studies to collect fresh data directly from the source.

- Continuously refreshing our database to ensure that the information remains current and reliable.

- Validating secondary data through cross-referencing with primary data to ensure accuracy and relevance.

Combining Secondary and Primary Research

By integrating both secondary and primary research methodologies, we ensure that our database is comprehensive, accurate, and up-to-date. The combined process involves:

- Merging historical data from secondary research with real-time data from primary research.

- Conducting thorough data validation and cleansing to remove inconsistencies and errors.

- Organizing data into a structured format that is easily accessible and usable for various applications.

- Continuously monitoring and updating the database to reflect the latest developments and trends in the healthcare field.

Through this meticulous process, we create a final database tailored to each region and domain within the healthcare industry. This approach ensures that our clients receive reliable and relevant data, empowering them to make informed decisions and drive innovation in their respective fields.

To request a free sample copy of this report, please complete the form below.

We value your inquiry and offer free customization with every report to fulfil your exact research needs.